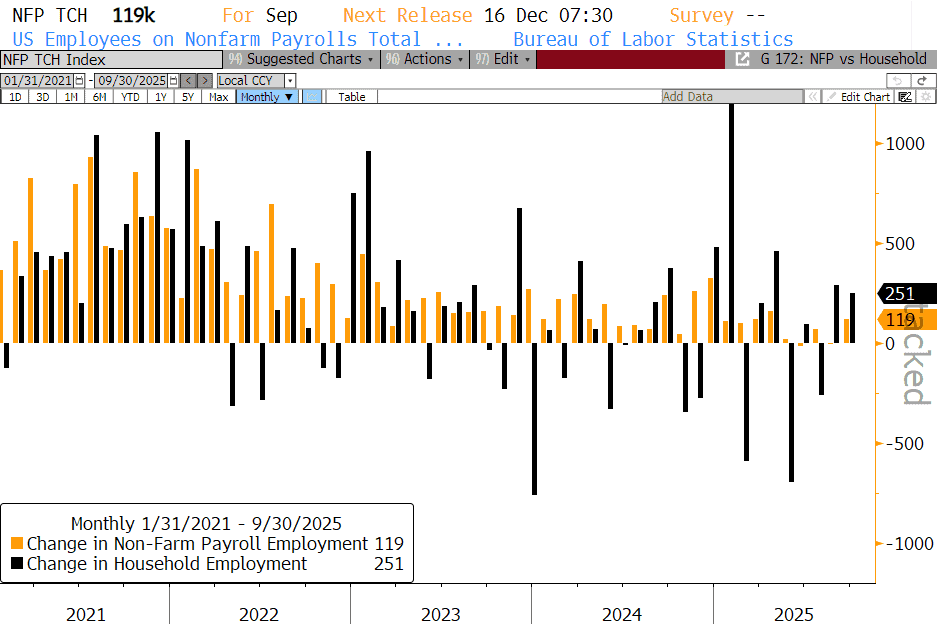

After a six-week delay, a wave of postponed economic reports finally arrived yesterday, including September’s Employment Situation Report. Nonfarm payrolls rose by 119k in September, more than twice the consensus forecast. Job gains were led by health care (+57k), leisure and hospitality (+47k), and government (+22k). Transportation and warehousing (-25k) and manufacturing (-6k) posted the largest declines. While the September headline was solid, job growth for the prior two months was revised down by a combined 33k. After those revisions, August payrolls now show employers actually shed jobs for the second time this year.

