Global markets were rattled this morning after Israel conducted a military strike on Iran. Oil prices shot higher and investors scrambled to shift assets into safe havens like gold and the Swiss franc. Investors have grown accustomed to overlooking Middle East unrest in recent years, but this latest escalation could mark a significant shift in the region.

The strikes have also raised the prospect of global oil prices hitting $100 a barrel or more. Tehran is widely expected to retaliate but investors are especially concerned about the conflict escalating beyond Israeli borders and Iran seeking to block the Strait of Hormuz, the world’s most important passageway for oil shipping. About a fifth of the world's oil consumption passes through the strait and any disruption there would undoubtedly elevate energy prices. The prospect of higher energy prices at a time when investors are already wrangling over tariff-related inflation concerns will, a minimum, keep uncertainty and market volatility heightened.

Earlier in the week, the World Bank cut its global growth forecast for 2025, pointing to the "significant headwind" posed by higher tariffs and related uncertainty. Its twice-yearly Global Economic Prospects report showed the bank lowered its forecasts for nearly 70% of all economies, including the United States, China, and Europe. It stopped short of predicting an outright recession but did say that this year’s growth would be the weakest outside of a recession since 2008 and forecasted that the pace of GDP growth over the next two years would be the slowest in any decade since the 1960s.

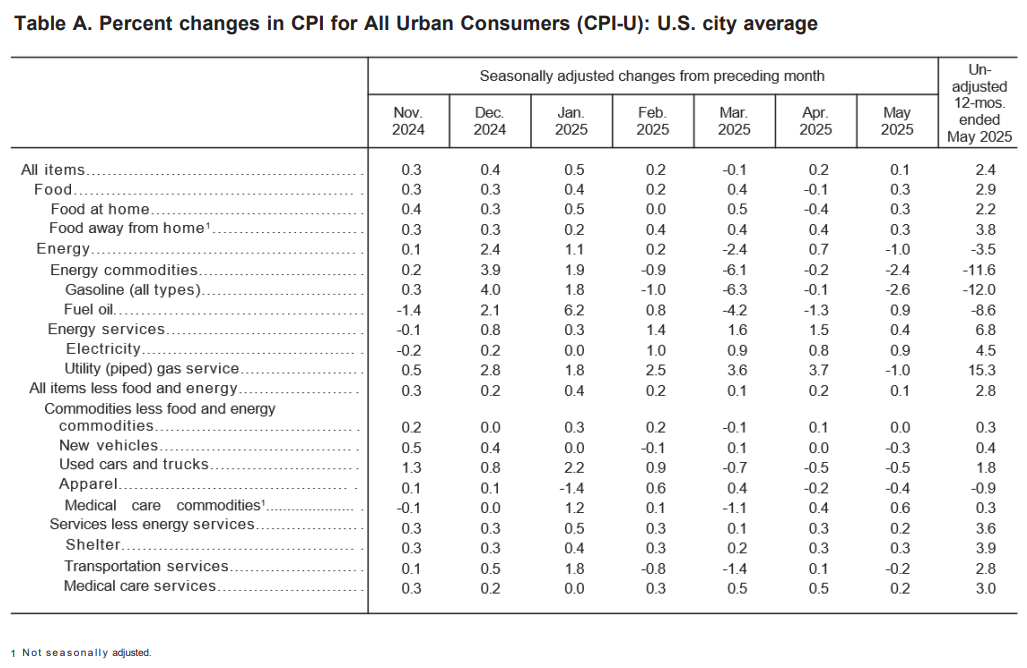

There was welcome news on inflation this week though as U.S. consumer prices increased less than expected in May. Cheaper gasoline prices partially offset higher rents and helped the Consumer Price Index (CPI) to rise by just 0.1% over the month (vs. 0.2% survey) and 2.4% annually, in line with expectations. Excluding food and energy, Core CPI also rose by 0.1% for the month (vs. 0.3% survey) and 2.8% annually (vs. 2.9% survey). Economists say inflation has been slow to respond to tariffs thus far as most retailers are selling merchandise accumulated before the duties took effect and caution that inflation is likely to accelerate in the coming months. However, to the extent that higher prices choke off demand, tariffs may be disinflationary in the short term. Although U.S. trade negotiations have transitioned from a frenzied beginning into more of a slow grind phase, the uncertainty is still weighing heavily on investors’ minds.

The Treasury market breathed a welcome sigh of relief this week after strong 10-year and 30-year bond auctions helped quell fears about U.S. debt losing its safe-haven status. Thursday’s 30-year auction had markets angsty for weeks amid worries investors would shun the U.S. government’s longest maturity borrowing. Instead, the auction brought in stronger-than-expected demand, which helped bring the yield down to 4.844%. The long bond continued to extend gains following the auction, pushing the benchmark rate below where it was when Moody’s revoked the U.S.’s last top tier credit rating in May citing concerns about growing budget deficits that show little sign of abating.

The Fed is set to meet next week. They will undoubtedly discuss the implications of a potential war in the Middle East, which complicates the inflation picture and will likely compel them to maintain a wait-and-see approach on any adjustment to the policy rate. Their statement and press conference will be especially impactful as the Fed attempts to address the juxtaposition of recent softening in inflation amid escalating tensions in the Middle East. Have a great weekend! Let’s go Thunder!

The Baker Group is one of the nation’s largest independently owned securities firms specializing in investment portfolio management for community financial institutions.

Since 1979, we’ve helped our clients improve decision-making, manage interest rate risk, and maximize investment portfolio performance. Our proven approach of total resource integration utilizes software and products developed by Baker’s Software Solutions* combined with the firm’s investment experience and advice.

Author

Andrea F. Pringle

Senior Vice President

The Baker Group LP

800.937.2257

*The Baker Group LP is the sole authorized distributor for the products and services developed and provided by The Baker Group Software Solutions, Inc.

INTENDED FOR USE BY INSTITUTIONAL INVESTORS ONLY. Any data provided herein is for informational purposes only and is intended solely for the private use of the reader. Although information contained herein is believed to be from reliable sources, The Baker Group LP does not guarantee its completeness or accuracy. Opinions constitute our judgment and are subject to change without notice. The instruments and strategies discussed here may fluctuate in price or value and may not be suitable for all investors; any doubt should be discussed with a Baker representative. Past performance is not indicative of future results. Changes in rates may have an adverse effect on the value of investments. This material is not intended as an offer or solicitation for the purchase or sale of any financial instruments.