As the government continues into its 17th day of shutdown, we look back at the economic calendar for the week and quickly find that most of economic data scheduled to be released has been delayed. The Kalshi betting markets site is currently calculating a forecast for the shutdown at just below 40 days. Heading into the last two Fed meetings, the “data driven” Fed is flying somewhat blind with the lack of key data releases over the last two weeks, including the lack of a jobs report and inflation data. Last week, NY Fed President John Williams said the lack of government data will not deter the Fed from cutting rates as long as other private data continues showing weakness.

Other news this week shook the financial markets as regional bank stocks were hit hard as fears are mounting around some bad loans. Zions Bank disclosed a $50 million charge-off related to defaulted commercial loans, triggering broader concerns about regional bank asset quality. Additionally, Western Alliance also alleged some loan issues related to borrower fraud. These loan loss related announcements came after earlier this week when JPMorgan CEO Jamie Dimon commented on the bankruptcies of U.S. auto parts supplier First Brand and car dealership Tricolor. Dimon stated “When you see one cockroach, there are probably more, and so everyone should be forewarned of this one.” JPMorgan is set to lose approximately $170 million from soured loans to Tricolor. Treasuries markets rallied yesterday alongside this fearful news pushing the 10-Year Treasury slightly below 4%.

On Tuesday, Fed Chairman Jerome Powell prepared remarks for an event hosted by the National Association for Business Economics. He stated, “there is no risk-free path for policy as we navigate the tension between our employment and inflation goals.” Additionally, he stated that “based on the data that we do have, it is fair to say that the outlook for employment and inflation does not appear to have changed much since our September meeting four weeks ago.”

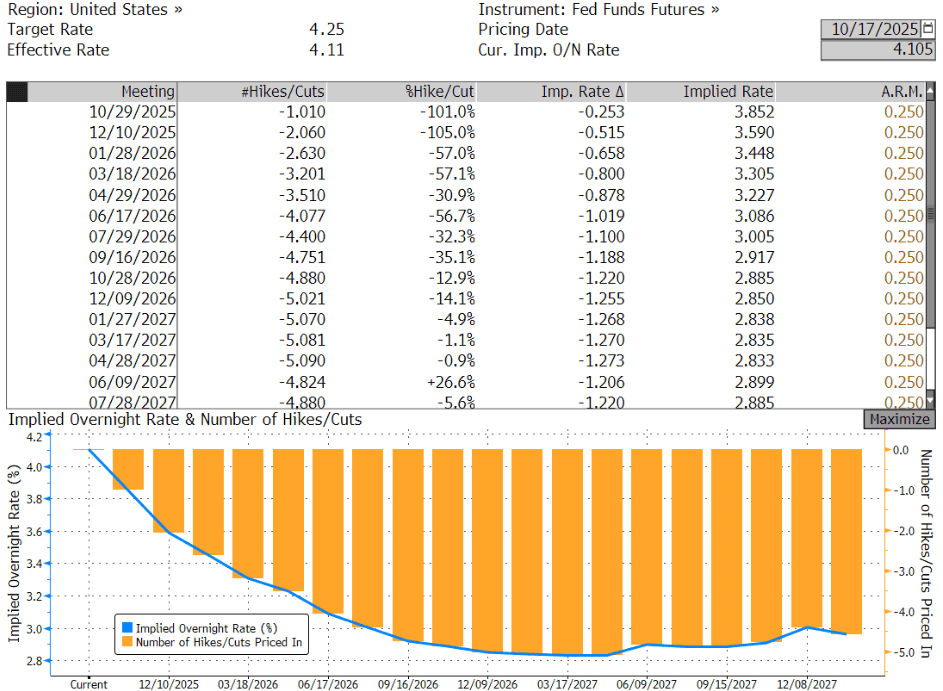

The market is fully expecting the Fed to cut 25 basis points in just under two weeks and another 25 basis points at their final meeting of the year on December 10th. Fed Funds futures markets are now pricing in just over a 100% chance of a 25-basis point rate cut in each of the final two Fed meetings of the year. Checking in on the markets this morning shows that the 2-Year Treasury yield is currently sitting at 3.47% and the 10-Year Treasury yield has snuck back above 4% at 4.01%.

Unless the government shutdown ends soon, next week’s economic data calendar will be minimal. The Consumer Price Index is scheduled to be released next Friday; however, this is unlikely due to the shutdown. Have a great weekend everyone!

World Interest Rate Probability

The Baker Group is one of the nation’s largest independently owned securities firms specializing in investment portfolio management for community financial institutions.

Since 1979, we’ve helped our clients improve decision-making, manage interest rate risk, and maximize investment portfolio performance. Our proven approach of total resource integration utilizes software and products developed by Baker’s Software Solutions* combined with the firm’s investment experience and advice.

Author

Dale Sheller

Managing Director

Director of Financial Strategies Group

The Baker Group LP

800.937.2257

*The Baker Group LP is the sole authorized distributor for the products and services developed and provided by The Baker Group Software Solutions, Inc.

INTENDED FOR USE BY INSTITUTIONAL INVESTORS ONLY. Any data provided herein is for informational purposes only and is intended solely for the private use of the reader. Although information contained herein is believed to be from reliable sources, The Baker Group LP does not guarantee its completeness or accuracy. Opinions constitute our judgment and are subject to change without notice. The instruments and strategies discussed here may fluctuate in price or value and may not be suitable for all investors; any doubt should be discussed with a Baker representative. Past performance is not indicative of future results. Changes in rates may have an adverse effect on the value of investments. This material is not intended as an offer or solicitation for the purchase or sale of any financial instruments.