This week, all eyes were on the other half of the Fed’s dual mandate, inflation or price stability, after last week’s labor market data releases. Last week’s lackluster labor market reports all but guaranteed an impending Fed rate cut coming next week. Did this week’s Producer Price Index (PPI) and the Consumer Price Index (CPI) release do anything to derail next week’s rate cut? Let’s look at this week in review!

The PPI for the month of August was released on Tuesday with the month-over-month change declining 0.1% (expected +0.3%). The year-over-year change came in at 2.6% (expected 3.3%). Additionally, Core PPI fell 0.1% (expected +0.3%) and rose 2.8% from a year ago (expected 3.5%). Wholesale inflation tends to lead to consumer inflation, so this was seen as a positive report for the Fed as they continue to look for signs of tariff-induced inflation.

On Thursday, the CPI was released showing that headline CPI rose 0.4% in August (expected 0.3%) and 2.9% from a year prior (expected at 2.9%) while Core CPI rose 0.3% (expected 0.3%) and 3.1% from a year ago (expected at 3.1%). Shelter costs were the largest contributor to the headline index increase, rising 0.5%, while food rose 0.5%, transportation services rose 1.0%, and used cars were up 1.0%. The headline increase in the CPI was a bit hotter than expected, the overall CPI report was in-line with expectations and should not be enough to change the Fed’s recent pivot to focus more on the labor market risks.

With many eyes focused on yesterday’s CPI release, the weekly initial jobless claims came in much higher than expected at 263,000 new claims (expected 235,000). The increase marks the highest level of new weekly jobless claims in four years. This weekly number can be volatile; however, it is one more data point in the weakening labor market.

Tuesday morning, the Bureau of Labor Statistics reported that job growth for the year through March was significantly lower than the government had reported. The BLS reduced net payroll gains by 911,000 in the 12 months through March. That means instead of adding 1.8 million jobs as originally reported, the U.S. economy created only 847,000. Markets were anticipating a big downward revision to job growth, but the size of the revision is concerning and puts further pressure on the Fed to cut rates next week.

This morning, the University of Michigan Consumer Sentiment Index fell to 55.4 (expected 58). The index fell for the second straight month, hitting its lowest level since May. Consumers continue to note multiple vulnerabilities in the economy, with rising risks to business conditions, labor markets, and inflation.

A quick mid-morning check-in on the markets shows stocks are off a bit with the Dow Jones Industrial Average down 150 points in today’s trading session. Treasury markets are selling off after multiple rallies this week, the 2-year note is currently yielding 3.56%, and the 10-year bond is yielding 4.06%.

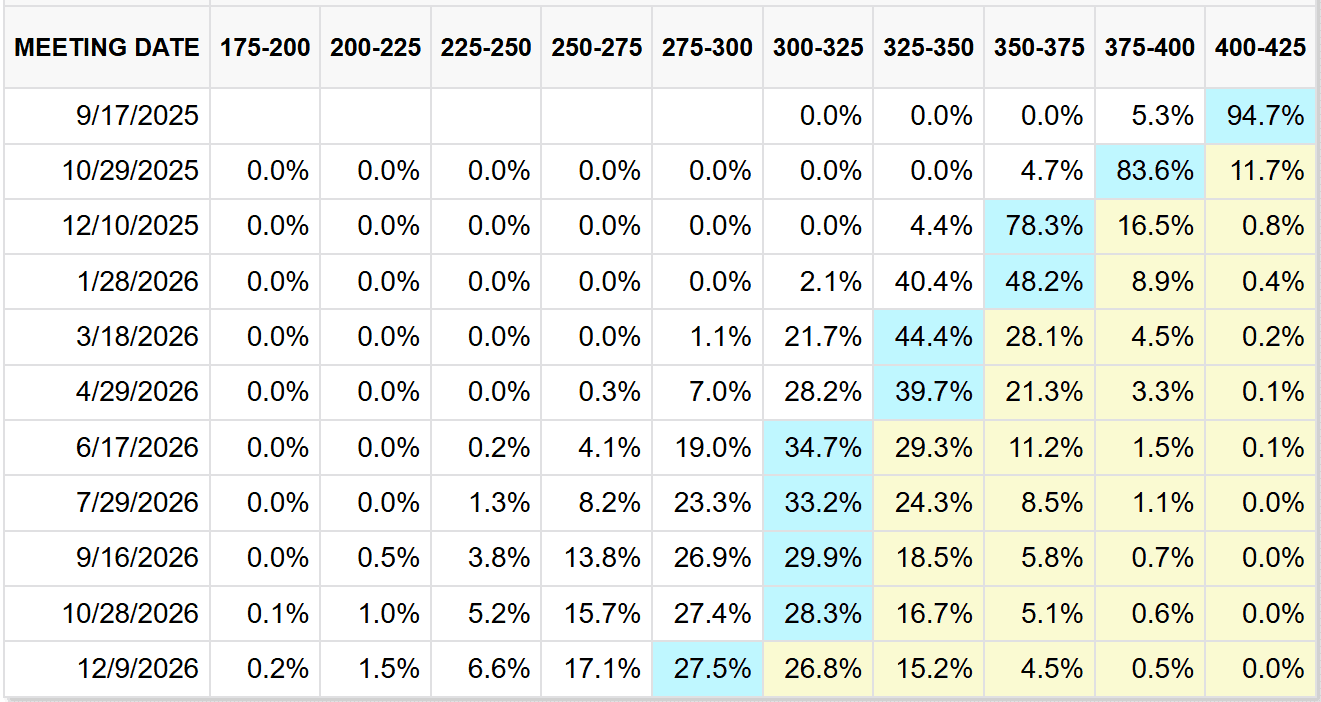

All eyes are on the Fed next week as they will conclude their regularly scheduled two-day policy setting meeting on Wednesday. The Fed Funds Futures market is currently pricing in a 95% chance of a 25-basis point rate cut and a 5% chance of a 50-basis point rate cut. It is all but a foregone conclusion that the Fed will cut rates 25 basis points next week. Additionally, the markets are pricing in an additional one to two 25 basis points rate cuts at the two remaining Fed meetings of 2025 (October and December).

Have a great weekend!

CME FedWatch Tool – Conditional Meeting Probabilities

The Baker Group is one of the nation’s largest independently owned securities firms specializing in investment portfolio management for community financial institutions.

Since 1979, we’ve helped our clients improve decision-making, manage interest rate risk, and maximize investment portfolio performance. Our proven approach of total resource integration utilizes software and products developed by Baker’s Software Solutions* combined with the firm’s investment experience and advice.

Author

Dale Sheller

Managing Director

Director of Financial Strategies Group

The Baker Group LP

800.937.2257

*The Baker Group LP is the sole authorized distributor for the products and services developed and provided by The Baker Group Software Solutions, Inc.

INTENDED FOR USE BY INSTITUTIONAL INVESTORS ONLY. Any data provided herein is for informational purposes only and is intended solely for the private use of the reader. Although information contained herein is believed to be from reliable sources, The Baker Group LP does not guarantee its completeness or accuracy. Opinions constitute our judgment and are subject to change without notice. The instruments and strategies discussed here may fluctuate in price or value and may not be suitable for all investors; any doubt should be discussed with a Baker representative. Past performance is not indicative of future results. Changes in rates may have an adverse effect on the value of investments. This material is not intended as an offer or solicitation for the purchase or sale of any financial instruments.