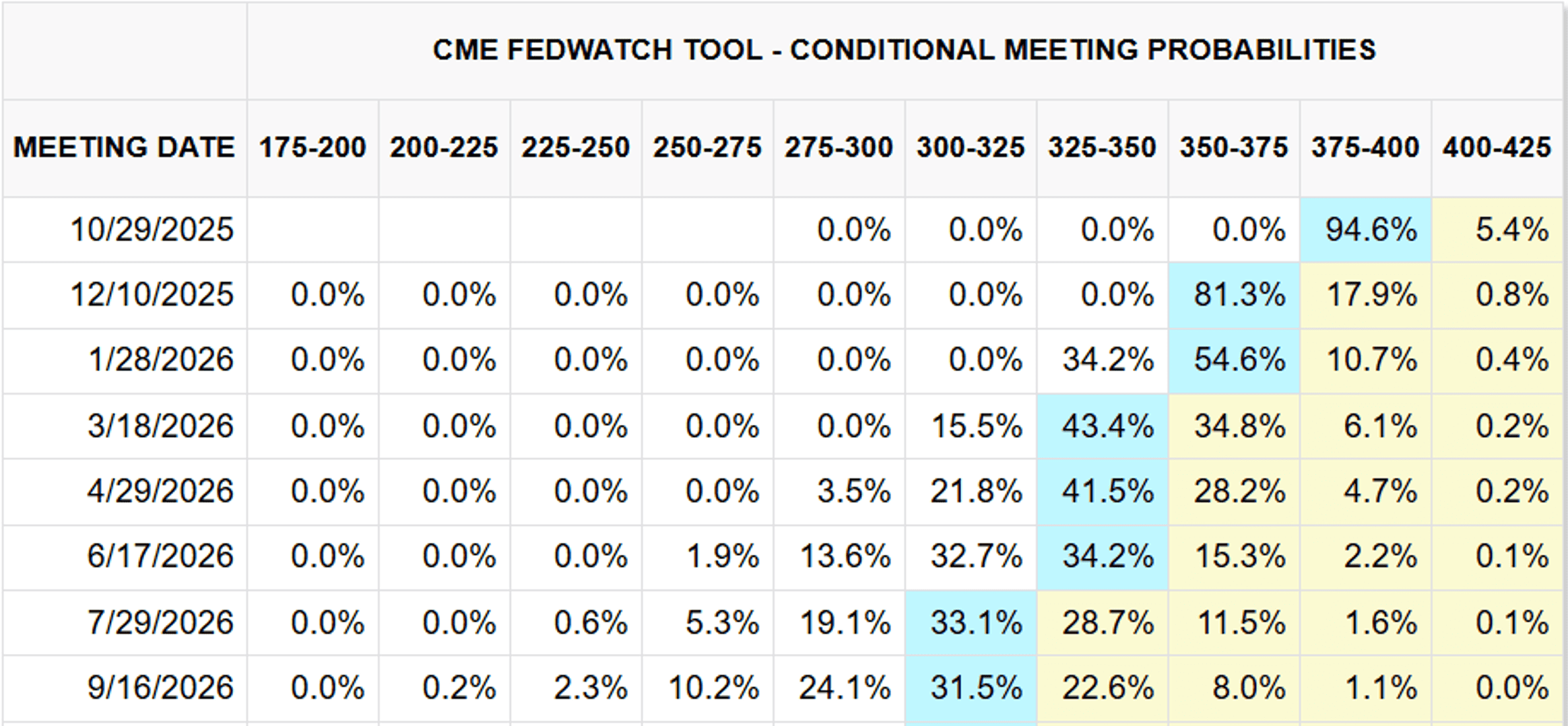

The bond market was fairly quiet this week as the government remains shutdown and most economic data is not being released. For the week, the 2yr yield was unchanged at 3.57% and the 10yr fell 2bp to 4.10%. We have already missed the most important data point of the month, the monthly jobs report, and now we will most likely not get the second most important data point, the Consumer Price Index, on time this coming week. However, since the September CPI is used to calculate cost of living adjustments for next year’s Social Security checks, the BLS has recalled staff to do the necessary calculations in order the release the September CPI before month-end (the data needed for the September CPI was already collected before the shutdown). And hopefully the Fed will have the latest inflation data before the next FOMC meeting on Oct 28-29. The question remains, will the Fed continue cutting rates in the absence of economic data, especially employment and inflation data? New York Fed President John Williams stated in an interview with the New York Times this week that a lapse in official government data would not deter him from wanting to take action at the Fed’s upcoming meetings. He acknowledged that government data were the “gold standard”, but private-sector providers and Fed surveys were also informative. The private payroll firm ADP released their monthly jobs data last week showing private payrolls fell 32,000 in September, the third negative month this year and the largest drop since March 2023. Based on that data alone it would be hard for the Fed to assume anything other than the labor market remains very weak and further rate cuts may be necessary. Markets certainly believe so with fed funds futures currently pricing in a 95% chance the Fed will cut rates 25bp at their meeting this month and an 81% chance they will cut again in December.

The focus for next week would normally be the CPI and PPI reports along with Retail Sales, Housing Starts/Permits, and Industrial Production. However, if the government remains shutdown, it could be another quiet week instead. How long will the shutdown last? It’s anyone’s guess at this point, but online betting markets are currently estimating it will last at least 27 days in total, which would make it the second longest shutdown in US history.

Fed Funds Futures Rate Cut Probabilities

The Baker Group is one of the nation’s largest independently owned securities firms specializing in investment portfolio management for community financial institutions.

Since 1979, we’ve helped our clients improve decision-making, manage interest rate risk, and maximize investment portfolio performance. Our proven approach of total resource integration utilizes software and products developed by Baker’s Software Solutions* combined with the firm’s investment experience and advice.

Author

Ryan W. Hayhurst

President

The Baker Group LP

800.937.2257

*The Baker Group LP is the sole authorized distributor for the products and services developed and provided by The Baker Group Software Solutions, Inc.

INTENDED FOR USE BY INSTITUTIONAL INVESTORS ONLY. Any data provided herein is for informational purposes only and is intended solely for the private use of the reader. Although information contained herein is believed to be from reliable sources, The Baker Group LP does not guarantee its completeness or accuracy. Opinions constitute our judgment and are subject to change without notice. The instruments and strategies discussed here may fluctuate in price or value and may not be suitable for all investors; any doubt should be discussed with a Baker representative. Past performance is not indicative of future results. Changes in rates may have an adverse effect on the value of investments. This material is not intended as an offer or solicitation for the purchase or sale of any financial instruments.