Stronger-than-expected labor data is bringing a measure of calm to jittery markets this morning, tempering fears of a sharp economic downturn following Wednesday’s report that the U.S. economy contracted for the first time in three years. While a more resilient job market may delay the timing of potential rate cuts, it also helps alleviate concerns about widespread job losses. Equity markets are responding positively, with stock prices rising and poised to recover much of the ground lost since last month’s tariff announcement. Meanwhile, bond prices are edging lower, with yields up roughly 2 to 8 basis points across the curve on the week.

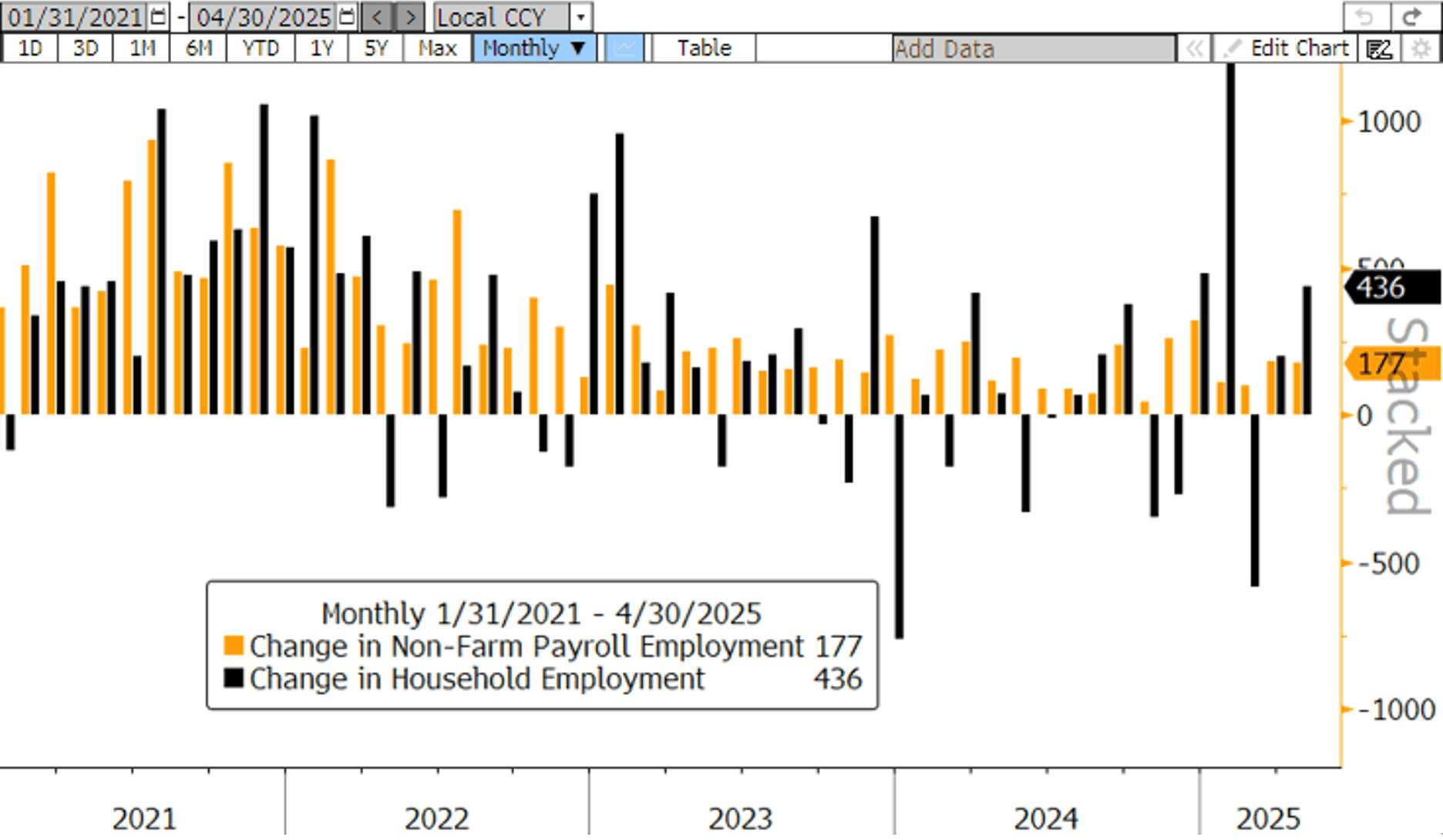

April’s Employment Situation report showed strong job growth in April. Nonfarm payrolls beat forecasts, adding 177k new jobs in April. The household survey showed even larger job gains of 436k. Job growth was strongest in healthcare, transportation, and hospitality, while sectors like manufacturing and retail struggled. The labor force participation rate also rose to 62.6%, the highest since January, and the unemployment rate held steady at 4.2%. However, on Wednesday private payroll processing firm ADP reported 62k private payroll gains, well below expectations of 115k and down sharply from 147k in March. The Job Openings and Labor Turnover (JOLTS) survey data also showed signs of a cooling labor market, with the number of job openings surprising to the downside and job openings per unemployed worker now well below pre-pandemic levels.

