It was a sleepy week for bond markets with the Thanksgiving holiday. There was plenty of data released this week, but much of that data was “old news” from September that is just now being released after the government resolved its shutdown. This stale data is useful to the extent that it either affirms or alters one’s view of the current economy, but traders were reluctant to reposition based on data that is now 2 months old. As a result, the 10yr began the week at around 4.02% and is sitting right at 4.00% as of the time of this writing.

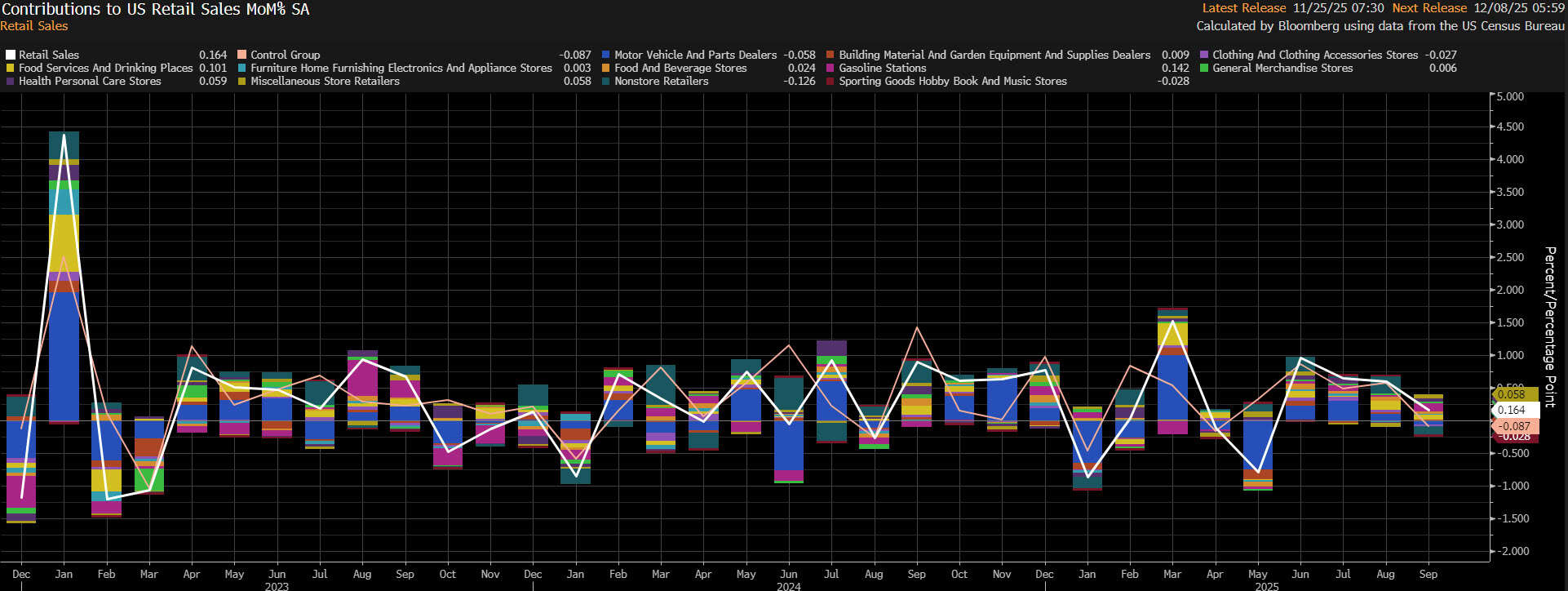

Some of the more closely watched numbers for the week included Retail Sales, PPI, and Durable Goods. Headline retail sales came in at 0.2% vs 0.4% exp. month-over-month with several categories reverting from a period of strong summer spending. Retail sales numbers aren’t adjusted for inflation, so with CPI coming in at 0.3% for the same September period, much of the increase in spending can likely be attributed to higher costs vs a real increase in consumption. September’s PPI number came in line with expectations at an increase of 0.3%. Much of the increase was due to volatile energy prices. Core PPI, which strips away volatile categories like food and energy, increased 0.1% vs 0.2% exp. Producer prices showed little inflationary pressure for the month which should help to alleviate the Fed’s concerns about increasing inflation. Additionally, there are several categories in the PPI report that feed into PCE, the Fed’s preferred measure of inflation, and many of these categories saw price declines for the month. Airfares were an exception as they jumped 0.8% MoM. We also got a look at Durable Goods orders for September and the headline number came in-line with analyst expectations at 0.5%. More importantly, Capital Goods Orders Non-Defense Ex Air, which is a proxy for business investment, came in at 0.9% vs 0.3% expected. The strength was surprising as Regional Fed surveys have suggested that business plans for capital expenditures could remain muted. Businesses could be taking advantage of bonus depreciation that was made permanent in the One Big Beautiful Bill act in July. This could be a reason why sentiment differed so strongly from actual investment.

The Dallas, Philadelphia, and Richmond Fed all reported lower activity levels than anticipated for the month of November. Lastly, the Conference Board’s Consumer Confidence survey came in much lower than expected. Consumers were pessimistic about the labor market and business conditions with views of their own financial situation falling to the lowest level since August of 2024. Given the timing, it’s hard to know how much the government shutdown impacted these levels of consumer pessimism.

As the reporting entities recover from the government shutdown, we should continue to receive older data from September combined with new upcoming data but delays are to be expected. As an example, we’d typically receive Non-Farm Payrolls next, but that has been delayed until December 16th.

Happy Thanksgiving to everyone and hope you have a great weekend!

The Baker Group is one of the nation’s largest independently owned securities firms specializing in investment portfolio management for community financial institutions.

Since 1979, we’ve helped our clients improve decision-making, manage interest rate risk, and maximize investment portfolio performance. Our proven approach of total resource integration utilizes software and products developed by Baker’s Software Solutions* combined with the firm’s investment experience and advice.

Author

Dillon Wiedemann

Senior Vice President of FSG

The Baker Group LP

800.937.2257

*The Baker Group LP is the sole authorized distributor for the products and services developed and provided by The Baker Group Software Solutions, Inc.

INTENDED FOR USE BY INSTITUTIONAL INVESTORS ONLY. Any data provided herein is for informational purposes only and is intended solely for the private use of the reader. Although information contained herein is believed to be from reliable sources, The Baker Group LP does not guarantee its completeness or accuracy. Opinions constitute our judgment and are subject to change without notice. The instruments and strategies discussed here may fluctuate in price or value and may not be suitable for all investors; any doubt should be discussed with a Baker representative. Past performance is not indicative of future results. Changes in rates may have an adverse effect on the value of investments. This material is not intended as an offer or solicitation for the purchase or sale of any financial instruments.