The Federal Reserve left interest rates unchanged this week, signaling patience as officials assess an economy that continues to show resilience. Chair Jerome Powell said growth has remained stronger than expected and that risks tied to inflation and the labor market have eased, leaving monetary policy appropriately positioned for now. While further rate cuts remain possible, Powell emphasized they would depend on future economic developments rather than a preset timeline.

The decision was not unanimous, with two governors favoring a modest rate cut. Still, most policymakers appear comfortable maintaining current rates as inflation remains above target but stable and the job market shows signs of balance rather than deterioration. Recent data suggest slower job growth is being offset by reduced labor supply, keeping unemployment relatively low.

The meeting was partly overshadowed by questions surrounding political pressure on the Fed and Powell’s future as his term nears its end. Powell declined to engage on those issues, instead underscoring the importance of central bank independence. Looking ahead, economists broadly expect the Fed to remain on hold for several months, with markets anticipating the next potential rate cut around midyear, likely under new leadership.

This morning, President Trump announced in a post on his Truth Social platform that he intends to nominate Kevin Warsh to be the next chair of the Federal Reserve. Warsh, 55, served as a Fed governor from 2006 to 2011 and has previously advised President Trump on economic policy. The president passed over Warsh for the top job in 2017 when he selected Powell. This time around the president made support for lower rates one of his explicit criteria for a Fed chair candidate. Warsh, like the three other finalists for the job, has said the Fed should be lowering rates more aggressively than it has. However, many see him as someone who could also be concerned about rising price pressures given how much he worried about rising inflation during his first stint at the Fed.

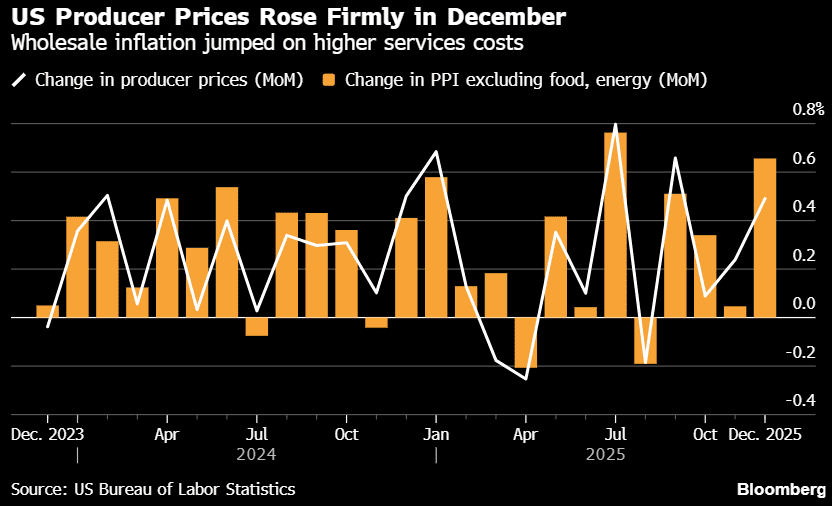

Also this morning, we got the latest reading of the Producer Price Index (PPI) for December, which showed wholesale prices far exceeded consensus estimates. Headline PPI rose 0.5% month-over-month (vs. 0.2% survey), the most in three months, and core prices (ex-food and energy) jumped 0.7% (vs. 0.2% survey), which was one of the highest rates of the year. The upside surprise suggests companies are increasingly passing on tariff costs, which risks keeping inflationary pressures elevated.

The calendar flips to February on Sunday, bringing the all-important “jobs week” to the forefront next week. We will get several readings on the state of the labor market culminating with Friday’s Employment Situation Report with non-farm payrolls, unemployment, and wage stats. Have a great weekend!

The Baker Group is one of the nation’s largest independently owned securities firms specializing in investment portfolio management for community financial institutions.

Since 1979, we’ve helped our clients improve decision-making, manage interest rate risk, and maximize investment portfolio performance. Our proven approach of total resource integration utilizes software and products developed by Baker’s Software Solutions* combined with the firm’s investment experience and advice.

Author

Andrea F. Pringle

Senior Vice President

The Baker Group LP

800.937.2257

*The Baker Group LP is the sole authorized distributor for the products and services developed and provided by The Baker Group Software Solutions, Inc.

INTENDED FOR USE BY INSTITUTIONAL INVESTORS ONLY. Any data provided herein is for informational purposes only and is intended solely for the private use of the reader. Although information contained herein is believed to be from reliable sources, The Baker Group LP does not guarantee its completeness or accuracy. Opinions constitute our judgment and are subject to change without notice. The instruments and strategies discussed here may fluctuate in price or value and may not be suitable for all investors; any doubt should be discussed with a Baker representative. Past performance is not indicative of future results. Changes in rates may have an adverse effect on the value of investments. This material is not intended as an offer or solicitation for the purchase or sale of any financial instruments.