This past Sunday, Game 7 of the Western Conference Finals ended with the OKC Thunder securing a decisive 125–93 victory over the Denver Nuggets. Despite delivering excitement throughout all seven games, the series sparked considerable criticism from fans who believed the Thunder benefited significantly from preferential officiating. Despite widespread perceptions of referee favoritism toward the Thunder, a closer look at the numbers shows that Oklahoma City was charged with four more personal fouls (158) than Denver (154) throughout the series. Perception gaps are not exclusive to the sports world; they exist in financial markets as well. In times of heightened emotion, whether in postseason play or while navigating a new regime in financial markets, the disconnect between perception and reality often widens.

The recent downgrade of U.S. sovereign debt by Moody’s has raised concerns about potential spillover effects into other segments of the bond market, as well as fears that U.S. Treasuries could lose their status as a global “safe haven” asset. At the start of the week, mortgage bonds from agencies like Fannie Mae and Freddie Mac showed slightly higher yields over Treasuries. The spread on recent Fannie Mae-guaranteed issues rose to 1.54%, up 5 basis points from Friday’s 1.49%, indicating a mild shift in investor risk perception. This subdued repricing was not limited to agency securities; broader credit markets, including corporate bonds, also reflected the same mellow response to the downgrade. The corporate bond market reacted mildly: investment-grade spreads widened by just one basis point and high-yield spreads by five, signaling confidence rather than concern. Complementing this, the IMF characterized the U.S. Treasury market as “orderly,” reaffirming its role as a stable haven in global finance.

Moody’s downgrade of U.S. sovereign debt from Aaa to Aa1 last Friday marked the final major agency to downgrade U.S. debt from the top rung of its rating hierarchy. The first downgrade from Standard & Poor’s (S&P) occurred in the summer of 2011, followed by Fitch Ratings 12 years later. Since then, U.S. interest rates have spanned a wide range—from the zero-interest rate policy (ZIRP) implemented after the Global Financial Crisis to the aggressive rate hikes that followed the COVID-19 pandemic—yet the U.S. dollar’s status as the world’s reserve currency has remained firmly intact.

