Markets spent much of the week in full-throttle risk-on mode, powered by growing conviction that the Fed is preparing to deliver rate cuts before year-end. A softer inflation narrative, political pressure from the White House, and dovish hints from Treasury Secretary Scott Bessent sent futures pricing to near-certainty for a September cut, with traders even entertaining a half-point move. By mid-week, the S&P 500 and Nasdaq were setting fresh records, bond and equity volatility gauges had collapsed, and two-year yields were nearing three-month lows.

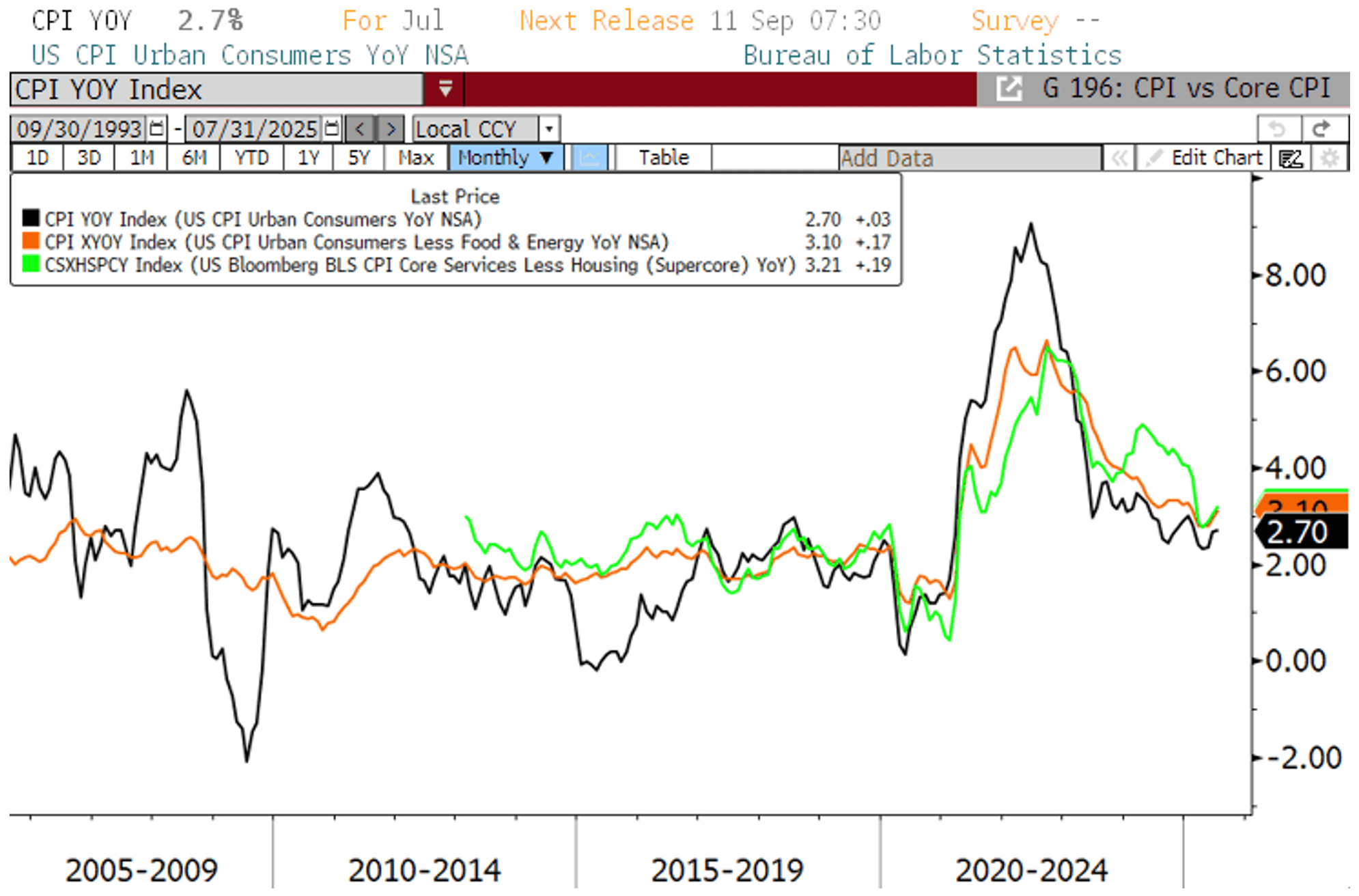

Tuesday’s release of inflation data for July showed little tariff impact on consumer prices thus far. The Consumer Price Index (CPI) rose 0.2% over the month, as expected, and rose 2.7% from a year ago (est. = 2.8%). Core CPI also ticked up as expected in July, rising 0.3% and 3.1% from a year ago (est. = 3.0). The lack of upside inflation surprise was enough to fan the rate-cut narrative and Treasury Secretary Bessent even suggested the Fed might need to “make up for the delay” with a 50bp rate cut in September. He also floated the idea of 150–175 bps of easing ahead. The latest Trump appointee to the Fed board could be in place by the September meeting, adding to expectations for a policy pivot. Markets are now pricing in more than two cuts by year-end and Wall Street banks have followed suit, adjusting forecasts to reflect more aggressive easing.

