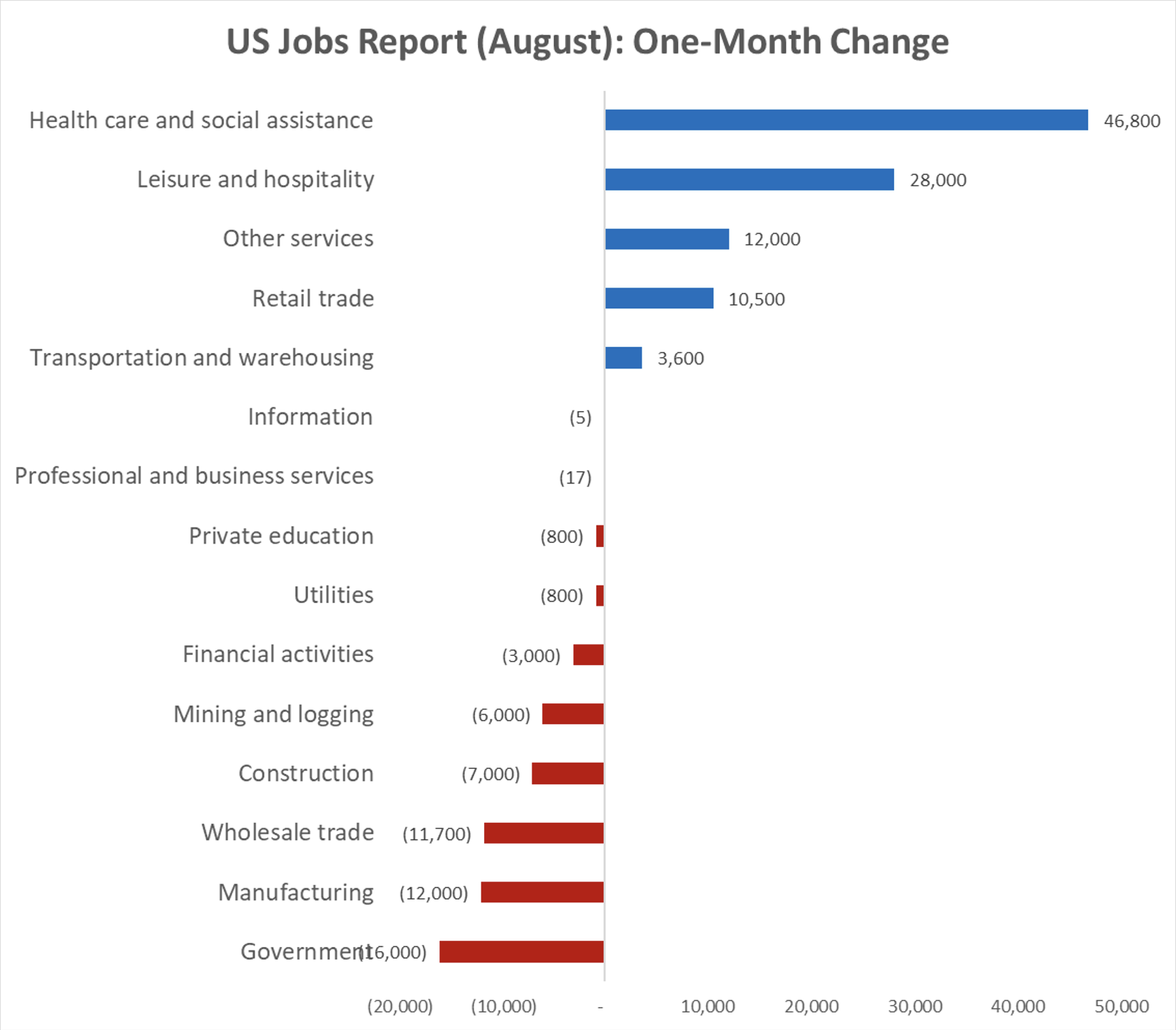

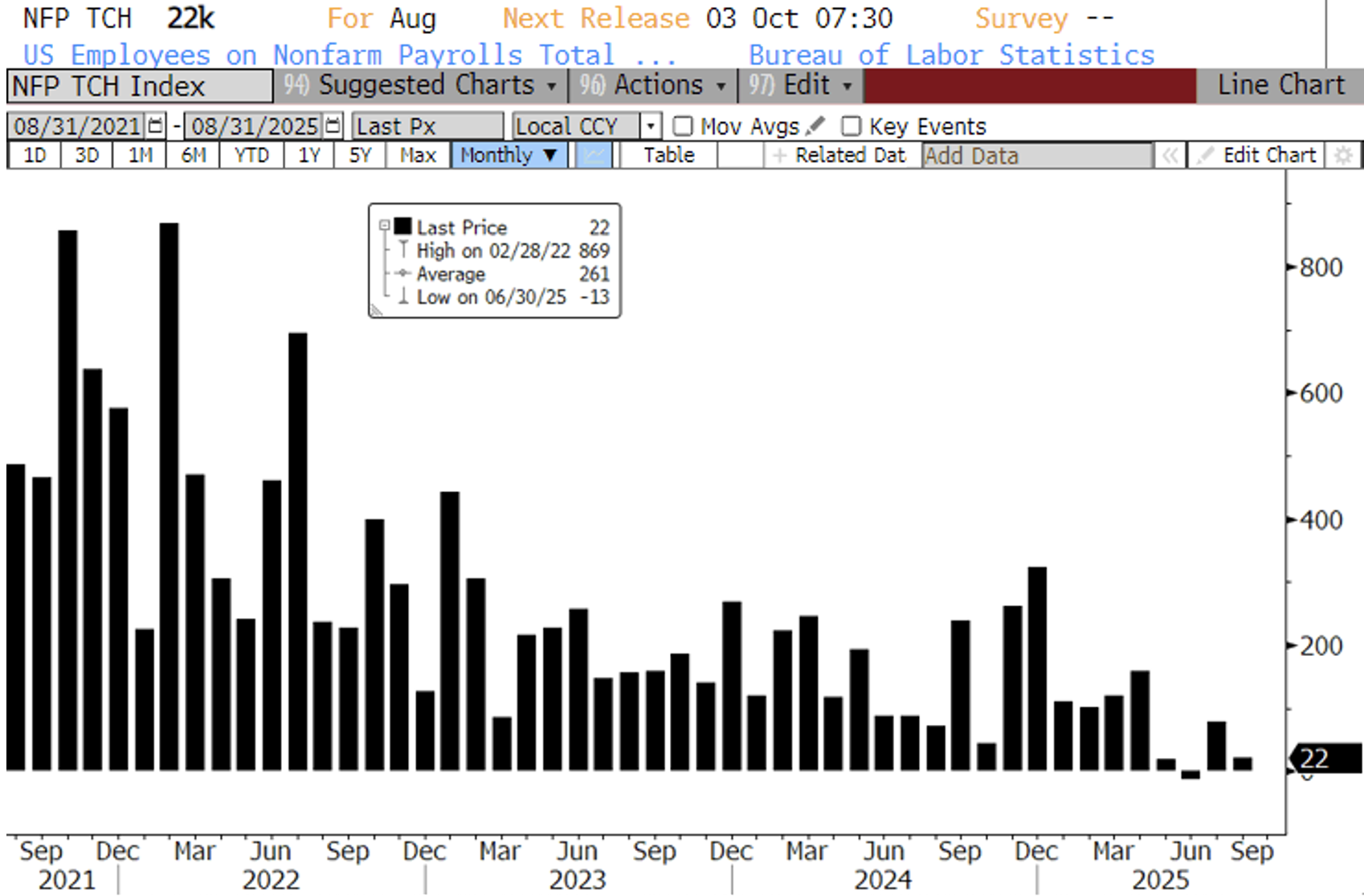

This week’s labor market data can be summed up in a single headline, Rate Cuts Are Coming. This morning’s dismal employment report capped a week of weak data that showed the labor market is cooling materially and cemented the case for a Fed rate cut later this month. The U.S. economy added just 22k jobs in August (sharply lower than the 75k estimate) and the unemployment rate rose to 4.3%, the highest level since October 2021. Importantly, nonfarm payrolls gains for the prior two months were also revised lower by 21k, meaning that the economy actually lost 13k jobs in June, the first monthly loss of jobs since December 2020 when the economy was still reeling from the pandemic. This brings 3-month average job growth in the U.S. to just 29k, far from the “robust” and “resilient” labor market we’ve grown accustomed to hearing about.

Today’s employment report comes on the heels of similarly subdued data earlier in the week. Yesterday, private payrolls firm ADP reported job gains of 54k in August, missing expectations of 68k. Survey data also highlighted another dimension of weakness, workers have become increasingly pessimistic. Confidence surveys show employees perceive a lack of job security and fewer opportunities for wage growth, amplifying the sense of slack in the system. On Wednesday, the Job Openings and Labor Turnover Survey (JOLTS) showed job openings fell in July to the lowest level in nearly a year. Opens fell to 7.18mm, missing estimates by nearly 200k and down 176k from a downwardly revised 7.36mm in June. Layoffs also rose 12k but missed estimates by 169k as June layoffs were revised higher by 192k. This brought the number of job openings per unemployed worker (a metric Fed Chairman Jerome Powell has said the committee closely monitors as an indicator of supply and demand in the labor market) below 1.0 for the first time since 2018, excluding the pandemic.

This cooling in the labor market is precisely what the Federal Reserve has been waiting to see from the data and cements the case for a rate cut later this month. Market pricing now tilts toward just over one cut in September and nearly three cuts priced in by year end. Importantly, December 2026 forecasts now show a drop of more than 150 bps, bringing the implied fed funds rate to ~2.8% by the end of next year.

