Happy Friday everyone! It was a short week due to President’s Day on Monday, but we still had an onslaught of important economic releases packed into the 4 days after the break. Both the stock market and bond markets opened Friday morning at a similar spot to where they opened at the start of the week, but the midweek market movements show a different story.

This morning, we received the initial GDP print for Q4 2025. Q4 GDP came in at a meager 1.4% quarter over quarter, versus estimates of 2.8%. Just a month ago, the Atlanta Fed’s GDP Now model was calling for a GDP print of 5.4%. This figure was touted by multiple public figures and across the financial news world. In just a few short weeks, that figure fell to 3% on Thursday. The final dagger was Thursday’s release of the US Trade Balance. Which saw the trade balance decline to -$70.3 billion versus estimates of -$55.5 billion. The decline was largely spurred by a swing in gold trading as well as imports of digital trade equipment.

As we dive further into the GDP print, we can see a few major contributing factors. First and foremost, we had a record setting government shutdown in Q4. Federal spending alone was estimated to have taken over 1% off the advanced estimate for Q4’s GDP print, the worst impact since 1994. The second major contributing factor was a slowdown in consumer spending. December’s retail sales figures came in flat and personal spending came in at 0.4% month over month. Government spending is expected to rebound for Q1 2026, barring another record-breaking government shutdown.

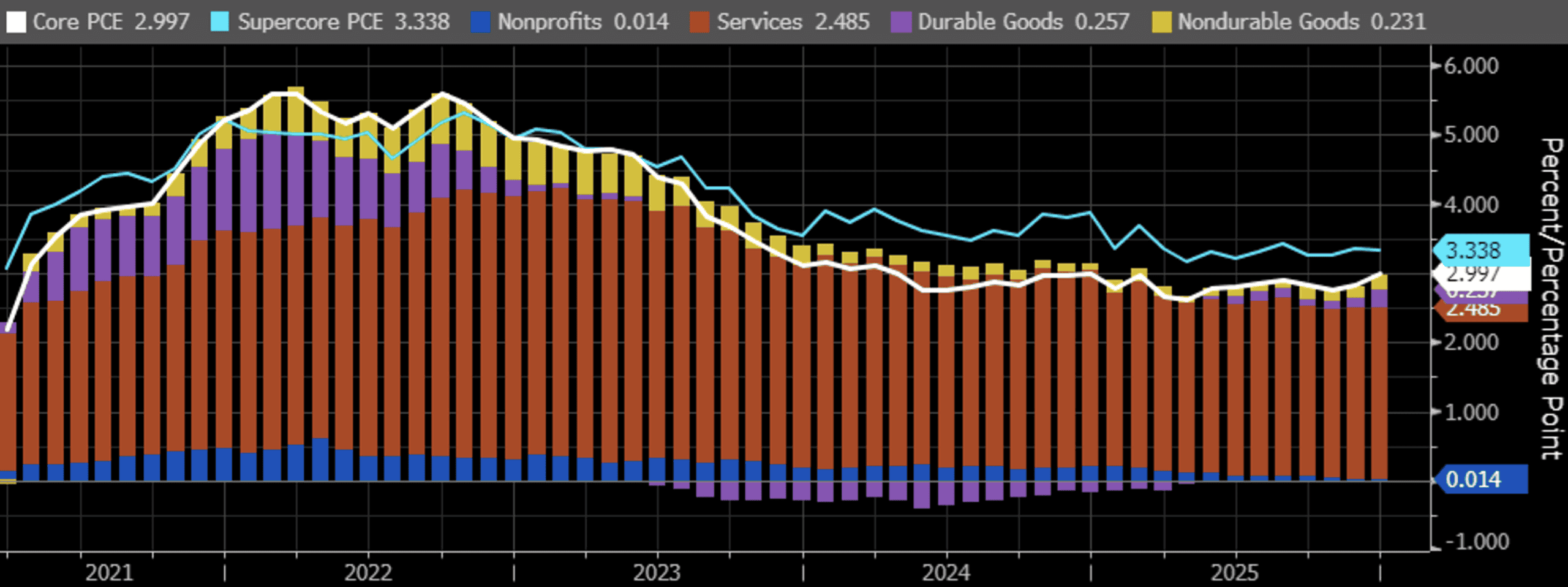

We also received December’s PCE prints. Year over year PCE came in at 2.9% versus estimates of 2.8% and core PCE came in at 3.0% against estimates of 2.9%. Slightly elevated against expectations and an increase from November, the December print posts the highest year over year rise since October of 2023. If core PCE continues to hover around 3%, there will be continued pressure on the Fed to hold rates steady for longer.

As I was writing this market update, the Supreme Court came down with a hammer and struck down President Trump’s global tariffs, ruling them illegal with a 6-3 decision. This has sent immediate shock waves through the markets. The stock market saw a quick pop in both the Dow Jones and S&P 500 as removal of the tariffs also removed a barrier for earnings. Treasury yields also climbed slightly, with the 10 year up 2bps to 4.08%. The removal of tariffs will create budget and policy questions for the administration going forward, and this initial reaction may be short lived. The White House will more than likely seek to restore tariffs through other means.

Next week we will get releases for durable goods, consumer confidence, and PPI. Have a great weekend everyone!

The Baker Group is one of the nation’s largest independently owned securities firms specializing in investment portfolio management for community financial institutions.

Since 1979, we’ve helped our clients improve decision-making, manage interest rate risk, and maximize investment portfolio performance. Our proven approach of total resource integration utilizes software and products developed by Baker’s Software Solutions* combined with the firm’s investment experience and advice.

Author

Luke Mikles

Senior Vice President of FSG

The Baker Group LP

800.937.2257

*The Baker Group LP is the sole authorized distributor for the products and services developed and provided by The Baker Group Software Solutions, Inc.

INTENDED FOR USE BY INSTITUTIONAL INVESTORS ONLY. Any data provided herein is for informational purposes only and is intended solely for the private use of the reader. Although information contained herein is believed to be from reliable sources, The Baker Group LP does not guarantee its completeness or accuracy. Opinions constitute our judgment and are subject to change without notice. The instruments and strategies discussed here may fluctuate in price or value and may not be suitable for all investors; any doubt should be discussed with a Baker representative. Past performance is not indicative of future results. Changes in rates may have an adverse effect on the value of investments. This material is not intended as an offer or solicitation for the purchase or sale of any financial instruments.