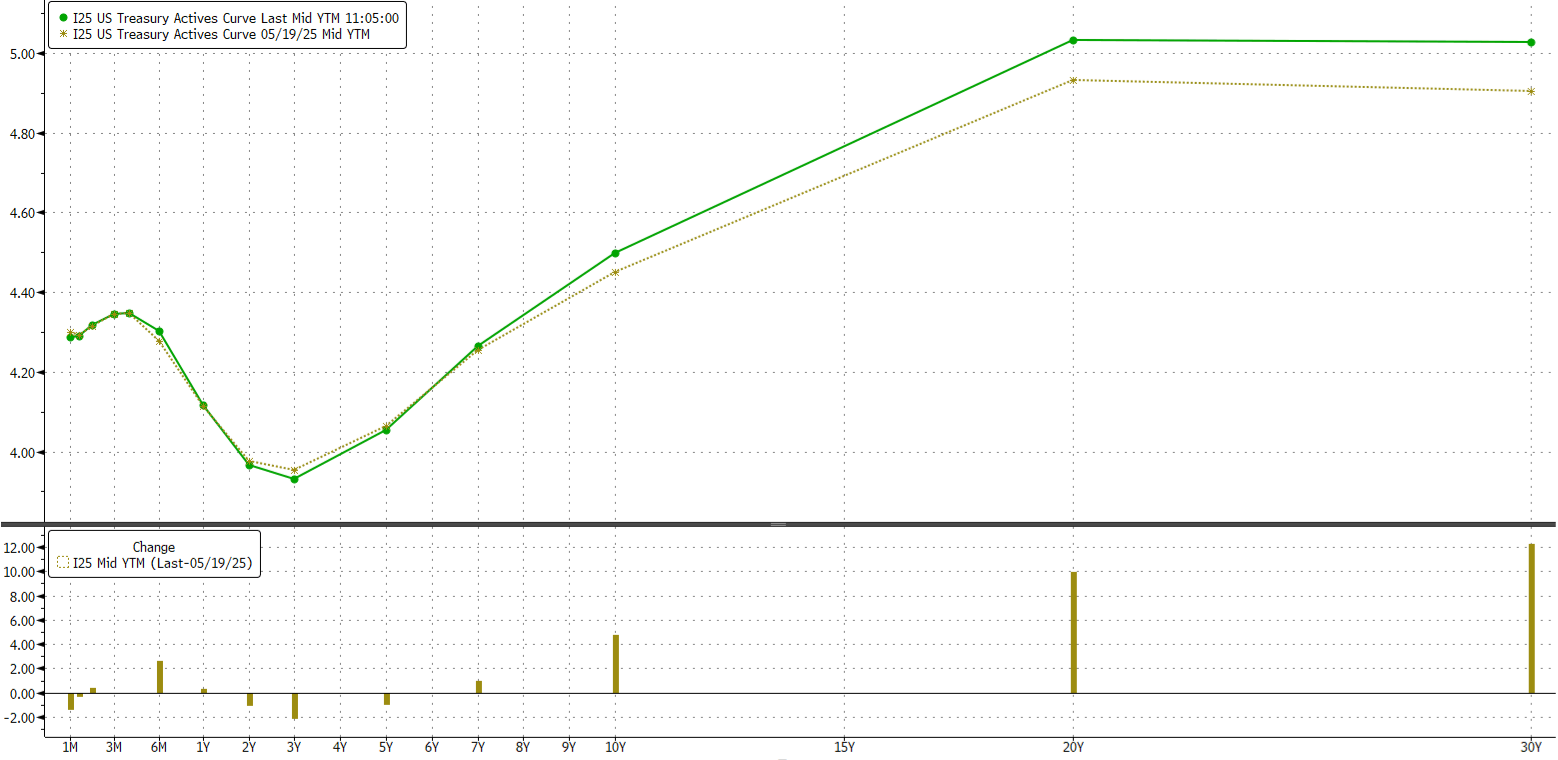

In a notable move this week, the far end of the yield curve steepened, as 20-year and 30-year Treasury spot rates jumped 10 and 12 basis points, respectively, reflecting growing unease around long-term inflation. On the contrary, since the beginning of 2025, the Consumer Price Index (CPI) on a year-over-year basis has fallen from 3.0% in January to 2.3% in the latest reading. Although inflation remains slightly above the 2% level preferred by many investors, the data suggests we are moving in the right direction—even when accounting for the most recent month’s data, which includes price shocks associated with Trump’s so-called "Day of Liberation."

Next week brings new data on the health of the consumer in terms of both consumption and income, as well as the Federal Reserve’s preferred inflation gauge: the Personal Consumption Expenditures (PCE) index.

Have a great weekend!

The Baker Group is one of the nation’s largest independently owned securities firms specializing in investment portfolio management for community financial institutions.

Since 1979, we’ve helped our clients improve decision-making, manage interest rate risk, and maximize investment portfolio performance. Our proven approach of total resource integration utilizes software and products developed by Baker’s Software Solutions* combined with the firm’s investment experience and advice.

Author

Carson Francis

Financial Analyst

The Baker Group LP

800.937.2257

*The Baker Group LP is the sole authorized distributor for the products and services developed and provided by The Baker Group Software Solutions, Inc.

INTENDED FOR USE BY INSTITUTIONAL INVESTORS ONLY. Any data provided herein is for informational purposes only and is intended solely for the private use of the reader. Although information contained herein is believed to be from reliable sources, The Baker Group LP does not guarantee its completeness or accuracy. Opinions constitute our judgment and are subject to change without notice. The instruments and strategies discussed here may fluctuate in price or value and may not be suitable for all investors; any doubt should be discussed with a Baker representative. Past performance is not indicative of future results. Changes in rates may have an adverse effect on the value of investments. This material is not intended as an offer or solicitation for the purchase or sale of any financial instruments.