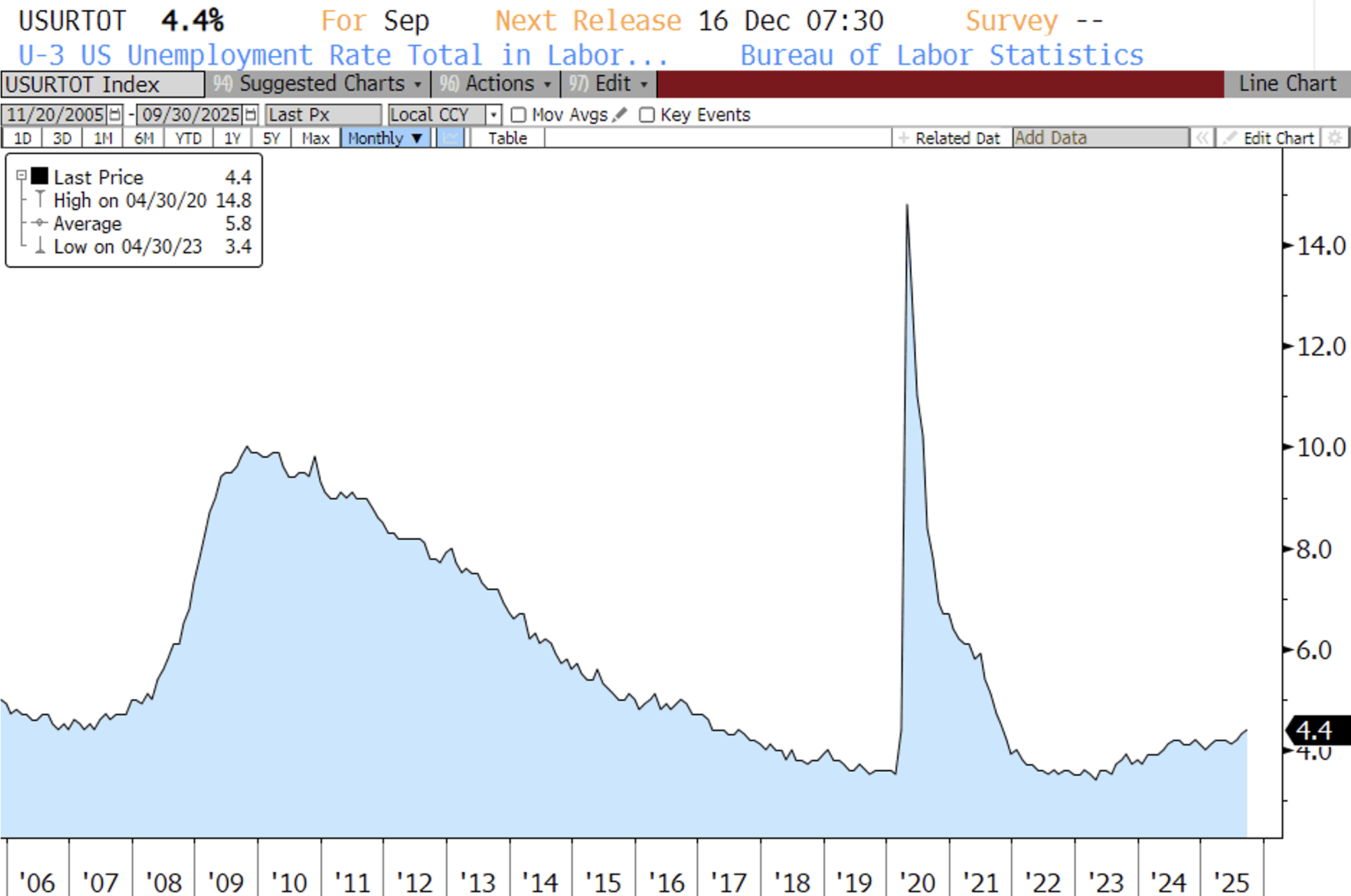

The report also highlighted an unexpected rise in the unemployment rate to 4.4%, up from 4.3% in August. The unemployment rate is now at its highest level since October 2021 when pandemic-era disruptions still weighed on the labor market. The increase was driven largely by a 470k jump in the labor force and a 245k decline in the number of people classified as “not in the labor force.” Workers re-entering the labor force is typically a positive sign, suggesting improving job prospects. Still, a 1% increase in unemployment has historically only occurred before or during recessions, so the Fed is likely to be particularly watchful for any signs of a further rise.

Additional Labor Department data this week showed layoffs remained low in mid-November, supporting the view that the job market is stuck in a “no-hire, no-fire” mode. Initial claims fell by 8k to 220k for the week ended November 15th. However, while layoffs remain subdued, more unemployed individuals are struggling to secure new positions amid soft hiring. The claims data also correspond to the survey week for November’s payroll report.

The Bureau of Labor Statistics (BLS) confirmed it will not release an October jobs report, as the government shutdown prevented staff from conducting the household survey that produces the unemployment rate. October’s change in nonfarm payrolls will instead be reflected cumulatively in November’s figures. The BLS also announced the November report will be delayed, meaning this is the last labor-market data the Fed will see before its December 10th meeting.

The Fed may be navigating without a clear view of the labor market for some time, as data is likely to remain distorted following the longest government shutdown in U.S. history. Futures markets are similarly uncertain. Yesterday traders assigned only a 33% probability of a December rate cut, but this morning those odds jumped to 73%.

Next week will be a shortened one due to Thanksgiving, but data releases will continue, with retail sales, PPI, and housing indicators all scheduled ahead of the holiday.

Have a great weekend!

The Baker Group is one of the nation’s largest independently owned securities firms specializing in investment portfolio management for community financial institutions.

Since 1979, we’ve helped our clients improve decision-making, manage interest rate risk, and maximize investment portfolio performance. Our proven approach of total resource integration utilizes software and products developed by Baker’s Software Solutions* combined with the firm’s investment experience and advice.

Author

Andrea F. Pringle

Senior Vice President

The Baker Group LP

800.937.2257

*The Baker Group LP is the sole authorized distributor for the products and services developed and provided by The Baker Group Software Solutions, Inc.

INTENDED FOR USE BY INSTITUTIONAL INVESTORS ONLY. Any data provided herein is for informational purposes only and is intended solely for the private use of the reader. Although information contained herein is believed to be from reliable sources, The Baker Group LP does not guarantee its completeness or accuracy. Opinions constitute our judgment and are subject to change without notice. The instruments and strategies discussed here may fluctuate in price or value and may not be suitable for all investors; any doubt should be discussed with a Baker representative. Past performance is not indicative of future results. Changes in rates may have an adverse effect on the value of investments. This material is not intended as an offer or solicitation for the purchase or sale of any financial instruments.