First and foremost, as many of you may already know, the Oklahoma City Thunder won the 2024–2025 NBA Championship this past Sunday. This is the first time the state of Oklahoma has brought home a championship in one of the five major sports leagues. A remarkable feat when you factor in that, at the turn of the decade, in the 2020–2021 season, the Thunder won 22 of their 72 games. This week made it clear that momentum—not legacy—often dictates who comes out on top, whether in markets or championships.

The University of Michigan Consumer Sentiment Index was released this morning, coming in at 60.7, beating June’s preliminary expectations of 60.5. The pickup in consumer sentiment from the lows of the April and May reports was mostly driven by the decline in inflation expectations. A modest dip in inflation expectations was observed, with both the 1-year and 5–10-year outlooks declining 10 basis points to 4% and 5%, respectively. At the same time, concerns over tariffs eased, with only 59% of respondents mentioning them compared to 66% in May, likely due to recent U.S. trade developments.

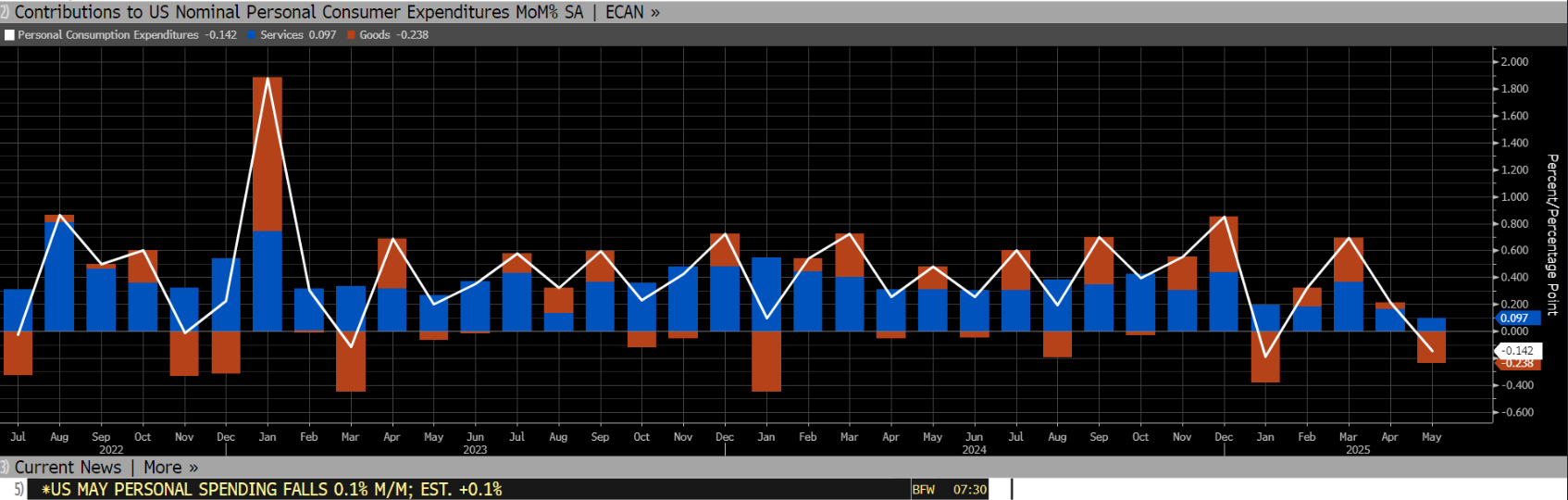

Although consumer sentiment and expectations are improving, hard data may be uncovering a conflicting narrative regarding the state of the consumer. This morning brought two key data points tied to the engine of GDP growth: personal spending and personal income. Personal spending slipped 0.1% in May, missing expectations for a 0.1% gain. Personal income also declined by 0.4%, falling short of the 0.3% increase analysts had forecast, as Social Security payments normalized following temporary surges in transfers earlier this spring. According to the U.S. Bureau of Economic Analysis (BEA), personal consumption expenditures made up 68.3% of GDP in Q1 2025. Given the consumer’s outsized role in the economy, these declining figures may point to emerging softness in the broader growth outlook.

Price pressures have remained surprisingly subdued in recent months, defying economists’ expectations that Trump-era tariffs would reignite inflation. Although many of the Personal Consumption Expenditure data points released this morning ticked up slightly from prior readings, the increase appears driven by one-time, technical price pressures rather than a shift in the underlying structural inflation trend. Certain upticks in sectors could largely be driven by external shocks—such as the rise in international airfare caused by recent geopolitical disruptions, or the increase in the “care economy,” potentially caused by a wage-work mismatch and ongoing shortages of foreign-born labor—rather than sustained, broad-based inflationary pressure. While a few categories showed upward movement, the overall inflation backdrop remains consistent with a slow and steady cooling trend.

Have a good weekend, everyone!

Source: Bloomberg, L.P.

The Baker Group is one of the nation’s largest independently owned securities firms specializing in investment portfolio management for community financial institutions.

Since 1979, we’ve helped our clients improve decision-making, manage interest rate risk, and maximize investment portfolio performance. Our proven approach of total resource integration utilizes software and products developed by Baker’s Software Solutions* combined with the firm’s investment experience and advice.

Author

Carson Francis

Financial Analyst

The Baker Group LP

800.937.2257

*The Baker Group LP is the sole authorized distributor for the products and services developed and provided by The Baker Group Software Solutions, Inc.

INTENDED FOR USE BY INSTITUTIONAL INVESTORS ONLY. Any data provided herein is for informational purposes only and is intended solely for the private use of the reader. Although information contained herein is believed to be from reliable sources, The Baker Group LP does not guarantee its completeness or accuracy. Opinions constitute our judgment and are subject to change without notice. The instruments and strategies discussed here may fluctuate in price or value and may not be suitable for all investors; any doubt should be discussed with a Baker representative. Past performance is not indicative of future results. Changes in rates may have an adverse effect on the value of investments. This material is not intended as an offer or solicitation for the purchase or sale of any financial instruments.