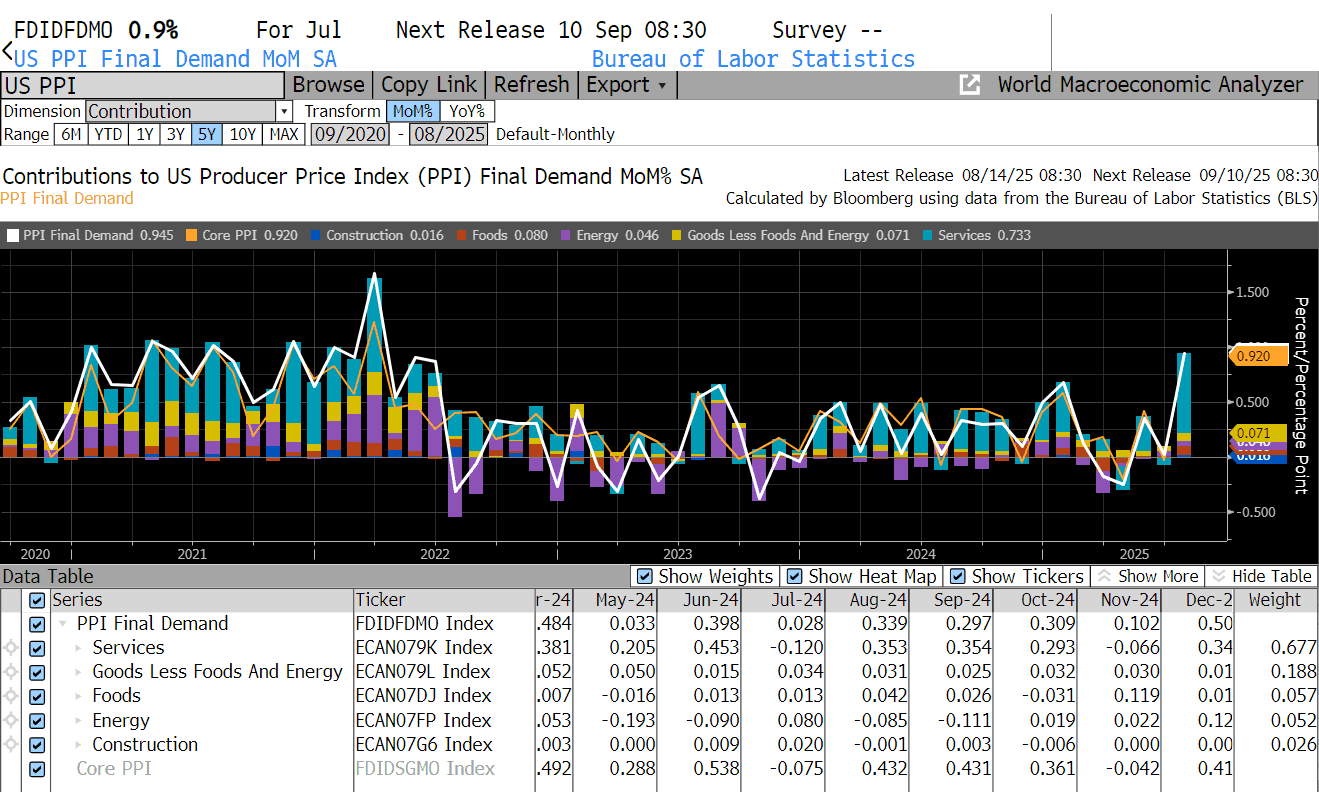

However, by Thursday the inflation narrative had changed. A sharp jump in U.S. producer prices in July, driven by the biggest jump in retail and wholesale margins in two years, shot down some of the rate cut fervor. The Producer Price Index (PPI) rose 1.2% from June, well above expectations, marking the sharpest increase since early 2021. On a year-over-year basis, PPI advanced 2.5%, up from 2.1% in June. This data factors importantly into the Fed’s preferred inflation gauge, the PCE price index, as components from PPI feed directly into the PCE calculation. While consumer inflation has shown little signs of increasing thus far, the surge in producer prices complicates the Fed’s path toward rate cuts, as changes in producer prices often augur similar changes in consumer prices are ahead.

Next week brings a full docket of fresh economic data as well as minutes from July’s FOMC meeting. The Fed’s annual central banking conference in Jackson Hole, Wyoming also kicks off next week with Fed Chair Jerome Powell set to speak on Friday about on the country’s economic outlook and the Fed's review of its policy framework.

Have a great weekend!

The Baker Group is one of the nation’s largest independently owned securities firms specializing in investment portfolio management for community financial institutions.

Since 1979, we’ve helped our clients improve decision-making, manage interest rate risk, and maximize investment portfolio performance. Our proven approach of total resource integration utilizes software and products developed by Baker’s Software Solutions* combined with the firm’s investment experience and advice.

Author

Andrea F. Pringle

Senior Vice President

The Baker Group LP

800.937.2257

*The Baker Group LP is the sole authorized distributor for the products and services developed and provided by The Baker Group Software Solutions, Inc.

INTENDED FOR USE BY INSTITUTIONAL INVESTORS ONLY. Any data provided herein is for informational purposes only and is intended solely for the private use of the reader. Although information contained herein is believed to be from reliable sources, The Baker Group LP does not guarantee its completeness or accuracy. Opinions constitute our judgment and are subject to change without notice. The instruments and strategies discussed here may fluctuate in price or value and may not be suitable for all investors; any doubt should be discussed with a Baker representative. Past performance is not indicative of future results. Changes in rates may have an adverse effect on the value of investments. This material is not intended as an offer or solicitation for the purchase or sale of any financial instruments.