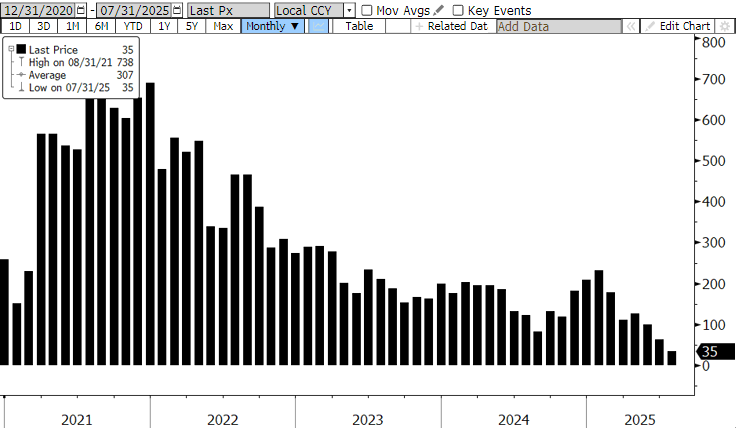

Treasury yields are plunging this morning as US payroll data showed job growth slowed dramatically over the past three months. Two-year notes tumbled 22 bps to 3.74% and 10-year yields fell 13 bps to 4.24% in the first few hours after the release of July’s Employment Situation Report. It showed just 73k jobs were added to non-farm payrolls last month, far fewer than the 106k jobs the market was expecting. Equally important, it also showed the two prior months of job gains were revised sharply lower. June non-farm payrolls were amended to show just 14k jobs added and May's report was revised down to 19k, a total downward revision of 258k. This means that over the last three months, employment growth has averaged a paltry 35k, the worst growth rate since the pandemic.

The unemployment rate also increased to 4.2% as 239k workers left the workforce. The unexpected drop to 62.2% in the labor force participation rate brings the share of the population working or looking for work to its lowest level in nearly three years, an important indicator as fewer people contributing to the production of goods and services can slow overall economic growth. The report clearly shows the labor market is losing steam and directly challenges the Fed’s hawkish posture coming out of this week’s FOMC meeting.

It also caps a week of high-profile data that showed economic momentum slowing and inflation progress stalling, one of the key reasons the FOMC elected to hold policy rates steady on Wednesday. Chairman Powell noted that the central bank must be cautious of inflation risks, especially with a new round of tariff implementation beginning this month. However, in the first double dissent in more than 30 years, Fed Governors Christopher Waller and Michelle Bowman voted against the Fed’s decision to keep rates unchanged. In separate statements released this morning, they voiced concerns that policymakers’ hesitance to lower rates poses a risk to a labor market that is showing increasing signs of weakness.

Futures traders have already taken this morning’s jobs report as fodder for significantly upping their rate cut bets. FF futures now have two 25 bp rate cuts fully priced in for this year, with an 86% chance of the first one coming at the next meeting in September. Prior to the release of the payrolls numbers, futures markets were pricing in a 36% chance of a September rate cut. With some questioning whether the Fed might already regret holding rates steady this week, bets on a 50 bp cut in September are also increasing.

The path forward for the Fed is most certainly a delicate one. If inflation moves higher alongside a deteriorating labor market, the two sides of its dual mandate will be in competition and warrant contradictory actions. All else equal, if the Fed were forced to choose between the two, it would likely ease policy to stave off significant labor market damage, but it may not be as fast or as accommodating in changing policy as it could be without the upside risk to inflation.

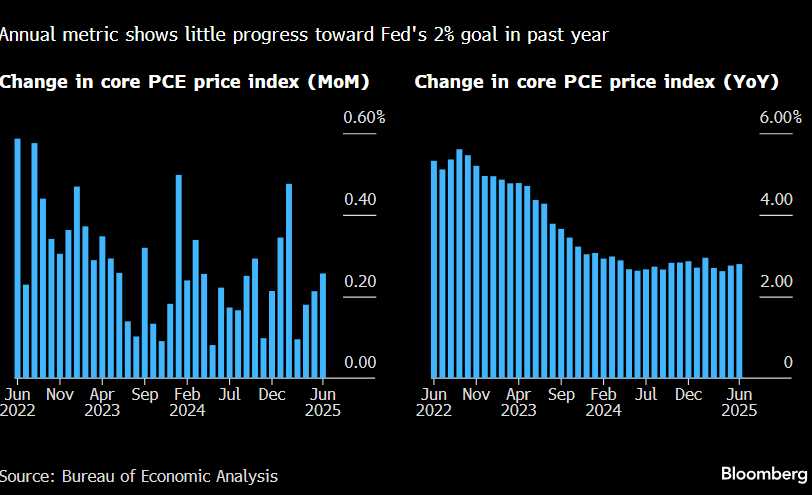

That, of course, is the scenario weighing on the minds of policymakers and investors alike, especially in light of this week’s news. The weakening jobs picture comes just days after data showed the Fed’s key inflation gauge increased in June at one of the fastest paces this year and just hours after President Trump unveiled a new round of tariffs that increase the average US tariff rate to 15.2% (from 13.3% previously and 2.3% in 2024).

The Personal Consumption Expenditures (PCE) price index rose 2.6% on an annual basis and 0.3% in the month of June. Core PCE increased 2.8% YoY and 0.3% MoM. The annual change in core PCE has held near this level for most of this year, fueling concerns that that progress towards the Fed’s 2% goal has essentially stalled at a time when central bankers are already concerned about tariff impacts being passed on to consumers in the form of higher prices. Last night, new tariff rates were announced for more than 65 countries plus the European Union. These tariffs will take effect after midnight on August 7th with rates ranging from 10% - 50%.

Next week has a lighter data docket but will be heavier on Fedspeak and undoubtedly deliver more headlines on tariffs. Have a wonderful weekend!

The Baker Group is one of the nation’s largest independently owned securities firms specializing in investment portfolio management for community financial institutions.

Since 1979, we’ve helped our clients improve decision-making, manage interest rate risk, and maximize investment portfolio performance. Our proven approach of total resource integration utilizes software and products developed by Baker’s Software Solutions* combined with the firm’s investment experience and advice.

Author

Andrea F. Pringle

Senior Vice President

The Baker Group LP

800.937.2257

*The Baker Group LP is the sole authorized distributor for the products and services developed and provided by The Baker Group Software Solutions, Inc.

INTENDED FOR USE BY INSTITUTIONAL INVESTORS ONLY. Any data provided herein is for informational purposes only and is intended solely for the private use of the reader. Although information contained herein is believed to be from reliable sources, The Baker Group LP does not guarantee its completeness or accuracy. Opinions constitute our judgment and are subject to change without notice. The instruments and strategies discussed here may fluctuate in price or value and may not be suitable for all investors; any doubt should be discussed with a Baker representative. Past performance is not indicative of future results. Changes in rates may have an adverse effect on the value of investments. This material is not intended as an offer or solicitation for the purchase or sale of any financial instruments.