Economic news this week was dominated by a flurry of high-impact headlines out of the World Economic Forum in Davos, Switzerland. The most notable development was the de-escalation of a major trade standoff between the U.S. and its European allies over the Danish territory of Greenland. In mid-January, President Trump announced plans to impose tariffs on eight European countries — Denmark, Norway, Sweden, France, Germany, the U.K., the Netherlands, and Finland — starting at 10% and rising to 25% unless they supported U.S. efforts to gain greater control over Greenland. However, the President abruptly backed away from those threats in his Davos speech, helping to stabilize jittery markets and ease equally strained diplomatic tensions.

Trump announced that the U.S. and NATO had “formed the framework of a future deal with respect to Greenland and, in fact, the entire Arctic Region,” while also ruling out the use of excessive force to take control of the semi-autonomous territory. “It’s a deal that everybody’s very happy with,” Trump told reporters. “It’s a long-term deal. It’s the ultimate long-term deal. It puts everybody in a really good position, especially as it pertains to security and to minerals.” Details of the framework remain unclear and are still subject to negotiations among Denmark, Greenland, and the U.S. Still, European diplomats noted that while the president’s shift in tone doesn’t resolve the dispute, it does help defuse an open rift between allies who typically prefer to manage disagreements through private diplomatic channels.

Markets responded quickly as geopolitical tensions within NATO cooled. Wall Street rallied immediately following Trump’s rollback of the tariff threat and announcement of a Greenland framework agreement. Treasury yields also stabilized, particularly at longer maturities, signaling reduced demand for safe-haven assets compared with the peak of the tension. Equity markets, however, are selling off again this morning as traders digest the gains of the past two days and turn their focus to the final economic data releases ahead of next week’s FOMC meeting. Treasuries have wavered as well, though the 10-year yield looks set to finish the week little changed, hovering near the 4.25% level.

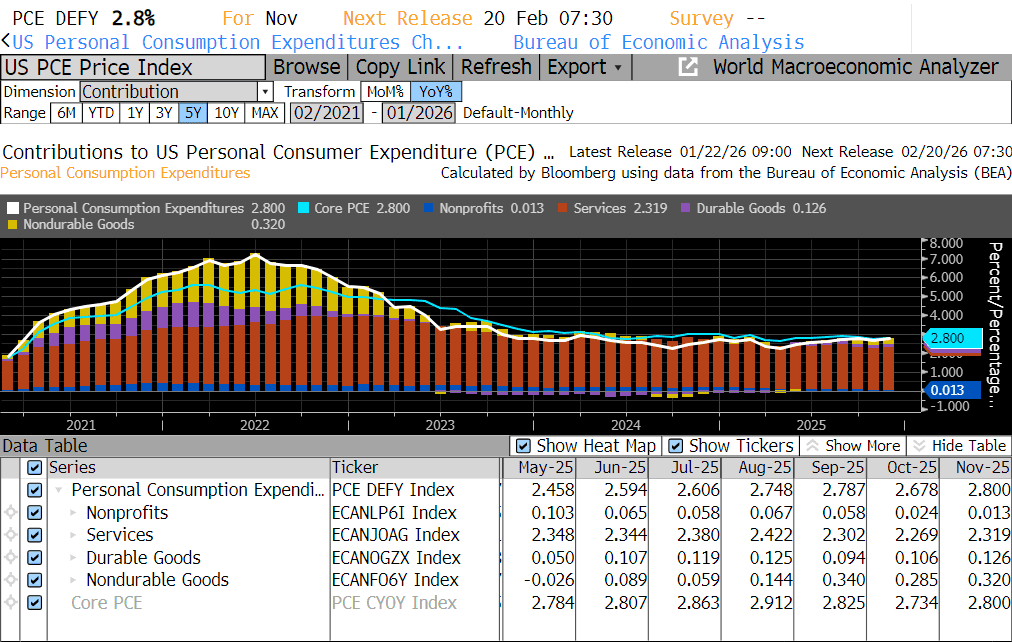

This week’s personal income and outlays reports for October and November (delayed due to the government shutdown) showed slightly cooler income growth and inflation, but noticeably stronger consumer spending. Real personal spending rose 0.3% in both October and November, accelerating from a 0.1% gain in September. Personal income, however, increased just 0.1% in October and 0.3% in November, meaning spending is outpacing income growth. Notably, the personal saving rate fell to 3.7% in October and then to 3.5% in November, its lowest level in three years, raising questions about the sustainability of future consumer spending. Headline PCE inflation held steady at 0.2% in both months. Core PCE, the Fed’s preferred inflation measure, came in at 0.21% in October before easing to 0.16% in November. On a year-over-year basis, core PCE remained at 2.8% in November, matching September’s reading.

Next week brings the FOMC’s January policy meeting, where the committee is widely expected to hold interest rates steady. While the economy continues to grow at a solid pace and inflation remains above the Fed’s 2% target, most economists still expect at least two rate cuts later this year. Futures markets are largely in agreement, with just under two cuts priced in by the end of 2026.

Have a great weekend!

The Baker Group is one of the nation’s largest independently owned securities firms specializing in investment portfolio management for community financial institutions.

Since 1979, we’ve helped our clients improve decision-making, manage interest rate risk, and maximize investment portfolio performance. Our proven approach of total resource integration utilizes software and products developed by Baker’s Software Solutions* combined with the firm’s investment experience and advice.

Author

Andrea F. Pringle

Senior Vice President

The Baker Group LP

800.937.2257

*The Baker Group LP is the sole authorized distributor for the products and services developed and provided by The Baker Group Software Solutions, Inc.

INTENDED FOR USE BY INSTITUTIONAL INVESTORS ONLY. Any data provided herein is for informational purposes only and is intended solely for the private use of the reader. Although information contained herein is believed to be from reliable sources, The Baker Group LP does not guarantee its completeness or accuracy. Opinions constitute our judgment and are subject to change without notice. The instruments and strategies discussed here may fluctuate in price or value and may not be suitable for all investors; any doubt should be discussed with a Baker representative. Past performance is not indicative of future results. Changes in rates may have an adverse effect on the value of investments. This material is not intended as an offer or solicitation for the purchase or sale of any financial instruments.