Financial markets took in a variety of news this week, balancing domestic policy shifts with global economic updates, as well as repositioning international capital flows. Uncertainty arose from recent developments in trade policy, as the Trump administration announced a 30% tariff on all goods imported from member countries of the European Union and Mexico. Market participants are revising risk expectations and preparing for possible spillover effects into domestic inflation, sentiment, and capital flow shifts along the risk curve in response to the trade war.

The latest inflation numbers released on Tuesday could be alarming at first glance for those fearing a resurgence of inflationary pressures. Two measures of inflation surprised expectations, headline Consumer Price Index (CPI) measured on a year-over-year basis, and core CPI on a month-over-month basis. Headline inflation came in 0.1% above expectations at 2.7% (YoY), while core CPI came in 0.1% below expectations at 0.2% (MoM). All Consumer Price Index readings came in higher than the prior month but can be attributed to something called the “base effect.” The base effect refers to the impact that a starting value has on changes in economic indicators. This base effect explains why headline CPI increased from 2.4% to 2.7%, as the flat 0.0% from June 2024 was replaced by a 0.3% increase in June 2025.

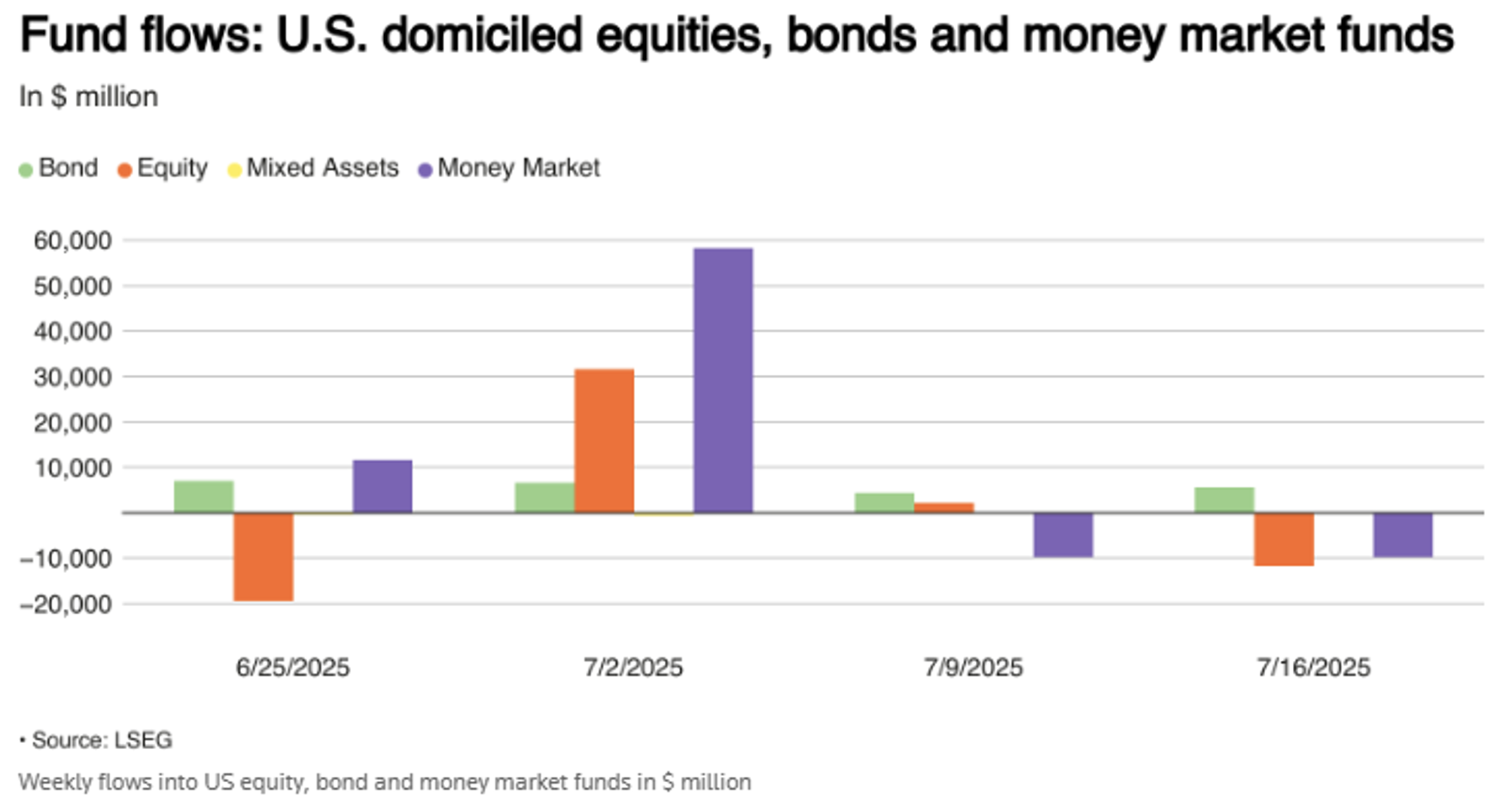

During the week ending July 16th, global equity funds saw roughly a $5.3 billion outflow, driven by apprehension over recent tariff threats. Following two consecutive weeks of net inflows, approximately $11.75 billion flowed out of U.S. equity funds, while other international markets such as Europe and Asia saw influxes of capital into their equity markets. Most notably, U.S. money market funds saw a net outflow of about $9.79 billion, marking the second consecutive week of net sales. Meanwhile, domestic bonds remained attractive, receiving net inflows of $5.55 billion, marking the 13th consecutive week of inflows. This shift reflects a rotation of cash out of money markets toward assets higher on the risk curve, motivated by strong real yields in mid- and long-duration bonds and emerging potential in international equity markets.

