The last week of May is ending with a flurry of chatter in the market about tariffs, inflation, and spending. Data out this morning showed that US consumers hit the brakes on spending in April, as expected. Headline personal spending rose 0.2%, in line with expectations, while personal income rose 0.8%, well above expectations. This marks the weakest quarter for spending (a key driver of GDP) in nearly two years, signaling an underlying level of anxiety about the economy among many consumers. The data also showed that inflation-adjusted personal spending rose 0.1% over the month, while goods imports plummeted by a record 20% amid higher tariffs and ongoing trade tensions.

Those tensions escalated further this morning after President Trump accused China of backtracking on its agreement to ease tariffs. The President’s post came just days after the administration announced new restrictions on Chinese student visas and chip design software, in another sign that frictions between the world’s two largest economies are back on the rise. On Wednesday, a US trade court also blocked most of President Trump's across-the-board import duties, ruling the president’s emergency powers cannot override the exclusive authority to regulate commerce with other countries given to Congress in the US Constitution. The White House quickly initiated an appeals process that could go all the way to the Supreme Court, confirming that trade policy will remain in flux and uncertainty is likely to persist for the time being.

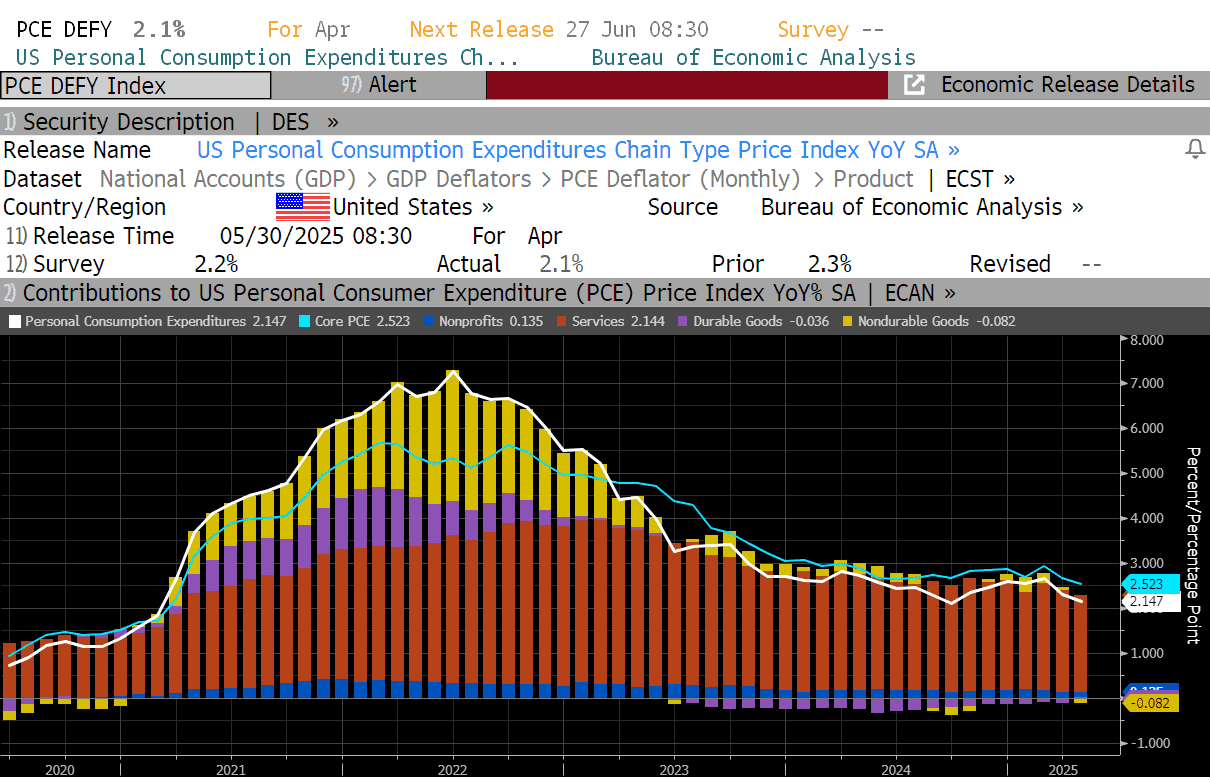

Reassuringly, April’s Personal Consumption Expenditures (PCE) index came in softer than expected this morning, indicating that inflation continues to moderate. The headline PCE price index rose 0.1% in April (vs. 0.0% prior) and 2.1% annually (vs. 2.3% prior). The Core measures, which strip volatile food and energy items, came in line with expectations at 0.1% MoM and 2.5% YoY. Prices rose modestly in categories with heavy exposure to imports from China but disinflation in services partially offset those increases.

While the Fed is likely to view the combination of soft inflation and moderated consumer activity as constructive, the broader concern remains the ripple effects of trade volatility. The uptick in prices from tariff-impacted goods suggests continued uncertainty around the level of pass-through costs that will end up in the hands of consumers. Futures markets continue to price in roughly two 25bp rate cuts in 2025 with the first cut expected sometime this fall.

Next week is the all-important jobs week, bringing a slew of data points on the health of the labor market. Hope everyone has a great weekend!

The Baker Group is one of the nation’s largest independently owned securities firms specializing in investment portfolio management for community financial institutions.

Since 1979, we’ve helped our clients improve decision-making, manage interest rate risk, and maximize investment portfolio performance. Our proven approach of total resource integration utilizes software and products developed by Baker’s Software Solutions* combined with the firm’s investment experience and advice.

Author

Andrea F. Pringle

Senior Vice President

The Baker Group LP

800.937.2257

*The Baker Group LP is the sole authorized distributor for the products and services developed and provided by The Baker Group Software Solutions, Inc.

INTENDED FOR USE BY INSTITUTIONAL INVESTORS ONLY. Any data provided herein is for informational purposes only and is intended solely for the private use of the reader. Although information contained herein is believed to be from reliable sources, The Baker Group LP does not guarantee its completeness or accuracy. Opinions constitute our judgment and are subject to change without notice. The instruments and strategies discussed here may fluctuate in price or value and may not be suitable for all investors; any doubt should be discussed with a Baker representative. Past performance is not indicative of future results. Changes in rates may have an adverse effect on the value of investments. This material is not intended as an offer or solicitation for the purchase or sale of any financial instruments.