Another whirlwind week comes to a close on a bit calmer footing. Several key releases on inflation and consumer spending came out this week which reinforced the idea that the economy is slowly cooling but is not showing signs of a meaningful decline.

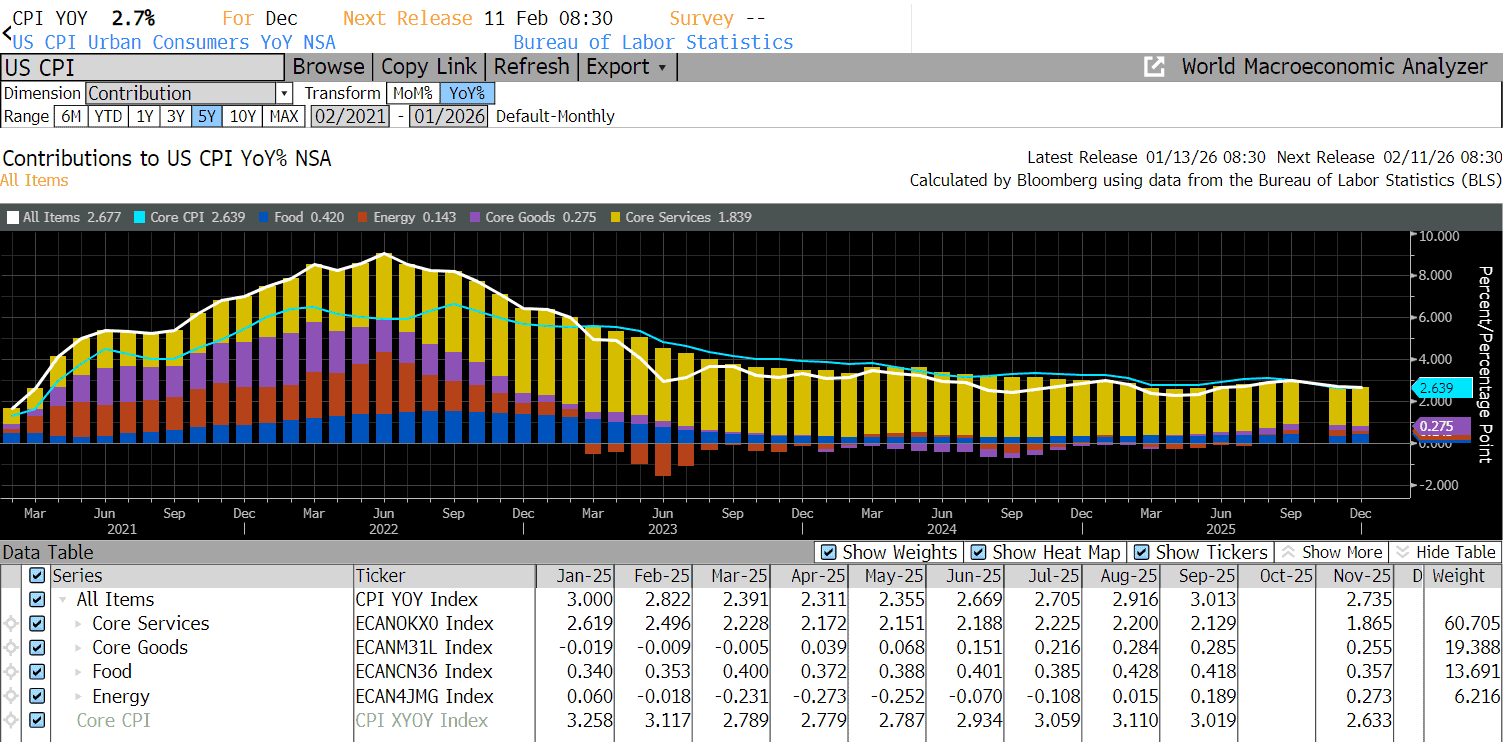

Tuesday’s reading of the Consumer Price Index (CPI) for December showed inflation trending in the right direction, even if progress remains uneven. CPI rose 0.3% from November and 2.7% from a year ago, in line with expectations. Core CPI came in below expectations, rising 0.2% from November (vs. 0.3% survey) and 2.6% YoY (vs. 2.7%). The data also showed that inflation appears to be becoming less broad-based across categories, which suggests the worst of the inflation surge is likely behind us. However, it also showcases just how tenuous the final leg of disinflation is likely to be, particularly with shelter and certain services still proving stubborn.

Wednesday’s Producer Price Index (PPI), which measures inflation from the producer side rather than the consumer side, was also somewhat constructive, though not at the headline level. Headline PPI edged up 0.2% in November as expected and rose to 3.0% YoY, well above expectations of +2.7%. However, like the CPI print, the core index, which eliminates the most volatile food and energy elements, was tame. Core PPI came in flat MoM, well under expectations of +0.2% MoM. Although the YoY measure ended up rising to 3.0% (vs. 2.7%), there was one important trend in the underlying data. Arguably the most important leading indicator in the PPI report, core intermediate goods, rose by less than 0.1% and has come in below 0.2% for three straight months.

Retail sales also came out on Wednesday and told a complementary story about growth. Although retail sales came in above expectations at 0.6% MoM in November (vs. 0.5% estimate), October spending was revised down to -0.1% MoM. The underlying data showed that consumers are still spending, but the pattern is becoming increasingly selective. Weakness was concentrated in spending at department stores, food stores, and on appliances and electronics which indicates households may be becoming more cautious, more value-conscious, and more sensitive to price levels than they were earlier in the cycle.

Next week is shortened with the MLK holiday on Monday, but the docket is full after that. Most notably, the third and final reading of Q3 2025 GDP is due out on Tuesday along with the Fed’s preferred measure of inflation, Personal Consumption Expenditures (PCE), for the month of November.

Enjoy the long weekend everyone!

The Baker Group is one of the nation’s largest independently owned securities firms specializing in investment portfolio management for community financial institutions.

Since 1979, we’ve helped our clients improve decision-making, manage interest rate risk, and maximize investment portfolio performance. Our proven approach of total resource integration utilizes software and products developed by Baker’s Software Solutions* combined with the firm’s investment experience and advice.

Author

Andrea F. Pringle

Senior Vice President

The Baker Group LP

800.937.2257

*The Baker Group LP is the sole authorized distributor for the products and services developed and provided by The Baker Group Software Solutions, Inc.

INTENDED FOR USE BY INSTITUTIONAL INVESTORS ONLY. Any data provided herein is for informational purposes only and is intended solely for the private use of the reader. Although information contained herein is believed to be from reliable sources, The Baker Group LP does not guarantee its completeness or accuracy. Opinions constitute our judgment and are subject to change without notice. The instruments and strategies discussed here may fluctuate in price or value and may not be suitable for all investors; any doubt should be discussed with a Baker representative. Past performance is not indicative of future results. Changes in rates may have an adverse effect on the value of investments. This material is not intended as an offer or solicitation for the purchase or sale of any financial instruments.