This week started off with the infamous Punxsutawney Phil predicting six more weeks of winter by seeing his shadow. In honor of Groundhog’s Day, I thought it’d be appropriate to quote the 1993 comedy classic, Groundhog Day… “this is pitiful, 1,000 people freezing their butts off to worship a rat!” It’s a must-see movie!

Happy First Friday of the month! This is typically jobs report Friday, however, due to the partial government shutdown this week, the Bureau of Labor Statistics temporarily paused their operations this week and therefore delayed their release of the labor market reports. We will now receive the January jobs report next Wednesday, February 11th. Expectations are for the unemployment rate to hold steady at 4.4% and an increase of 70,000 nonfarm payrolls.

Shortly after the groundhog saw his shadow, the S&P Global US Manufacturing Purchasing Manager’s Index (PMI) and the ISM Manufacturing PMI. The S&P Global US Manufacturing PMI came in slightly higher than expected at 52.4 (estimated 52.0) signaling that US manufacturing improved at a stronger pace in January. The ISM PMI rebounded to 52.6 last month (estimated 48.5). It was the first time in 12 months that the PMI was above 50 and the highest reading since August 2022. Analysts see the improvement as likely temporary, with manufacturers still complaining about the uncertainty brought by some of the current trade policies.

On Wednesday, the ADP National Employment Report was released showing that private businesses added 22,000 jobs (estimated 45,000) in the month of January. This report showed a significant slowdown and highlighted the cooling labor market. Education and health services increased 74,000, while professional/business services and manufacturing saw declines.

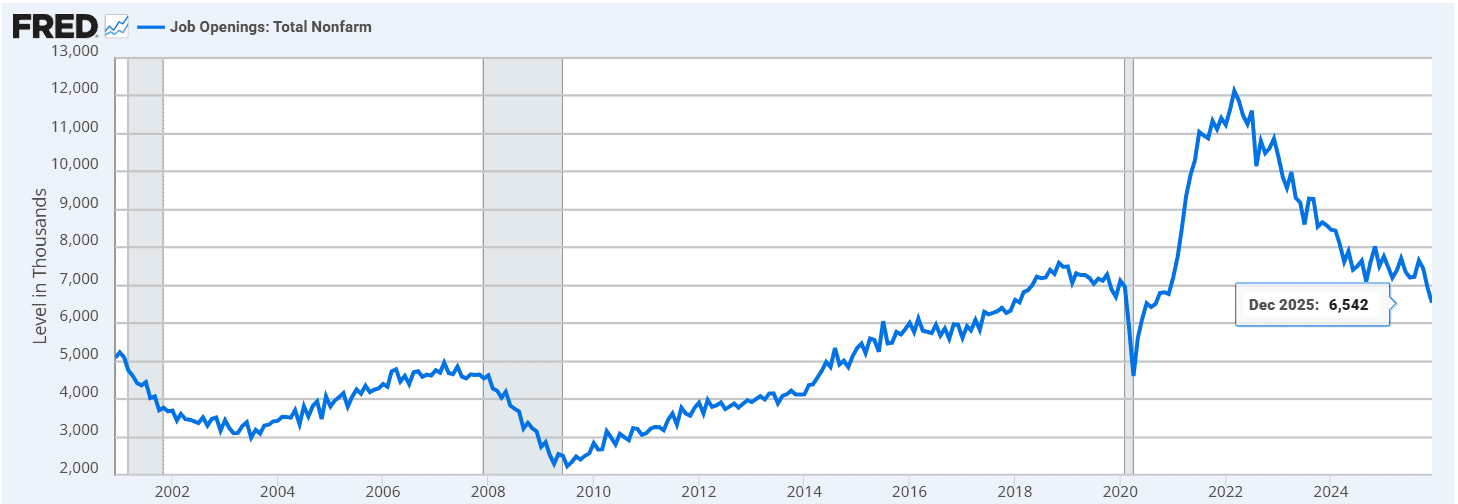

The Job Openings and Labor Turnover Survey or JOLTS Report was released yesterday showing that the number of US job openings dropped to the lowest level in more than five years in December and data for the prior month was revised amid a softening in labor marketing conditions at the end of 2025. Job openings decreased by 386,000 to 6.542 million, the lowest level since September 2020. The hiring rate ticked up to 3.3% and the layoff level saw little change at 1.8 million or a rate of 1.1%. The JOLTS report and ADP National Employment Report both provided more data points to support the current narrative of a “low-fire, low-job” job market. Lastly, U.S. jobless claims rose more than expected last week. The number of people who applied for unemployment benefits rose to 231,000 (estimated 212,000) in the week through January 31st, up from 209,000 a week earlier.

This morning the University of Michigan’s survey on consumer sentiment ticked higher. The gauge increased up to 57.3 from 56.4 the previous month. Consumers’ expectations for inflation over the next year declined but longer run inflation expectations ticked up slightly.

Stocks are up strong this morning with Treasuries selling off a bit throughout the yield curve. The 10-Year Treasury Yield is currently sitting at 4.21%.

Next week will be a big week for releases as we will get the slightly delayed Job Reports, retails sales data and the latest inflation data via the Consumer Price Index. Stay tuned and have a great weekend!

The Baker Group is one of the nation’s largest independently owned securities firms specializing in investment portfolio management for community financial institutions.

Since 1979, we’ve helped our clients improve decision-making, manage interest rate risk, and maximize investment portfolio performance. Our proven approach of total resource integration utilizes software and products developed by Baker’s Software Solutions* combined with the firm’s investment experience and advice.

Author

Dale Sheller

Managing Director

Director of Financial Strategies Group

The Baker Group LP

800.937.2257

*The Baker Group LP is the sole authorized distributor for the products and services developed and provided by The Baker Group Software Solutions, Inc.

INTENDED FOR USE BY INSTITUTIONAL INVESTORS ONLY. Any data provided herein is for informational purposes only and is intended solely for the private use of the reader. Although information contained herein is believed to be from reliable sources, The Baker Group LP does not guarantee its completeness or accuracy. Opinions constitute our judgment and are subject to change without notice. The instruments and strategies discussed here may fluctuate in price or value and may not be suitable for all investors; any doubt should be discussed with a Baker representative. Past performance is not indicative of future results. Changes in rates may have an adverse effect on the value of investments. This material is not intended as an offer or solicitation for the purchase or sale of any financial instruments.