Despite money managers' lackluster sentiment toward domestic stocks, highlighted by outflows from U.S. equity funds, retail sales remain strong. On Thursday morning, Retail Sales Advance MoM, which tracks sales of both new and used goods for personal or household consumption, beat expectations of 0.1%, coming in at 0.6%. One possible driver of the sharp rise in retail sales was the strong performance in the automobiles and parts category, which was the largest contributor to the overall increase in June. According to the data, sales at motor vehicle and parts dealers rose 1.6% month-over-month, well above the headline number, and this jump likely reflects tariff-driven price increases as well as residual supply chain pressures. This aligns with broader commentary suggesting that part of the retail sales strength came from higher prices rather than increased purchase volumes, especially in goods sensitive to trade policy impacts, where consumers are front-running purchases in fear of future price increases.

Have a good weekend, everyone!

The Baker Group is one of the nation’s largest independently owned securities firms specializing in investment portfolio management for community financial institutions.

Since 1979, we’ve helped our clients improve decision-making, manage interest rate risk, and maximize investment portfolio performance. Our proven approach of total resource integration utilizes software and products developed by Baker’s Software Solutions* combined with the firm’s investment experience and advice.

Author

Carson Francis

Financial Analyst

The Baker Group LP

800.937.2257

*The Baker Group LP is the sole authorized distributor for the products and services developed and provided by The Baker Group Software Solutions, Inc.

INTENDED FOR USE BY INSTITUTIONAL INVESTORS ONLY. Any data provided herein is for informational purposes only and is intended solely for the private use of the reader. Although information contained herein is believed to be from reliable sources, The Baker Group LP does not guarantee its completeness or accuracy. Opinions constitute our judgment and are subject to change without notice. The instruments and strategies discussed here may fluctuate in price or value and may not be suitable for all investors; any doubt should be discussed with a Baker representative. Past performance is not indicative of future results. Changes in rates may have an adverse effect on the value of investments. This material is not intended as an offer or solicitation for the purchase or sale of any financial instruments.