The Federal Reserve delivered a much anticipated 25bp rate cut on Wednesday, its third consecutive cut this year, but paired the move with a cautionary message: don’t expect a straight-line easing cycle from here. In the press conference that followed the FOMC’s December meeting, Chairman Powell acknowledged that inflation “remains somewhat elevated.” He also noted that policymakers still lack sufficient visibility into a softening labor market, where data gaps and measurement issues complicate the outlook. In fact, Powell noted that the Fed believes monthly payroll gains are overstated by as much as 60,000, implying job growth may have been negative since April!

The Committee’s rate decision was unusually divided with two regional presidents dissenting in favor of no cut and a third pushing for a more impactful 50bp cut. Clearly FOMC members have differing views about whether persistent inflation or a weakening labor-market poses a greater risk to the economy. Powell acknowledged this tension in his comments, explaining that there is “no risk-free path for policy” for the Fed as it navigates its dual mandate.

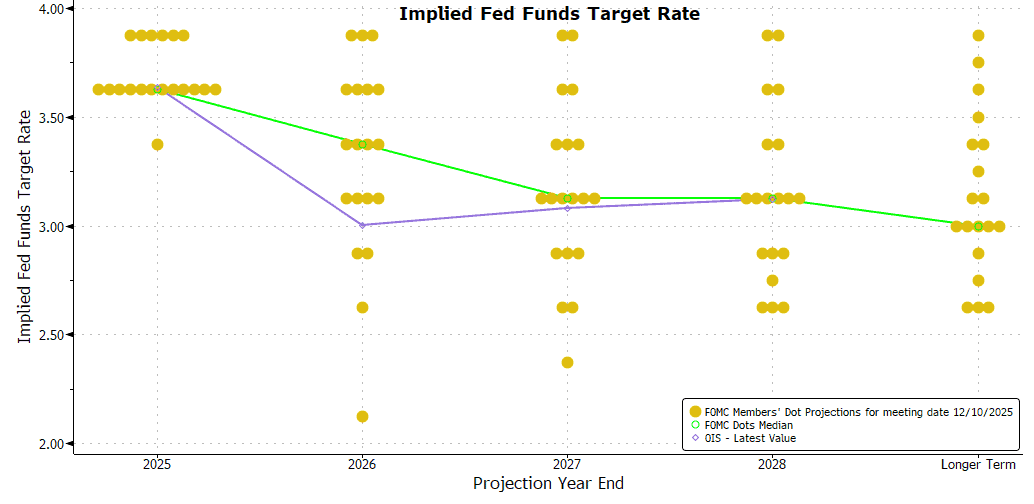

Despite the internal divergence, the Committee does appear to agree on two key facts, 1. inflation is still too high and 2. the labor market has softened with further downside risk. Where the members differ is in how those risks are weighted and what individual forecasts imply going forward. Powell suggested that the Fed is now “well positioned to wait and see” how the economy evolves, a comment that is be widely interpreted to signal a pause in the cutting cycle. The Fed’s updated “dot plot” shows only one 25 bp cut in 2026 with another single cut in 2027, which is unchanged from the Fed’s September projections and notably more hawkish than market pricing. Futures markets are currently pricing in the next rate cut to come in June 2026 with just over two full cuts priced in by the end of 2026.

Markets also focused on the Fed’s announcement that it would begin purchasing $40 billion per month in Treasury bills. Powell stressed that this is not quantitative easing, but a reserve-management operation designed to maintain “ample” liquidity in the banking system. Even so, the Fed acknowledged that purchases may need to remain “elevated” for a few months before moderating, an implicit acknowledgment of short-term liquidity concerns.

Next week’s focus will be on November’s delayed Employment Situation Report, which is due out Tuesday, and CPI for November, which will be released Thursday. Have a great weekend!

The Baker Group is one of the nation’s largest independently owned securities firms specializing in investment portfolio management for community financial institutions.

Since 1979, we’ve helped our clients improve decision-making, manage interest rate risk, and maximize investment portfolio performance. Our proven approach of total resource integration utilizes software and products developed by Baker’s Software Solutions* combined with the firm’s investment experience and advice.

Author

Andrea F. Pringle

Senior Vice President

The Baker Group LP

800.937.2257

*The Baker Group LP is the sole authorized distributor for the products and services developed and provided by The Baker Group Software Solutions, Inc.

INTENDED FOR USE BY INSTITUTIONAL INVESTORS ONLY. Any data provided herein is for informational purposes only and is intended solely for the private use of the reader. Although information contained herein is believed to be from reliable sources, The Baker Group LP does not guarantee its completeness or accuracy. Opinions constitute our judgment and are subject to change without notice. The instruments and strategies discussed here may fluctuate in price or value and may not be suitable for all investors; any doubt should be discussed with a Baker representative. Past performance is not indicative of future results. Changes in rates may have an adverse effect on the value of investments. This material is not intended as an offer or solicitation for the purchase or sale of any financial instruments.