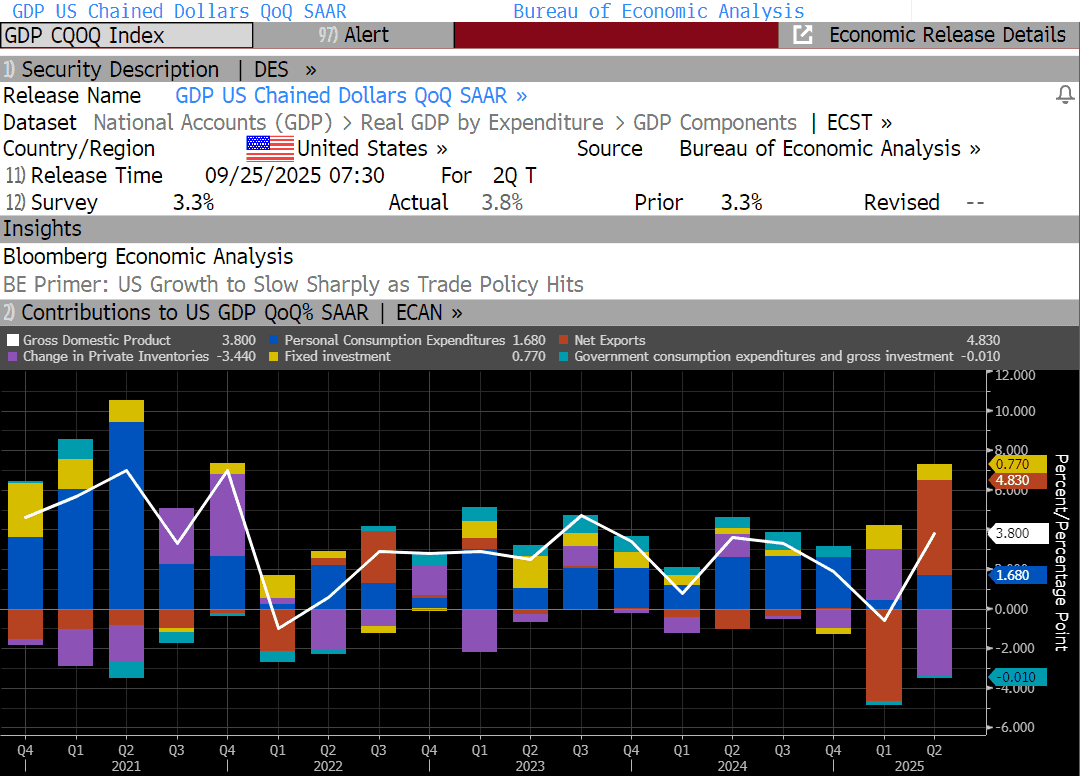

The Federal Reserve’s job just got a bit tougher this week. First, news came yesterday that second-quarter GDP was revised up to 3.8%, the strongest pace since the third quarter of 2023. President Donald Trump also unveiled a new round of tariffs yesterday, including a 100% duty on branded pharmaceuticals, a 50% tariff on imported kitchen cabinets and bathroom vanities, 30% on upholstered furniture, and a 25% levy on heavy-duty trucks. Details remain thin, and exemptions are almost certain, but the combination of stronger growth and potential new price pressures challenges market expectations for aggressive easing from the Fed.

Markets had been assigning better than an 80% probability of a half-point reduction by December but that has slipped closer to 60% as the market recalibrates the Fed’s room to maneuver. A flurry of Fedspeak this week also underscored the need for a cautious path forward. "Heavy front-loading of cuts before you know whether this is all there's going to be on inflation and before you know whether this inflation is going to be persistent runs a risk of a mistake," Chicago Fed President Austan Goolsbee told reporters in Michigan this week.

San Francisco Fed President Mary Daly, speaking in Utah, pointed to “yellow flags” in the labor market, citing challenges for new college graduates and longer job searches for many workers. Still, she cautioned that policy easing should proceed gradually with inflation running above the Fed’s 2% goal even before factoring in tariffs. "If you adjust the path all at once, you risk one of the goals… If you adjust the path gradually, assess the information before deciding, then you can actually get to a good achievement."

Kansas City Fed President Jeffrey Schmid went even further, appearing to lay out his case for holding rates steady. At an event in Dallas, he told the audience "I view the current stance of policy as only slightly restrictive, which I think is the right place to be." Still, President Trump’s newest appointee, Stephen Miran, continued to press for sharp rate cuts to prevent labor market decline on Thursday, saying his fellow central bankers are overly fearful that tariffs will drive inflation up.

