While we can certainly agree that neither “motivator” is ideal for balance sheet managers, both have been big drivers over the past five years. During COVID-19, surging liquidity and non-existent loan demand left many scrambling for wholesale assets. FOMO (Fear of Missing Out) drove many to extend duration much farther than usual to find yield and margin. During the surging loan demand that followed the pandemic, many chose to chase loan volume, overlooking their offering rates and credit risk in the face of historical inflation and Fed hikes.

At the time, these moves were certainly understandable, (though it is not my intention to play Monday morning quarterback). However, the fear of missing out on yield in 2020/2021 and the fear of missing out on potential loan volume in 2022/2023 both led to actions that the industry will continue to feel for quite some time.

The cost of these strategies is still impacting many balance sheets across the industry today. However, there has been an even more sinister impact from these past pressures: FOMU (Fear of Messing Up). Many balance sheet leaders are now holding back on making key strategic decisions due to this very fear. I would argue that over a long enough period, FOMU will do even more damage to balance sheets than FOMO ever could. Our industry leaders and decision makers cannot build balance sheets for the future while constantly looking over their shoulders. I certainly believe that we should take the time to learn from our past mistakes and use those experiences to make us better. However, holding our management teams hostage through fear is certainly not the path forward.

Fast forward to the industry’s current situation and we once again have assets yields at levels we haven’t seen since 2007! The problem is that our actions are noticeably slower than in the past. Many worry about the risks of inflation and tariffs potentially driving longer yields higher over time. This is a valid and understandable concern. However, the current market volatility has equal risks to both the rising and falling rate scenarios. If we continue to over analyze and focus only on the risks from rising rates, we potentially leave ourselves exposed to the risk from falling rates. Given the challenges we still face from the last time rates unexpectedly shot higher, additional care is certainly called for right now. At the same time, we must realize that not taking any action is virtually as risky as taking the “wrong” action.

