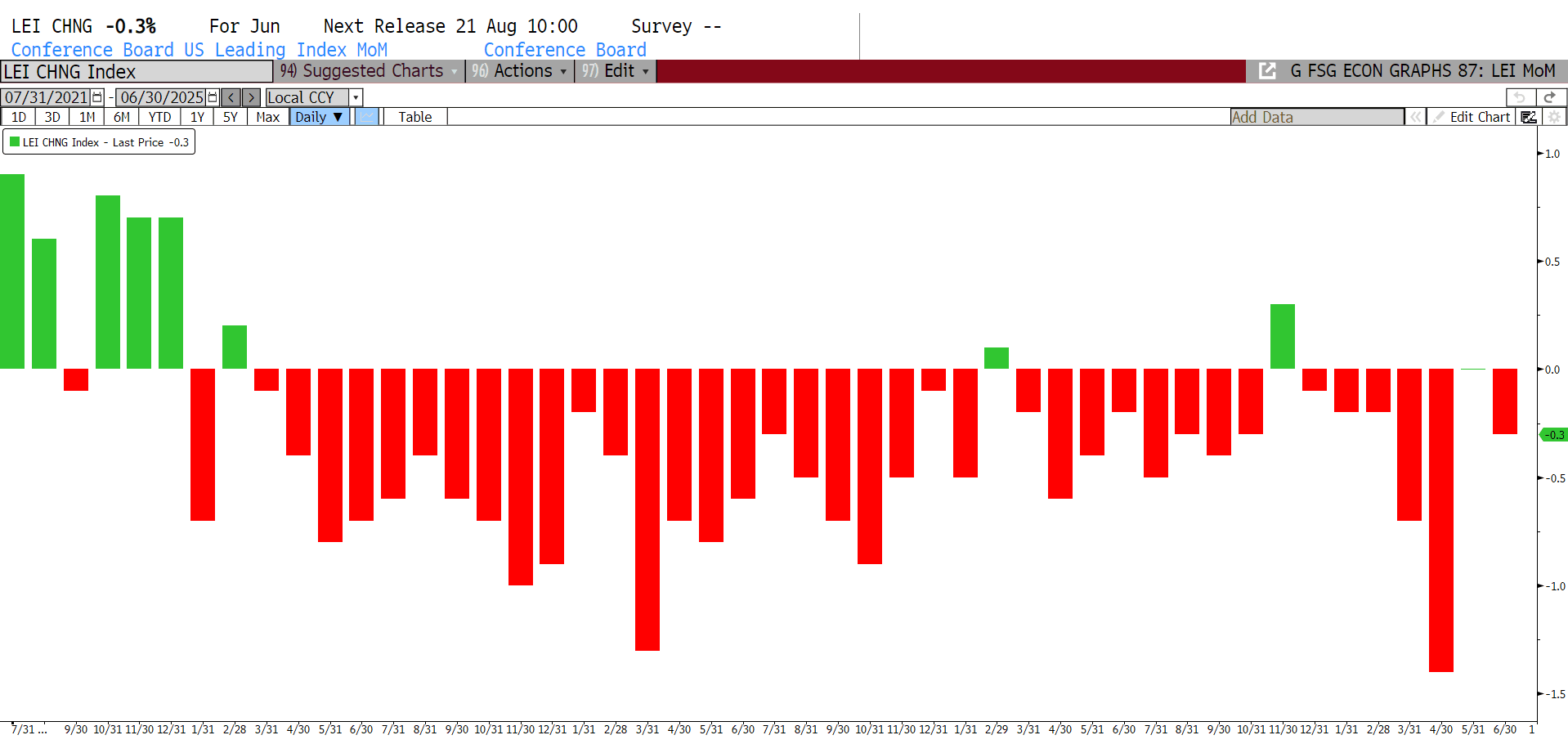

It was a relatively quiet week for economic data, with only a handful of noteworthy releases. Among them was the Conference Board’s Leading Economic Index (LEI), which came in at -0.3% (exp = -0.3%). This marks the 38th negative reading out of the past 41 months, underscoring persistent headwinds in the “soft-data”. Initial jobless claims for the week were reported at 217,000—slightly better than consensus expectations of 226,000.

This week did bring a slew of manufacturing data. Activity in the Richmond Fed region declined sharply in July, posting its largest monthly contraction since September 2024. This survey contrasts with recent improvements we saw in the New York and Philadelphia Fed surveys released earlier this month. Continuing on manufacturing, S&P Global’s Composite Purchasing Manager’s Index (PMI), a survey of over 1,100 manufacturers and service providers, saw a sharp increase for the month. However, the uptick was largely driven by services, while the manufacturing component declined from June’s 37-month high. This points to a fresh weakening in factory activity not seen since December. Analysts often turn to manufacturing data for early signs of pricing pressure. This month, price increases registered the second-strongest monthly rise since September 2022. Survey respondents cited tariffs and labor costs as key drivers behind the increase.

The housing market continued its slump, with U.S. existing home sales falling to a nine-month low. Housing affordability remains a drag as prices stay elevated due to limited supply and mortgage rates stagnating near 7%. U.S. Durable Goods orders, a key proxy for future business investment, declined by 9.3%. These orders typically cover items expected to last at least three years, suggesting a cautious stance by businesses toward larger capital expenditures.

Looking ahead, next week should offer more market-moving potential. The FOMC rate decision comes Wednesday. Markets are currently only pricing in just a 2.6% chance of a rate cut, but it will be interesting to see if they signal potential for additional cuts later in the year. Also on deck are the advance Q2 GDP report, non-farm payrolls, updated unemployment figures, PCE, and the JOLTS survey.

Have a great weekend!

The Baker Group is one of the nation’s largest independently owned securities firms specializing in investment portfolio management for community financial institutions.

Since 1979, we’ve helped our clients improve decision-making, manage interest rate risk, and maximize investment portfolio performance. Our proven approach of total resource integration utilizes software and products developed by Baker’s Software Solutions* combined with the firm’s investment experience and advice.

Author

Dillon Wiedemann

Senior Vice President of FSG

The Baker Group LP

800.937.2257

*The Baker Group LP is the sole authorized distributor for the products and services developed and provided by The Baker Group Software Solutions, Inc.

INTENDED FOR USE BY INSTITUTIONAL INVESTORS ONLY. Any data provided herein is for informational purposes only and is intended solely for the private use of the reader. Although information contained herein is believed to be from reliable sources, The Baker Group LP does not guarantee its completeness or accuracy. Opinions constitute our judgment and are subject to change without notice. The instruments and strategies discussed here may fluctuate in price or value and may not be suitable for all investors; any doubt should be discussed with a Baker representative. Past performance is not indicative of future results. Changes in rates may have an adverse effect on the value of investments. This material is not intended as an offer or solicitation for the purchase or sale of any financial instruments.