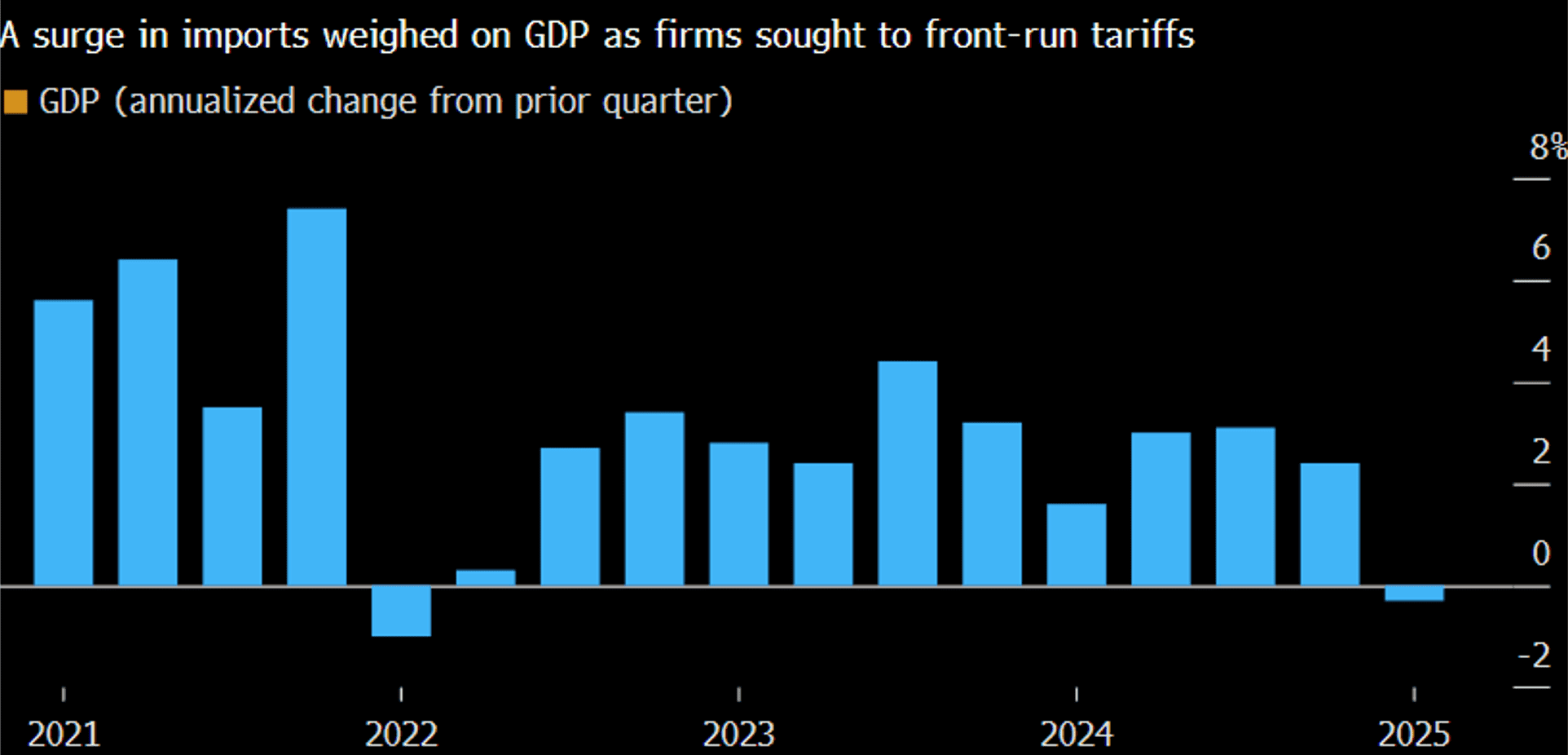

On Wednesday, the Bureau of Economic Analysis reported that the U.S. economy contracted by 0.3% in Q1 2025, marking the first decline in real GDP since early 2022. The drop was driven primarily by a sharp drag from net exports, which subtracted nearly 5 percentage points from overall growth, the most on record. The import surge—attributed to preemptive stockpiling ahead of newly imposed tariffs—more than offset underlying domestic activity. Government spending also contracted for the first time since Q2 2022, as DOGE-driven federal cuts began to take hold. Personal consumption, which accounts for roughly two-thirds of GDP, also slowed meaningfully in the first quarter to 1.8% (down from 4.0% in Q4). That marks the weakest pace since mid-2023 but still above forecasts.

This week’s reading of Personal Consumption Expenditures (PCE) for the month of March showed the Fed’s preferred inflation gauge continued to moderate. The PCE Price Index was flat in March and rose 2.3% year-over-year, while Core PCE held steady at 2.6%, matching its lowest annual rate since 2021. The Fed’s favored "Supercore" inflation (core services less housing) measure also declined, suggesting broad-based disinflation.

Next week will be quieter in terms of economic releases, but all eyes will be on the Federal Reserve, which meets on May 6–7. While the Fed Funds target range is expected to remain unchanged, markets will scrutinize the Fed’s statement and press conference for clues about the pace and timing of future rate cuts—especially in light of softening growth and tariff-related price pressures. Have a great weekend!

The Baker Group is one of the nation’s largest independently owned securities firms specializing in investment portfolio management for community financial institutions.

Since 1979, we’ve helped our clients improve decision-making, manage interest rate risk, and maximize investment portfolio performance. Our proven approach of total resource integration utilizes software and products developed by Baker’s Software Solutions* combined with the firm’s investment experience and advice.

Author

Andrea F. Pringle

Senior Vice President

The Baker Group LP

800.937.2257

*The Baker Group LP is the sole authorized distributor for the products and services developed and provided by The Baker Group Software Solutions, Inc.

INTENDED FOR USE BY INSTITUTIONAL INVESTORS ONLY. Any data provided herein is for informational purposes only and is intended solely for the private use of the reader. Although information contained herein is believed to be from reliable sources, The Baker Group LP does not guarantee its completeness or accuracy. Opinions constitute our judgment and are subject to change without notice. The instruments and strategies discussed here may fluctuate in price or value and may not be suitable for all investors; any doubt should be discussed with a Baker representative. Past performance is not indicative of future results. Changes in rates may have an adverse effect on the value of investments. This material is not intended as an offer or solicitation for the purchase or sale of any financial instruments.