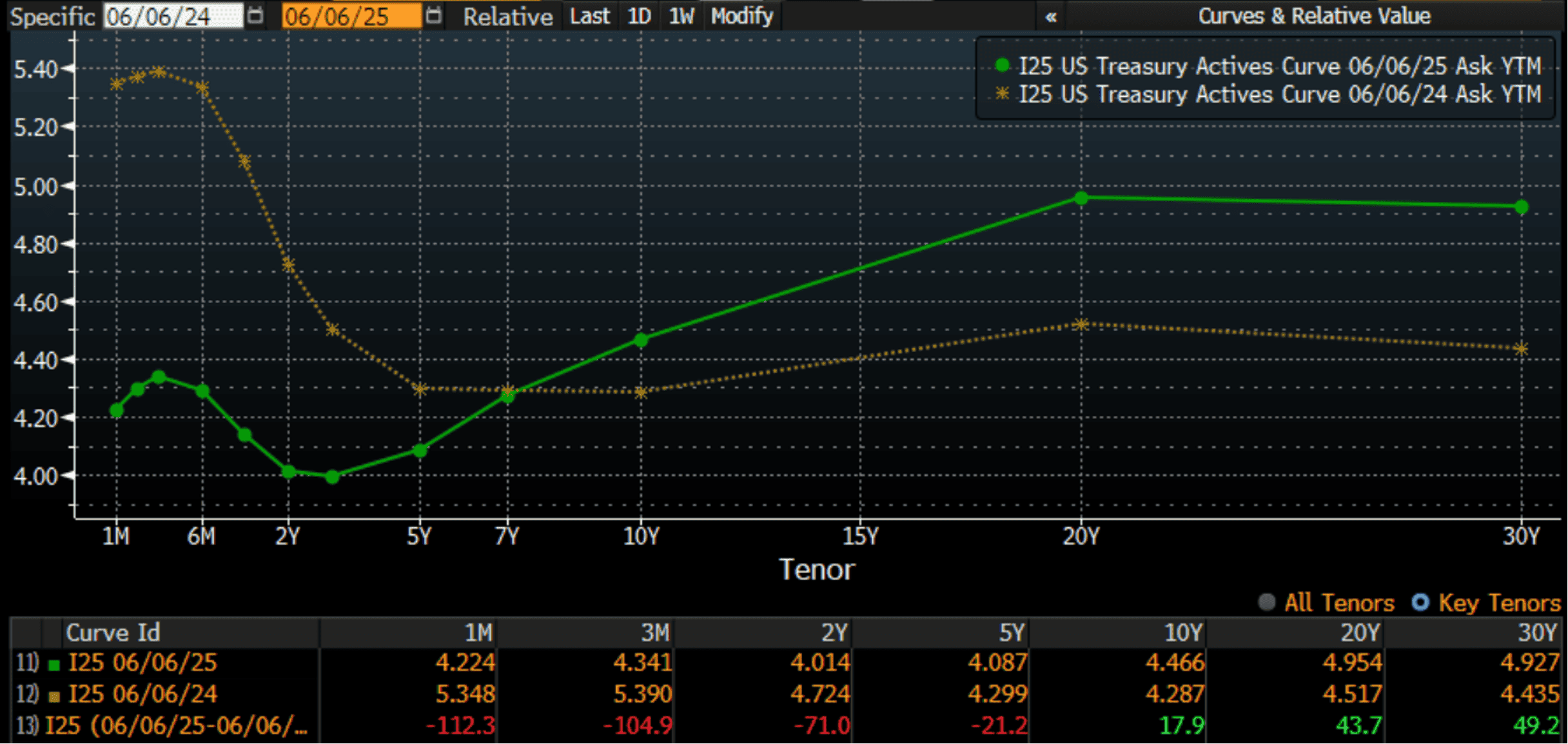

If we look at rates over the past year, we can see that 30yr treasuries have in fact risen by 49bps. However, while many have put off acting because of the fear of recent past, the shorter end of the curve has dropped by 20 to100bps. So, while we watch the drama play out in the treasury market on the long end, the part of the curve that impacts most of our asset pricing is down quite a bit. Many people argue that earning 4.30% in cash is a “good rate” right now, not realizing that yield has dropped 100bps over just the past year.

No one is saying that we should take drastic action and risk repeating the mistakes from COVID-19. However, it’s important to realize that volatility is here to stay so delaying action and decisions is not an answer. Instead, we need to take this opportunity to review our balance sheets weaknesses and needs. Some institutions will need to focus on adding higher tier credits on the loan side to better hedge future credit risk. Others will need to add additional bullet alternative assets to hedge their asset sensitivity in a falling rate environment. The main key here is that it’s not our job to guess where rates are heading. We can leave that for the TV personalities who get paid to generate financial content. However, it is also past time for us to take action and properly manage our balance sheets. I argue that a solid balance sheet/IRR approach to strategy and performance is more critical than it has been in a long time. Our board of directors and customers count on us to make proactive strategic decisions that steer the ship through stormy seas.

The Baker Group is one of the nation’s largest independently owned securities firms specializing in investment portfolio management for community financial institutions.

Since 1979, we’ve helped our clients improve decision-making, manage interest rate risk, and maximize investment portfolio performance. Our proven approach of total resource integration utilizes software and products developed by Baker’s Software Solutions* combined with the firm’s investment experience and advice.

Author

Andrew Okolski

Managing Director

The Baker Group LP

800.937.2257

*The Baker Group LP is the sole authorized distributor for the products and services developed and provided by The Baker Group Software Solutions, Inc.

INTENDED FOR USE BY INSTITUTIONAL INVESTORS ONLY. Any data provided herein is for informational purposes only and is intended solely for the private use of the reader. Although information contained herein is believed to be from reliable sources, The Baker Group LP does not guarantee its completeness or accuracy. Opinions constitute our judgment and are subject to change without notice. The instruments and strategies discussed here may fluctuate in price or value and may not be suitable for all investors; any doubt should be discussed with a Baker representative. Past performance is not indicative of future results. Changes in rates may have an adverse effect on the value of investments. This material is not intended as an offer or solicitation for the purchase or sale of any financial instruments.