Expectations for Federal Reserve interest-rate cuts were jostled this week by a surprising mix of U.S. economic data. First, the release of weaker-than-expected December retail sales on Tuesday pushed Fed easing expectations higher, raising the odds of an April rate cut to near 50-50. Retail sales came in flat (0.0%) in December, well under expectations of a 0.4% gain. The report showed pullbacks in several big-ticket categories, including autos, furniture, electronics, and clothing. More importantly for GDP tracking, the “core” control-group measure (ex-autos, gas, building materials, and food services) fell 0.1%, and prior core sales were revised lower, consistent with slower real consumption growth into year-end.

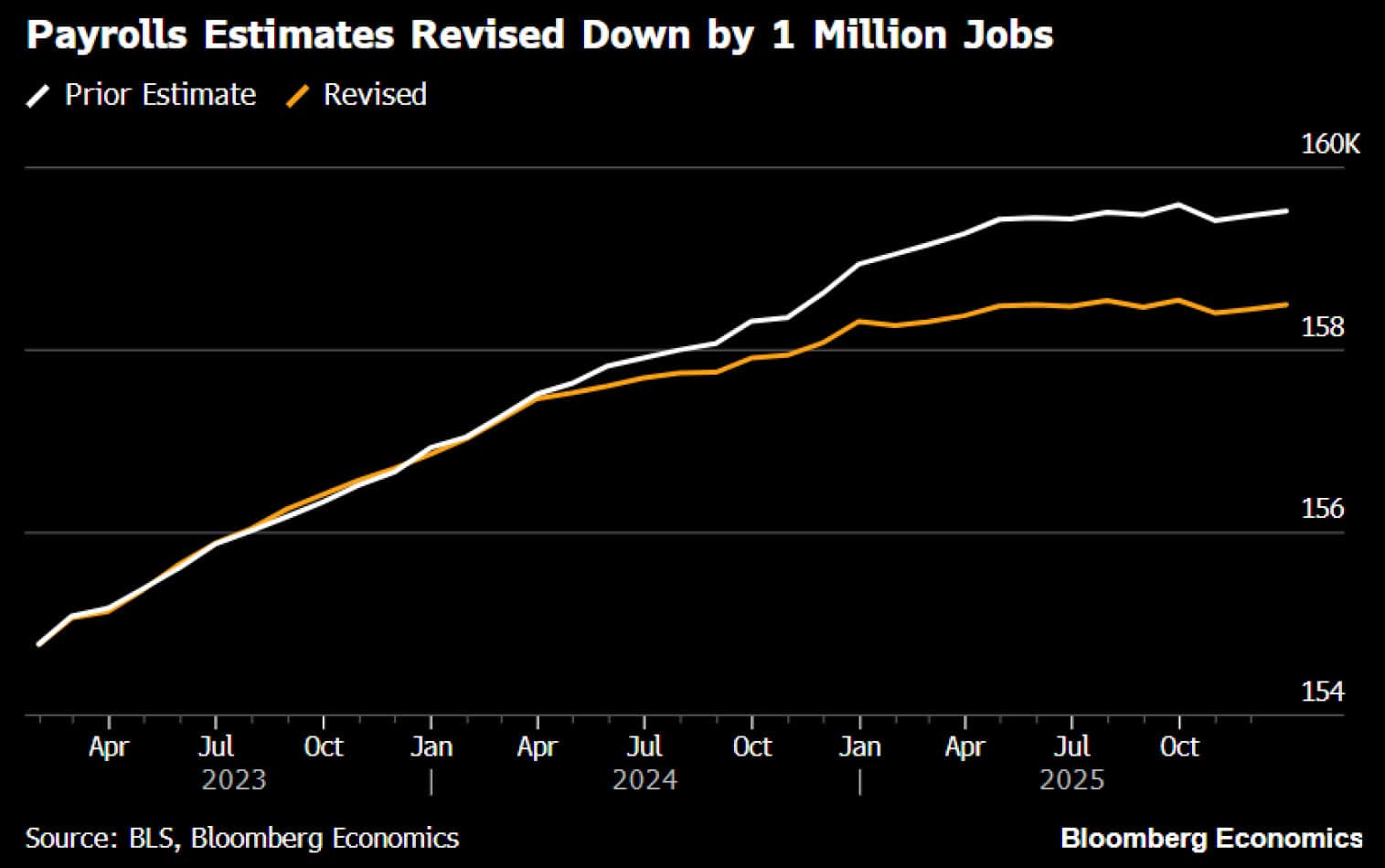

That sentiment reversed Wednesday as January jobs data surprised to the upside and traders pushed back bets on future rate cuts to later in the summer. Nonfarm payrolls increased by 130k last month, nearly double the consensus forecast (+65k). The unemployment rate also edged lower to 4.3% from 4.4% in December, suggesting the labor market may be on more stable footing to start 2026. However, the release also included sizable downward revisions to prior data. Annual benchmark revisions cut 2025 payroll levels by roughly one million jobs, implying labor-market cooling in 2024–2025 was much more pronounced than previously believed.

This morning, Fed rate cut expectations are holding steady after consumer inflation came in lighter than expected. The Consumer Price Index (CPI) for January rose 0.2% month-over-month (vs. 0.3% expected) and 2.4% year-over-year (vs. 2.5%). Core CPI, which excludes the more volatile food and energy components, increased 0.3% for the month and 2.5% from a year earlier, in line with expectations. Energy and goods categories provided much of the relief, while several core services components remained comparatively firm. Even so, the print reinforced the broader disinflation trend that has been developing in recent months and supported market expectations that the Fed has the flexibility to ease policy later this year if similar readings persist.

Futures markets are currently pricing the first rate cut of 2026 to come in July, with just over 2.5 total cuts expected for the year.

Next week is shortened by the Presidents' Day holiday but will still bring several housing-market readings, along with the release of minutes from the FOMC’s January meeting. Have a nice long weekend!

The Baker Group is one of the nation’s largest independently owned securities firms specializing in investment portfolio management for community financial institutions.

Since 1979, we’ve helped our clients improve decision-making, manage interest rate risk, and maximize investment portfolio performance. Our proven approach of total resource integration utilizes software and products developed by Baker’s Software Solutions* combined with the firm’s investment experience and advice.

Author

Andrea F. Pringle

Senior Vice President

The Baker Group LP

800.937.2257

*The Baker Group LP is the sole authorized distributor for the products and services developed and provided by The Baker Group Software Solutions, Inc.

INTENDED FOR USE BY INSTITUTIONAL INVESTORS ONLY. Any data provided herein is for informational purposes only and is intended solely for the private use of the reader. Although information contained herein is believed to be from reliable sources, The Baker Group LP does not guarantee its completeness or accuracy. Opinions constitute our judgment and are subject to change without notice. The instruments and strategies discussed here may fluctuate in price or value and may not be suitable for all investors; any doubt should be discussed with a Baker representative. Past performance is not indicative of future results. Changes in rates may have an adverse effect on the value of investments. This material is not intended as an offer or solicitation for the purchase or sale of any financial instruments.