As we close out just over three weeks of the government shutdown, markets continue to steer through muddy waters with limited new data. Fed policymakers are also in a required quiet period ahead of next week’s pivotal policy meeting, leaving little new information to digest this week. The one notable exception was the release of this morning's September Consumer Price Index (CPI). Furloughed Bureau of Labor Statistics (BLS) workers were called back in to calculate September CPI in order to determine the 2026 Cost of Living Adjustments (COLA) necessary for Social Security benefits.

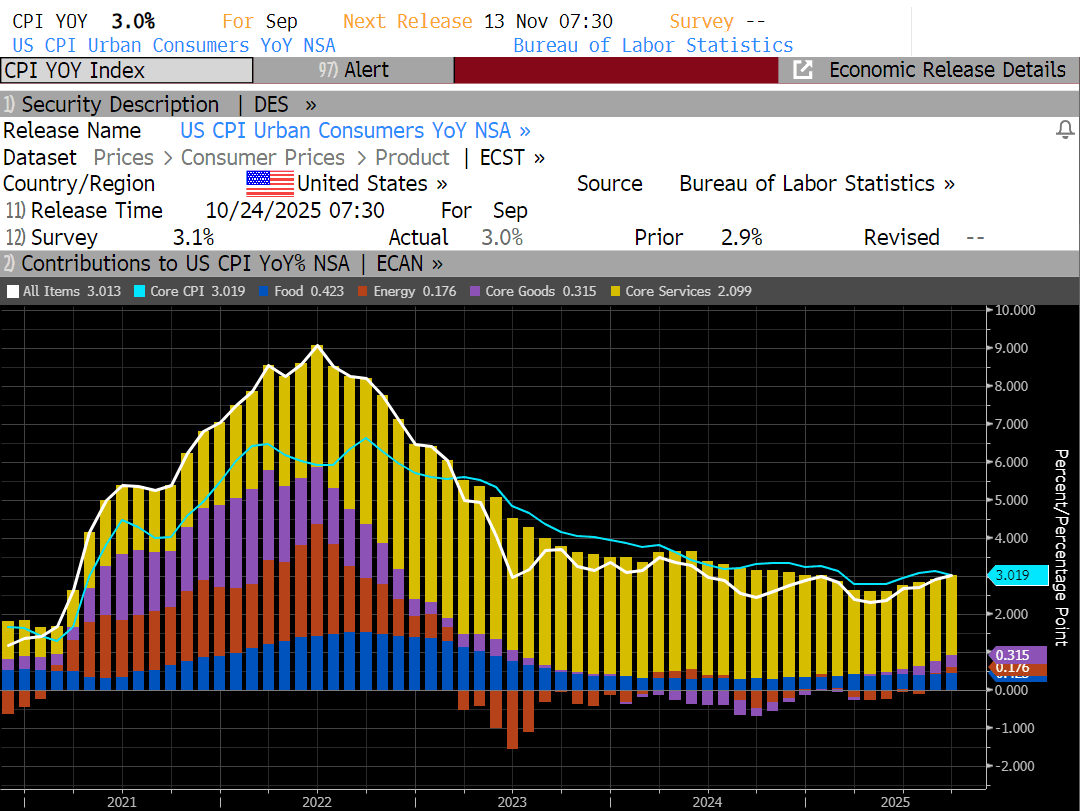

This morning’s numbers showed that inflation increased slightly less than expected in September, rising 0.3% after climbing 0.4% in August. On an annual basis, CPI increased 3.0% after advancing 2.9% in August. Excluding the volatile food and energy components, Core CPI rose 0.2% month-over-month and 3.0% year-over-year. That marks the slowest monthly increase in the core measure in three months.

This report is welcome news for Fed policymakers who meet next week to decide a near-term rate path, especially for those who have been leery of cutting rates further. The central bank is widely expected to reduce the policy rate by a quarter point next week to a range of 3.75% to 4.00%, marking the lowest level since December 2022. However, the lack of new data may complicate the Fed’s path in subsequent meetings.

This morning’s softer than expected inflation data has investors betting it will be enough to convince Fed officials they can cut again in December, especially if there is no October CPI report released next month. Data collection for September CPI was completed before the government shutdown, but the BLS has not been able to collect new price data since. This morning, a White House-affiliated X account said, “there will likely NOT be an inflation release next month for the first time in history.” That means this could be the last look at inflation data for the Fed’s next two meetings.

Futures markets are currently assigning a ~97% probability of an October cut and a ~96% chance of a December cut. Next week, markets will undoubtedly be paying close attention to the Fed’s rate decision but likely much more so to the tone of the accompanying statement and Chairman Powell’s press conference that follows. Investors will be parsing every word for clues about whether this is the start of a sustained cutting cycle or if the committee remains hesitant to make significant changes to its policy stance amid limited data.

Have a great weekend!

The Baker Group is one of the nation’s largest independently owned securities firms specializing in investment portfolio management for community financial institutions.

Since 1979, we’ve helped our clients improve decision-making, manage interest rate risk, and maximize investment portfolio performance. Our proven approach of total resource integration utilizes software and products developed by Baker’s Software Solutions* combined with the firm’s investment experience and advice.

Author

Andrea F. Pringle

Senior Vice President

The Baker Group LP

800.937.2257

*The Baker Group LP is the sole authorized distributor for the products and services developed and provided by The Baker Group Software Solutions, Inc.

INTENDED FOR USE BY INSTITUTIONAL INVESTORS ONLY. Any data provided herein is for informational purposes only and is intended solely for the private use of the reader. Although information contained herein is believed to be from reliable sources, The Baker Group LP does not guarantee its completeness or accuracy. Opinions constitute our judgment and are subject to change without notice. The instruments and strategies discussed here may fluctuate in price or value and may not be suitable for all investors; any doubt should be discussed with a Baker representative. Past performance is not indicative of future results. Changes in rates may have an adverse effect on the value of investments. This material is not intended as an offer or solicitation for the purchase or sale of any financial instruments.