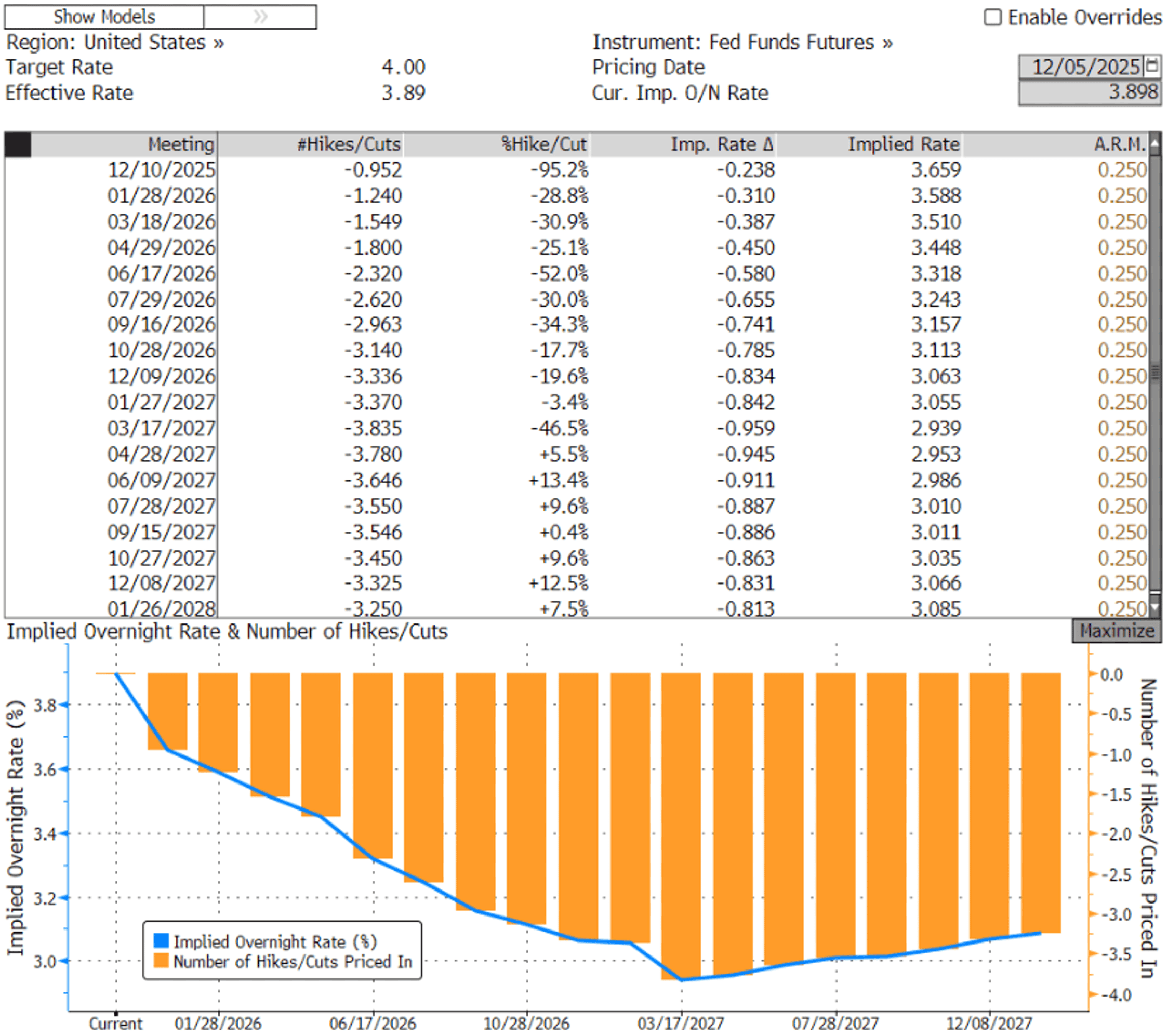

Tis the season! Thanksgiving has come and gone, and now it is time for the real holiday! Conference Championship Weekend in college football is here and a handful of teams are jockeying for the final few playoff spots, and by Sunday the bracket will be clear. In much the same way, the race to be the next chair of the Federal Reserve has seen contenders rise and fall, but the path forward is starting to take shape. President Trump recently signaled that Kevin Hassett, director of the National Economic Council, is the frontrunner, and prediction markets now give him an 80% chance of nomination, which is up sharply from 36% just last week. While the official decision is still months away, markets still have another obstacle to get past, the final FOMC meeting of the year. Chairman Powell and co will meet on the 10th, where traders are pricing in a 95% probability of a 25 basis point rate cut. Another sharp move, as the probability of a December rate cut was sub 40% less than a month ago.

This morning, we received September’s PCE reading with both headline and core PCE coming in at 2.8% year over year, in line with expectations. The report was delayed several weeks due to the government shutdown but comes just in time for the FOMC’s meeting next week. Septembers’ reading is sure to add more fuel to the December rate cut fire. The September PCE reading has helped the stock market extend its weekly gains this morning with the Dow Jones and S&P 500 both up around 1% for the week. Treasury yields are also on the rise. The US 10 Year Treasury has climbed 10 basis points since the end of last week, currently sitting at 4.11%.

On Wednesday we also received the news that ADP’s private payrolls showed a decline of 32,000 jobs in November, against an expected increase of 40,000. The ADP report is one of the few data prints we will receive before the December meeting, the JOLTS report is expected December 9th, as the October jobs report has been cancelled and the November report has been delayed until after the FOMC meeting. Just like PCE, this is more fuel to the rate cut fire.

The FOMC is tasked with a dual mandate of price stability and maximum employment, a job I do not envy in the slightest. Many members are currently divided on which threat is the largest. As it stands, it appears that the downside risks to employment are outweighing the risks that inflation rears back as the December rate cut probabilities would imply. A month of delayed data or no data at all has not made this task any easier.

Next week we will see the release of PPI, the JOLTs report and of course Wednesday’s FOMC meeting and press conference. Have a great weekend everyone!

The Baker Group is one of the nation’s largest independently owned securities firms specializing in investment portfolio management for community financial institutions.

Since 1979, we’ve helped our clients improve decision-making, manage interest rate risk, and maximize investment portfolio performance. Our proven approach of total resource integration utilizes software and products developed by Baker’s Software Solutions* combined with the firm’s investment experience and advice.

Author

Luke Mikles

Senior Vice President of FSG

The Baker Group LP

800.937.2257

*The Baker Group LP is the sole authorized distributor for the products and services developed and provided by The Baker Group Software Solutions, Inc.

INTENDED FOR USE BY INSTITUTIONAL INVESTORS ONLY. Any data provided herein is for informational purposes only and is intended solely for the private use of the reader. Although information contained herein is believed to be from reliable sources, The Baker Group LP does not guarantee its completeness or accuracy. Opinions constitute our judgment and are subject to change without notice. The instruments and strategies discussed here may fluctuate in price or value and may not be suitable for all investors; any doubt should be discussed with a Baker representative. Past performance is not indicative of future results. Changes in rates may have an adverse effect on the value of investments. This material is not intended as an offer or solicitation for the purchase or sale of any financial instruments.