The Federal Reserve left interest rates unchanged this week and signaled that the central bank is not yet ready to consider adjustments to its policy stance. At the conclusion of the two-day meeting on Wednesday, the FOMC voted unanimously to maintain the federal funds target range at 4.25% to 4.50%, marking the fourth straight meeting without a move. This decision was widely anticipated and the subsequent comments from Fed Chair Jerome Powell’s press conference gave few clues about the Fed’s next steps.

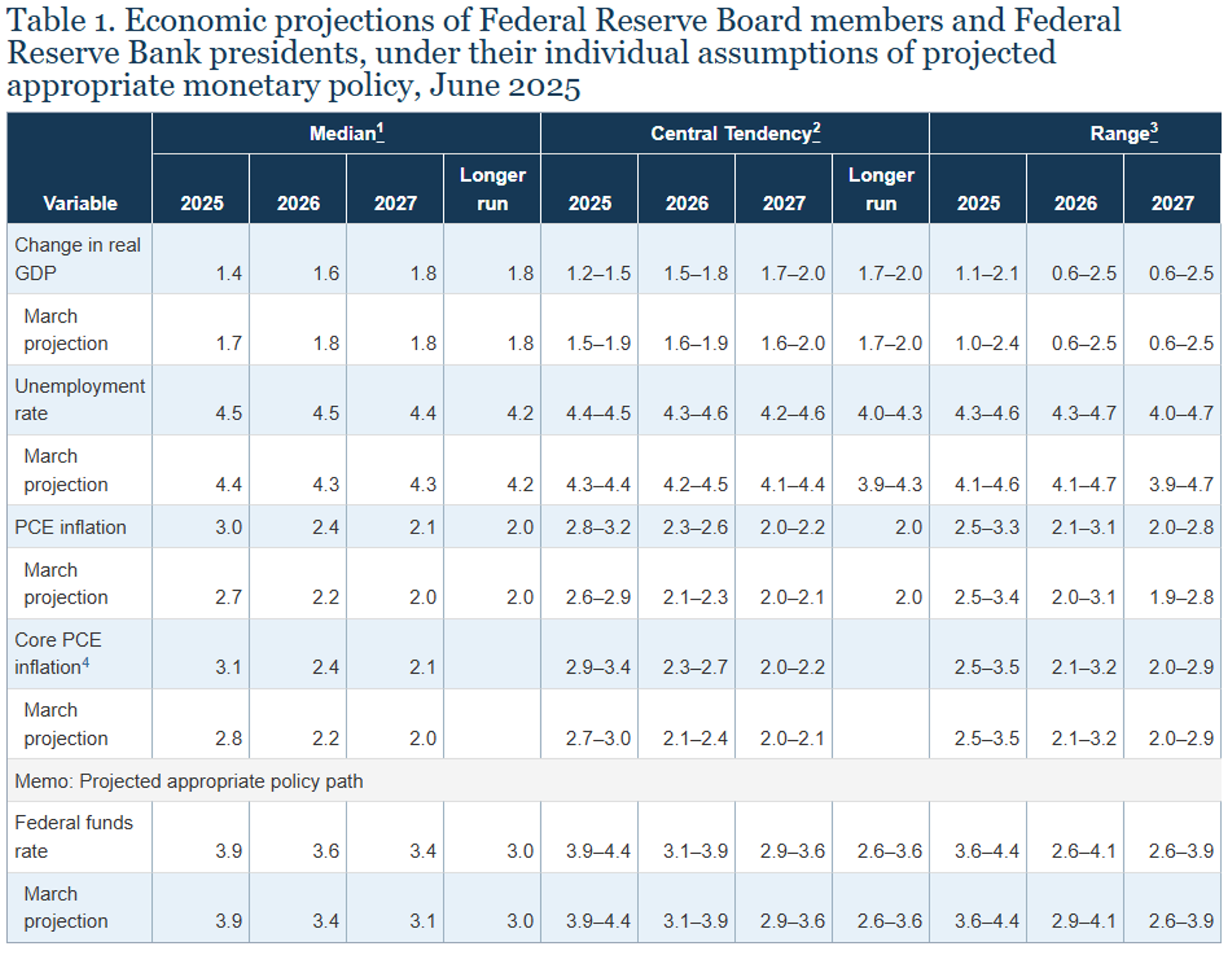

The Fed’s updated Summary of Economic Projections (SEP) still reflects a median forecast of two rate cuts by the end of 2025. Futures markets are still expecting two rate cuts as well. However, the “dot plot” showed seven of the 19 FOMC participants anticipate no cuts at all this year, exposing a greater divide within the central bank about how soon policy should ease.

Underlying that hesitation was a slightly hotter inflation outlook. The Fed revised its headline PCE inflation forecast for 2025 up to 3.0% and its core PCE forecast to 3.1%, citing potential upward pressure from new tariffs and lingering supply-side friction (the March SEP had forecast headline and core PCE at 2.7% and 2.8%, respectively). Economic growth expectations were downgraded slightly, with GDP now projected to expand just 1.4% this year (vs. 1.7% in March). The unemployment forecast was also revised, now expected to drift up to 4.5% by year end (vs. 4.4% in March).

During his post-meeting press conference, Chairman Powell emphasized the Fed’s data-dependent stance, saying that while rate cuts remain possible, the committee needs greater confidence that inflation is moving sustainably toward the 2% target. "Uncertainty remains elevated,” Powell said, pointing to trade policy volatility and global tensions as complicating factors but also said, “Despite elevated uncertainty, the economy is in solid position.” Powell also addressed the inflationary impact of tariffs more directly than in past briefings. “Someone has to pay for the tariffs,” he remarked, noting that such cost increases often feed into prices paid by consumers.

Treasury yields rose modestly after the meeting, and futures markets pushed out expectations for the first rate cut to September or later. Some Fed officials, including Governor Christopher Waller on CNBC this morning, have signaled they’d support a rate cut as soon as July if inflation continues to cool. But others are clearly less convinced. Thus far the Fed has demonstrated a penchant for the wait-and-see approach, so odds are more favorable that the Fed remains on hold through the summer.

The road ahead hinges on key labor market and inflation data, any new developments on the trade and tariff front, as well as the unfolding situation in the Middle East. A continued slowdown in inflation could give dovish members the cover they need to move forward with cuts—but a reacceleration, or any renewed labor market strength or escalation of geopolitical tensions, could easily shift the narrative again.

Have a great weekend!

The Baker Group is one of the nation’s largest independently owned securities firms specializing in investment portfolio management for community financial institutions.

Since 1979, we’ve helped our clients improve decision-making, manage interest rate risk, and maximize investment portfolio performance. Our proven approach of total resource integration utilizes software and products developed by Baker’s Software Solutions* combined with the firm’s investment experience and advice.

Author

Andrea F. Pringle

Senior Vice President

The Baker Group LP

800.937.2257

*The Baker Group LP is the sole authorized distributor for the products and services developed and provided by The Baker Group Software Solutions, Inc.

INTENDED FOR USE BY INSTITUTIONAL INVESTORS ONLY. Any data provided herein is for informational purposes only and is intended solely for the private use of the reader. Although information contained herein is believed to be from reliable sources, The Baker Group LP does not guarantee its completeness or accuracy. Opinions constitute our judgment and are subject to change without notice. The instruments and strategies discussed here may fluctuate in price or value and may not be suitable for all investors; any doubt should be discussed with a Baker representative. Past performance is not indicative of future results. Changes in rates may have an adverse effect on the value of investments. This material is not intended as an offer or solicitation for the purchase or sale of any financial instruments.