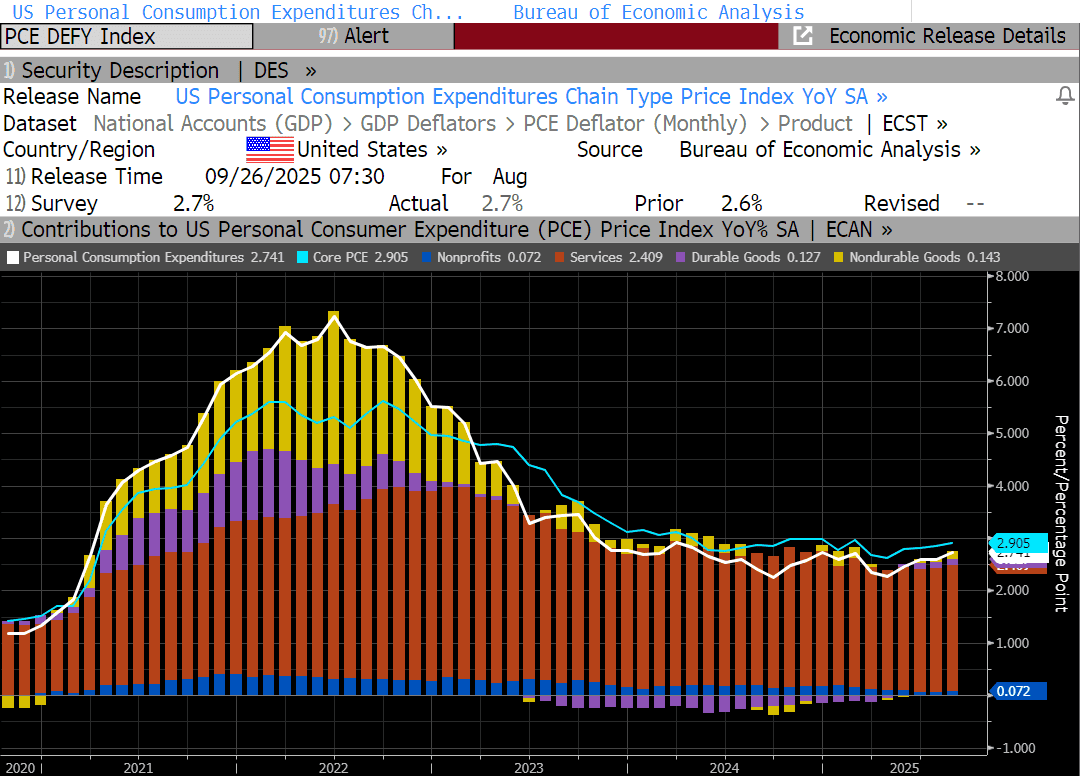

This morning, inflation and spending data showed consumers are continuing to spend despite stubborn inflation. The personal consumption expenditures (PCE) price index rose 0.3% in July and held steady at 2.7% annually. Real personal spending though continued at a steady clip for the third straight month, rising 0.4% in August. The consecutive strong gains in spending add evidence to the case that the economy is still solid. However, the ability of consumers to maintain their spending momentum will, of course, depend on how well the labor market holds up.

Next week will bring critical insight into that topic. Several key indicators are due on the state of the labor market throughout the week including Job openings, ADP employment, Initial jobless claims and the latest Nonfarm Payrolls and Unemployment stats. Have a great weekend!

The Baker Group is one of the nation’s largest independently owned securities firms specializing in investment portfolio management for community financial institutions.

Since 1979, we’ve helped our clients improve decision-making, manage interest rate risk, and maximize investment portfolio performance. Our proven approach of total resource integration utilizes software and products developed by Baker’s Software Solutions* combined with the firm’s investment experience and advice.

Author

Andrea F. Pringle

Senior Vice President

The Baker Group LP

800.937.2257

*The Baker Group LP is the sole authorized distributor for the products and services developed and provided by The Baker Group Software Solutions, Inc.

INTENDED FOR USE BY INSTITUTIONAL INVESTORS ONLY. Any data provided herein is for informational purposes only and is intended solely for the private use of the reader. Although information contained herein is believed to be from reliable sources, The Baker Group LP does not guarantee its completeness or accuracy. Opinions constitute our judgment and are subject to change without notice. The instruments and strategies discussed here may fluctuate in price or value and may not be suitable for all investors; any doubt should be discussed with a Baker representative. Past performance is not indicative of future results. Changes in rates may have an adverse effect on the value of investments. This material is not intended as an offer or solicitation for the purchase or sale of any financial instruments.