Despite a lighter than usual schedule of data releases, this week’s economic indicators continued to reflect the mixed narrative of an economy showing signs of both growth and contraction. The continuation of the indecisiveness in economic data has plagued both policy makers and investors alike as both navigate a landscape that has yet to reveal a clear direction.

On Monday, the 18th, the Federal Reserve Bank of New York released their Current General Business Activity Survey, which is conducted monthly. The survey measures the change in general business activity for the service sector over the previous month in the state of New York and a few of its surrounding areas. The results were less than optimal in terms of growth, as the survey remained in contractionary territory at -11.7, and was a little more than two points lower than the prior reading of -9.3. The following Thursday, the Federal Reserve Bank of Philadelphia released their monthly survey, the Philadelphia Fed Business Outlook Survey. This survey measures manufacturing activity in the mid-Atlantic region and made a large move into negative territory coming in with a reading of -0.3, which is 16.2 points lower than the prior of 15.9. Both surveys reflect a gloomy outlook regarding both the manufacturing and service sector in the eastern region of the United States.

Turning to the housing sector, more specifically the Housing Starts economic indicator, which is released by the U.S. Census Bureau reflects the number of new residential construction projects that began during a specific month. In the month of July, the bureau reported that 1428k new private residential construction projects began, which was notably higher than both analyst expectations as well as prior readings which were 1297k and 1321k, respectively.

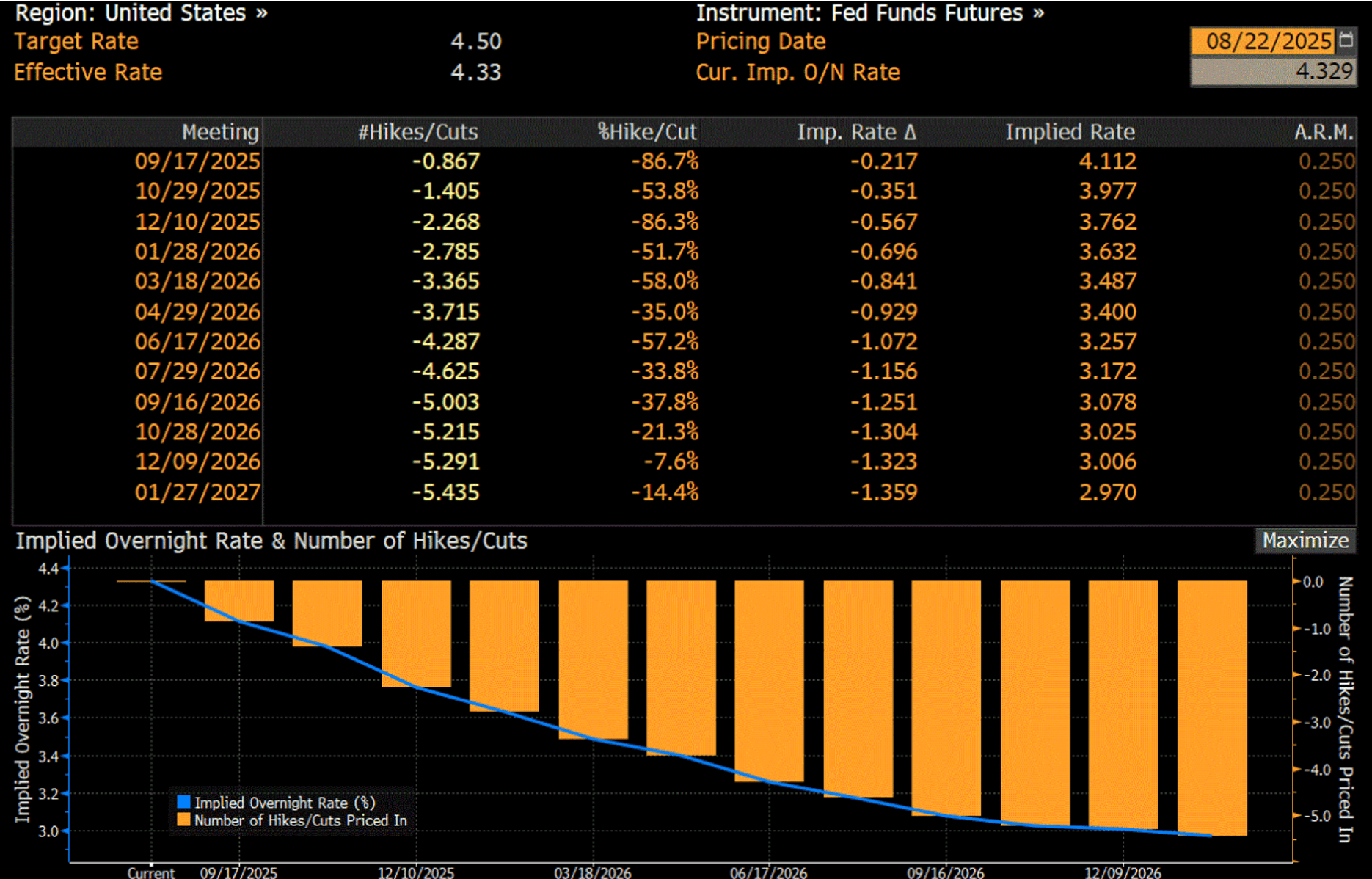

Yesterday, two important data points, Initial Jobless Claims, ticked up 10k higher than analyst expectations and 11k higher than the prior week’s reading. This sign of the weakness in the job market was mentioned explicitly mentioned numerous times in this morning’s public address from Chairman Jerome Powell. Powell stated that downside risks to employment are rising, and that new strategy shifts focus on keeping long term inflation expectations stable. Fed Funds Futures as of Thursday brought an implied rate change of -47.7bps (i.e, a little under two rate cuts) by December 10, 2025, which is the last FOMC Meeting of the year, to now pricing in over two cuts with the implied change coming in at -56.7bps. The increase in the implied probabilities of rate cuts for the remainder of the year affirms many investors’ beliefs that Jerome Powell’s Speech this morning was indeed dovish and is a signal to a future decrease in the Federal Reserve’s primary monetary policy tool, the effective federal funds rate.

Next week’s economic data regarding inflation, the state of the consumer in terms of consumption and income, as well as soft data readings, most notably the U. of Mich. Sentiment Survey, are set to release which gives investors and policy makers more insights into the direction of the economy going forward. Have a good weekend everyone!

The Baker Group is one of the nation’s largest independently owned securities firms specializing in investment portfolio management for community financial institutions.

Since 1979, we’ve helped our clients improve decision-making, manage interest rate risk, and maximize investment portfolio performance. Our proven approach of total resource integration utilizes software and products developed by Baker’s Software Solutions* combined with the firm’s investment experience and advice.

Author

Carson Francis

Financial Analyst

The Baker Group LP

800.937.2257

*The Baker Group LP is the sole authorized distributor for the products and services developed and provided by The Baker Group Software Solutions, Inc.

INTENDED FOR USE BY INSTITUTIONAL INVESTORS ONLY. Any data provided herein is for informational purposes only and is intended solely for the private use of the reader. Although information contained herein is believed to be from reliable sources, The Baker Group LP does not guarantee its completeness or accuracy. Opinions constitute our judgment and are subject to change without notice. The instruments and strategies discussed here may fluctuate in price or value and may not be suitable for all investors; any doubt should be discussed with a Baker representative. Past performance is not indicative of future results. Changes in rates may have an adverse effect on the value of investments. This material is not intended as an offer or solicitation for the purchase or sale of any financial instruments.