The first Friday of the month jobs report came one day early ahead of tomorrow’s Fourth of July Holiday. Today’s job report was almost as highly anticipated as tomorrow’s Nathan’s Hot Dog Eating Contest where Joey Chestnut will make his return after a one-year hiatus. Some are asking if Joey Chestnut is the greatest athlete of our time?! I’ll let you decide.

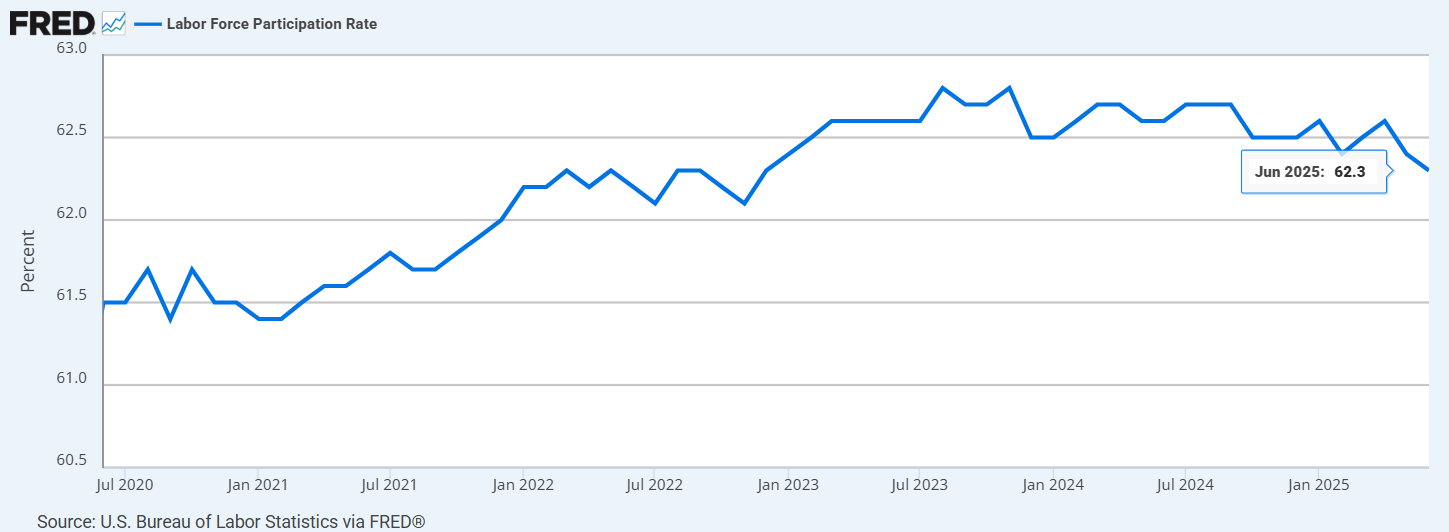

This morning’s release showed that nonfarm payrolls increased by 147,000 for the month of June, above expectations for 106,000 additional jobs. This month’s jobs report saw gains in state government (+47,000) and health care jobs (+39,000), while the federal government (-7,000) continued to shed jobs. The unemployment rate, which comes from a separate “Household Survey”, fell from 4.2% to 4.1% (estimated to rise to 4.3%). If you peel back the layers a bit and look at what drove the decline in the unemployment rate, you may think differently about the decline in the unemployment rate. The population grew by 200,000 and the number of employed grew by 93,000, however, 329,000 people left the labor force so the Labor Force Participation Rate fell to 62.3% (down 0.3% in 2 months) and that’s what caused the unemployment rate to fall to 4.1%. Three times as many people left the labor force than were getting a job. This jobs report continues to put the Fed into a wait and see approach as they will continue to wait for the potential tariff inflation that may or may not come this summer. Fed Funds Futures markets are now pricing in a 70% change of a rate cut at the mid-September FOMC Meeting.

Additionally, this morning, initial jobless claims came in a bit lower than expected at 233,000 for the prior week (estimated 241,000) and continuing claims came in slightly higher than expected at 1,964K vs. an expected 1,962K.

Earlier in the week, more labor market data points were released in the Jobs Openings Labor and Turnover Survey (JOLTS) and the ADP National Employment Report. The JOLTS report showed that job openings totaled 7.77 million (est. 7.3 million). The ADP report told a different story than today’s nonfarm payrolls report as the report revealed that 33,000 nonfarm private jobs were unexpectedly lost in June, much lower than the estimated increase of 98,000. The marked the first drop in ADP Employment change since March 2023.

On Tuesday of this week, the S&P Global US Manufacturing Purchasing Manager’s Index rose to 52.9 in June up from 52 in May, its highest reading since May 2022. ISM Manufacturing PMI also increased to 49.0 in June, up from 48.5 in May. A reading below 50 is contractionary, but June’s number of 49.0 represents a slower rate of contraction when compared to the prior month’s figure.

The Treasury Market is currently seeing a fairly strong selloff with the 10-Year Treasury being off almost half a point with a yield at 4.34% and the 2-Year Treasury yield at 3.88%. The Dow Jones Industrial Average is up about 300 points in today’s trading session.

Next week’s economic calendar is on the lighter side with the highlights coming from the weekly jobless claims and the release of the FOMC Meeting Minutes from their June meeting.

Enjoy your Fourth of July Holiday Weekend!

Labor Force Participation Rate (July 2020 to Present)

The Baker Group is one of the nation’s largest independently owned securities firms specializing in investment portfolio management for community financial institutions.

Since 1979, we’ve helped our clients improve decision-making, manage interest rate risk, and maximize investment portfolio performance. Our proven approach of total resource integration utilizes software and products developed by Baker’s Software Solutions* combined with the firm’s investment experience and advice.

Author

Dale Sheller

Managing Director

Director of Financial Strategies Group

The Baker Group LP

800.937.2257

*The Baker Group LP is the sole authorized distributor for the products and services developed and provided by The Baker Group Software Solutions, Inc.

INTENDED FOR USE BY INSTITUTIONAL INVESTORS ONLY. Any data provided herein is for informational purposes only and is intended solely for the private use of the reader. Although information contained herein is believed to be from reliable sources, The Baker Group LP does not guarantee its completeness or accuracy. Opinions constitute our judgment and are subject to change without notice. The instruments and strategies discussed here may fluctuate in price or value and may not be suitable for all investors; any doubt should be discussed with a Baker representative. Past performance is not indicative of future results. Changes in rates may have an adverse effect on the value of investments. This material is not intended as an offer or solicitation for the purchase or sale of any financial instruments.