Treasury yields tumbled following the payroll release this morning, with the 2-year note sliding toward 3.75%, its lowest since early 2023. The 10-year yield fell to 4.07%, more than 70bps lower than its high January. Equity markets also whipsawed between hopes of Fed easing and fears of a hard landing. Next week, critical PPI and CPI inflation data are due out, giving the FOMC one last look at inflation ahead of their next meeting.

Have a great weekend!

Source: Bloomberg, L.P.

The Baker Group is one of the nation’s largest independently owned securities firms specializing in investment portfolio management for community financial institutions.

Since 1979, we’ve helped our clients improve decision-making, manage interest rate risk, and maximize investment portfolio performance. Our proven approach of total resource integration utilizes software and products developed by Baker’s Software Solutions* combined with the firm’s investment experience and advice.

Author

Andrea F. Pringle

Senior Vice President

The Baker Group LP

800.937.2257

*The Baker Group LP is the sole authorized distributor for the products and services developed and provided by The Baker Group Software Solutions, Inc.

INTENDED FOR USE BY INSTITUTIONAL INVESTORS ONLY. Any data provided herein is for informational purposes only and is intended solely for the private use of the reader. Although information contained herein is believed to be from reliable sources, The Baker Group LP does not guarantee its completeness or accuracy. Opinions constitute our judgment and are subject to change without notice. The instruments and strategies discussed here may fluctuate in price or value and may not be suitable for all investors; any doubt should be discussed with a Baker representative. Past performance is not indicative of future results. Changes in rates may have an adverse effect on the value of investments. This material is not intended as an offer or solicitation for the purchase or sale of any financial instruments.