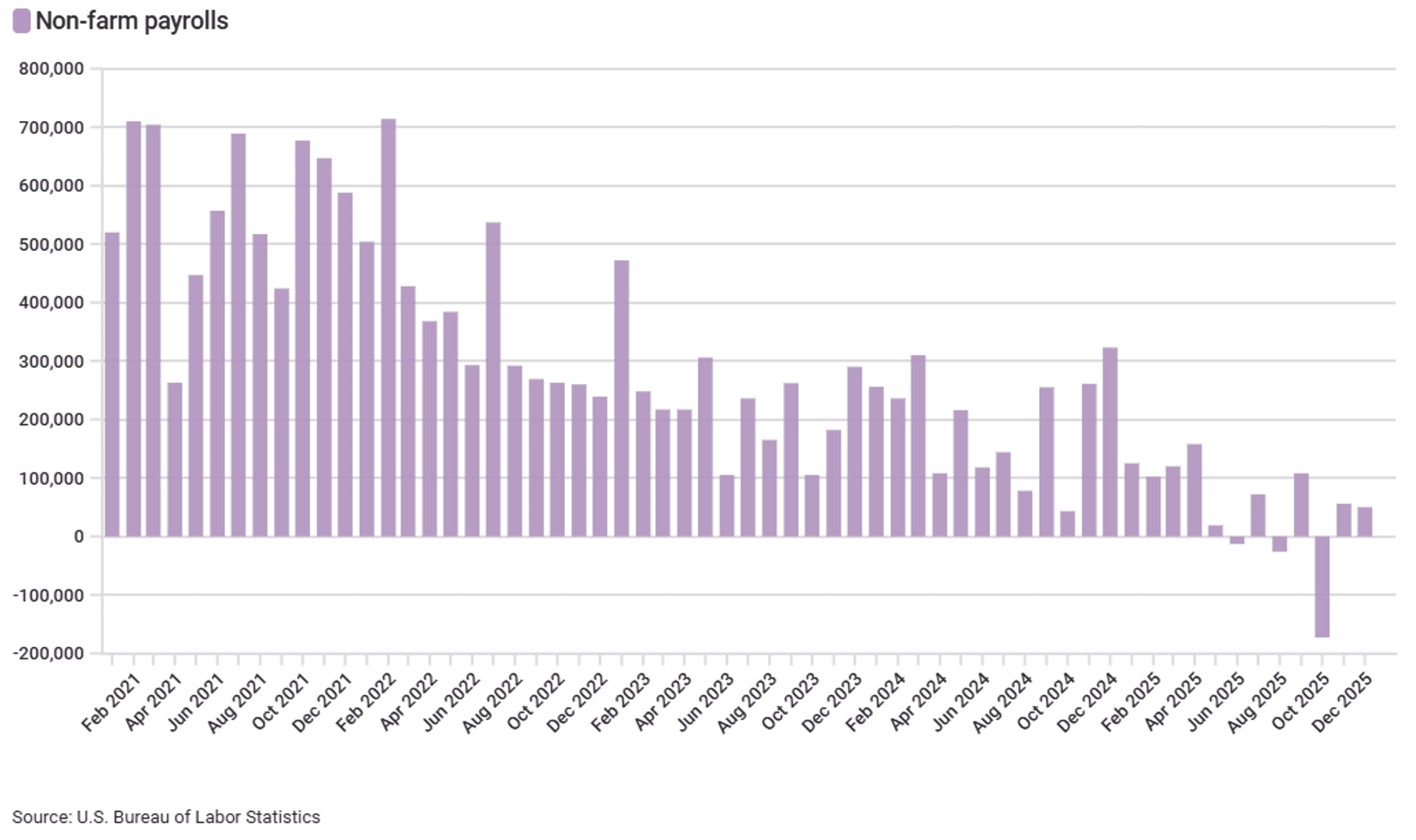

Good morning and Happy Jobs Report Friday! This morning, the Bureau of Labor Statistics released the December jobs report which showed that nonfarm payrolls rose 50,000 (est = 73,000) for the month. Employment in leisure and hospitality increased by 47,000 from November to December, and employment in healthcare increased by 21,000. Employment fell by 25,000 in retail trade and by 11,000 in construction. Revisions were made to the payroll numbers for the prior two months, with October’s report revised down by 68,000 from a loss of 105,000 to a loss of 173,000 jobs, while November’s report was revised down by 8,000 from a gain of 64,000 to 56,000. At the same time, the unemployment rate fell to 4.4%, which was estimated to come in at 4.5%. The decline in the unemployment rate comes after the unemployment rate rose to 4.6% in November, which is the highest it’s been since September 2021. This morning’s jobs report is being seen by some as a “Goldilocks print”. Soft enough to keep rate-cut hopes alive but strong enough to avoid some recession fears.

Earlier this week, the Job Openings and Labor Turnover Survey was related for the month of November. The economy had 7.15 million open jobs in November, down from 7.45 million in October. Hiring activity trended in a similar direction. There were an estimated 5.12 million new hires in November, a decline from 5.37 million the month before. Job openings are at their lowest level since September 2024, while hires are at their lowest since June of the same year. The longstanding trend of the labor market remains clear, we are in a low-hire, low-fire labor market.

Alongside this morning’s jobs report was a release of the University of Michigan’s Consumer Sentiment Index. The reading came in a 54, surpassing the forecasted number of 53.5 and up from 5.29 from the previous month. This increase suggests that consumers are more optimistic about the economic conditions than initially anticipated. Consumers’ inflation expectations for the year ahead held steady at 4.2%, the lowest reading since January 2025. Longer-run inflation expectations ticked up to 3.4% from 3.2% in December.

Bond markets are relatively flat this morning with the 10-Year Treasury Bond yielding 4.17%. Stocks are up this morning with the Dow Jones Industrial Average sitting approximately 500 points below 50,000.

The Consumer Price Index (CPI) for the month of December will be released next Tuesday. Headline CPI is expected to increase 2.7% from the previous year and 0.3% from the previous month. Core CPI is expected to increase by the same. The Producer Price Index and retail sales data will be released next Wednesday. Until then, have a great weekend!

U.S. Nonfarm Payrolls (2021 to Current)

The Baker Group is one of the nation’s largest independently owned securities firms specializing in investment portfolio management for community financial institutions.

Since 1979, we’ve helped our clients improve decision-making, manage interest rate risk, and maximize investment portfolio performance. Our proven approach of total resource integration utilizes software and products developed by Baker’s Software Solutions* combined with the firm’s investment experience and advice.

Author

Dale Sheller

Managing Director

Director of Financial Strategies Group

The Baker Group LP

800.937.2257

*The Baker Group LP is the sole authorized distributor for the products and services developed and provided by The Baker Group Software Solutions, Inc.

INTENDED FOR USE BY INSTITUTIONAL INVESTORS ONLY. Any data provided herein is for informational purposes only and is intended solely for the private use of the reader. Although information contained herein is believed to be from reliable sources, The Baker Group LP does not guarantee its completeness or accuracy. Opinions constitute our judgment and are subject to change without notice. The instruments and strategies discussed here may fluctuate in price or value and may not be suitable for all investors; any doubt should be discussed with a Baker representative. Past performance is not indicative of future results. Changes in rates may have an adverse effect on the value of investments. This material is not intended as an offer or solicitation for the purchase or sale of any financial instruments.