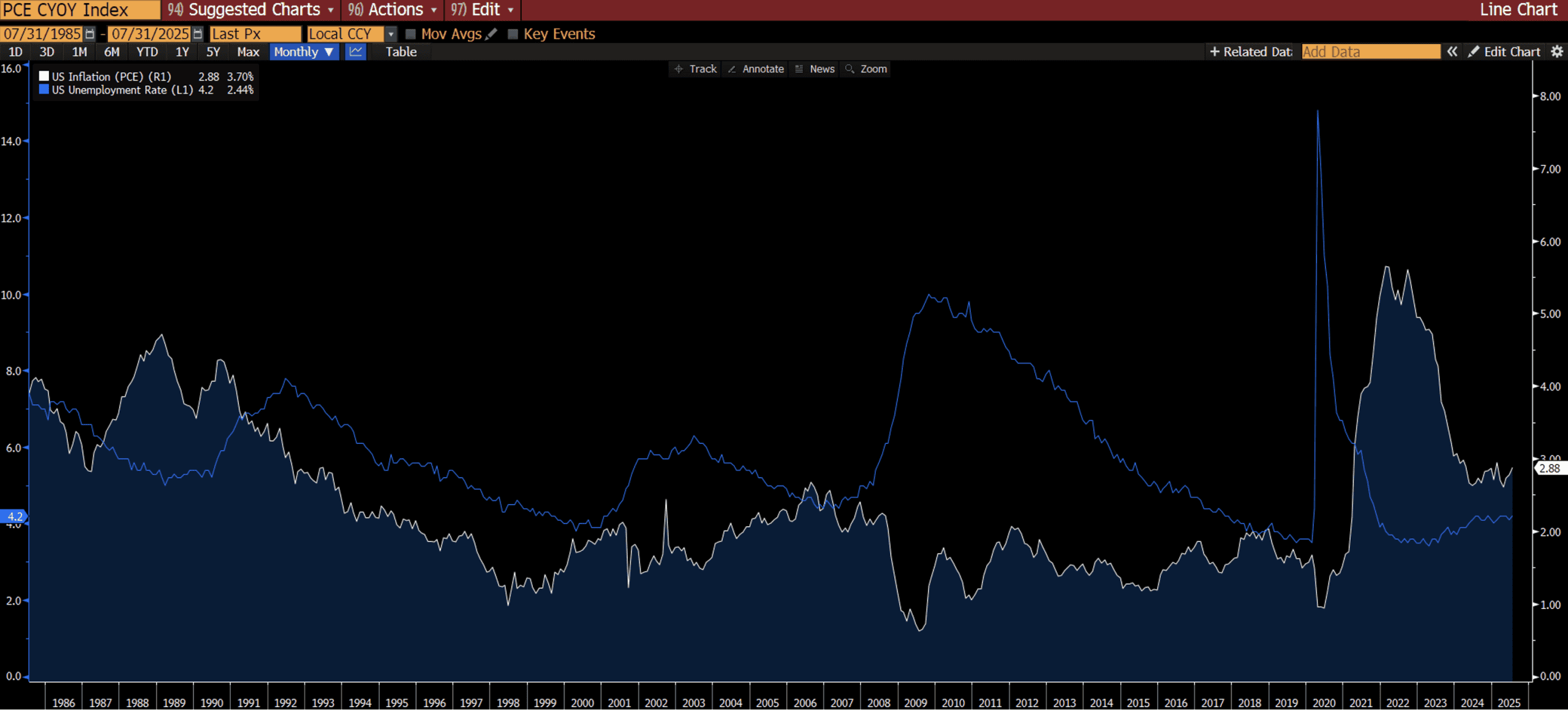

We had a Fed meeting this week if you haven’t already heard. The Fed decided to move its benchmark rate down 25bp in a move that was widely expected by market participants. Although the rate change was expected, markets were much more focused on the Summary of Economic Projections (SEP) that the Fed releases at every other meeting. The SEP provides guidance to what the Fed is thinking internally about the future direction of interest rates, inflation and the economy overall. The last time the Fed released it’s SEP in June, members of the Fed were expecting 2 rate cuts through the remainder of 2025 which would put the upper bound rate at 4%. In this iteration of the SEP, Fed officials priced in one extra cut between now and year-end which would put the upper bound rate at 3.75%. This is a significant adjustment because it indicates that the Fed is expecting to cut at each of the 3 final meetings throughout the remainder of the year. What ultimately caused this adjustment in policy? It comes down to where the Fed sees risk in regard to its dual mandate of maximum employment and long-term price stability. In the June meeting, the Fed saw inflation as the bigger risk due to tariffs, but shortly after that meeting, cracks in the job market started to appear causing the Fed to reassess its outlook. We’re currently sitting at an unemployment rate of 4.3%, which is still considered full employment for the economy, but further deterioration in the labor market would be unwelcome news for the Fed. The labor market tends to be an asymmetric risk as a smaller increase in unemployment (or concerns about future employment) can have a larger downside impact on inflation. If workers become concerned about future layoffs or prospects of new jobs, they tend to save more and spend less which ultimately brings down aggregate price levels. Chairman Powell called the rate cut a “risk management cut” and highlighted that there is “no risk-free path” for the Fed in the current environment. This highlights that risks are increasing in the labor market, but Fed officials are still concerned about doing too much too soon.

In addition to the Fed meeting this week, we also received retail sales for the month of August which came in higher than expected at 0.6% (exp = 0.2%) with much of the increase coming from online purchases. Even though Consumer Spending makes up roughly 70% of the economy, the market gave very little reaction to this positive number as the focus was clearly on the rate decision this week. Another potential reason for the muted reaction is that the retail sales number is not adjusted for inflation, so it is likely that some of this increase is being driven by higher prices in addition to the amount of goods purchased.

Wrapping up the week, the Conference Board released its Leading Economic Indicators Index which came in at -0.5 (exp = -0.2). This number is a leading index that points to future economic growth or contraction and has been negative for 42 of the last 46 months.

Looking ahead to next week, we’ve got the 3rd revision to Q2 GDP coming out, as well as Durable Goods Orders, Personal Income & Spending, and the Fed’s preferred measure of inflation, PCE.

Hope you have a great weekend!

The Baker Group is one of the nation’s largest independently owned securities firms specializing in investment portfolio management for community financial institutions.

Since 1979, we’ve helped our clients improve decision-making, manage interest rate risk, and maximize investment portfolio performance. Our proven approach of total resource integration utilizes software and products developed by Baker’s Software Solutions* combined with the firm’s investment experience and advice.

Author

Dillon Wiedemann

Senior Vice President of FSG

The Baker Group LP

800.937.2257

*The Baker Group LP is the sole authorized distributor for the products and services developed and provided by The Baker Group Software Solutions, Inc.

INTENDED FOR USE BY INSTITUTIONAL INVESTORS ONLY. Any data provided herein is for informational purposes only and is intended solely for the private use of the reader. Although information contained herein is believed to be from reliable sources, The Baker Group LP does not guarantee its completeness or accuracy. Opinions constitute our judgment and are subject to change without notice. The instruments and strategies discussed here may fluctuate in price or value and may not be suitable for all investors; any doubt should be discussed with a Baker representative. Past performance is not indicative of future results. Changes in rates may have an adverse effect on the value of investments. This material is not intended as an offer or solicitation for the purchase or sale of any financial instruments.