As Ferris Bueller once wisely said “Life moves pretty fast. If you don’t stop and look around once in a while, you could miss it.” This feels very true this week with all of the market moving news that occurred. We started off the week with Federal Reserve Chairman Jerome Powell meeting with Congress over two days and he made plenty of statements that had the markets pondering what is truly next for the Fed. We finish the week with the February jobs report. Even though last Friday was the first Friday of the month, the Bureau of Labor Statistics pushed back the February jobs report release to this morning. Let’s take a dive into this week’s economic data and key releases.

This morning we found out that non-farm payrolls increased 311,000 (est. = 225K) in February and the unemployment rate increased from 3.4% to 3.6%. A reminder that the non-farm payrolls number comes from the establishment survey while the unemployment rate comes from a separate household survey. The higher-than-expected non-farm payrolls report continues to support the narrative of a tight labor market and puts additional pressure on the Federal Reserve to consider a 50-basis point rate hike at their upcoming meeting which concludes on March 22nd. The household survey which produced the 3.6% unemployment rate in February showed a monthly job gain of only 177,000 and an increase of 242,000 in the number of unemployed people from January to February. Additionally, 419,000 people joined the labor force which helped push the labor force participation rate up to 62.5% (est. = 62.4%). The labor force participation rate still remains 0.8% below the pre-pandemic level of 63.3%. Average hourly earnings rose a smaller than expected at 0.2% in February (est. = 0.3%) and 4.6% form a year ago (est. = 4.7%). The Fed welcomes a slowdown in wage gains as they continue to fight any inflationary pressures on the economy.

On Wednesday, the Job Openings & Labor Turnover Survey (JOLTS) was released showing a decline in January for the number of open jobs. The JOLTS report shows there are 10.824 million job openings, down 410,000 from December. That equates to about 1.9 job openings per available worker, or a gap of 5.13 million. The number of quits fell to 3.88 million, the lowest level since May 2021 and layoffs rose sharply up 241,000 or 16%.

With the jobs report being released this morning, all eyes will be on the Consumer Price Index (CPI) report next week. Expectations are for a 0.4% month over month change and a 6.0% year over year change in headline CPI. Core CPI (excludes food and energy) is expected to also increase 0.4% month over month and 5.5% year over year. That will be the last major data set the Fed has to consider before their rate-setting meeting this month.

The big question leading up to the Fed’s March meeting is will they hike 25 or 50 basis points? Many were saying that a strong jobs report would solidify the Fed hiking rates 50 basis points. Per the CME’s FedWatch Tool, the expectations from the market are for a 57% chance of a 25bp rate hike and a 43% chance of a 50bp rate hike at the upcoming March Fed meeting. We will find out in just under 2 weeks!

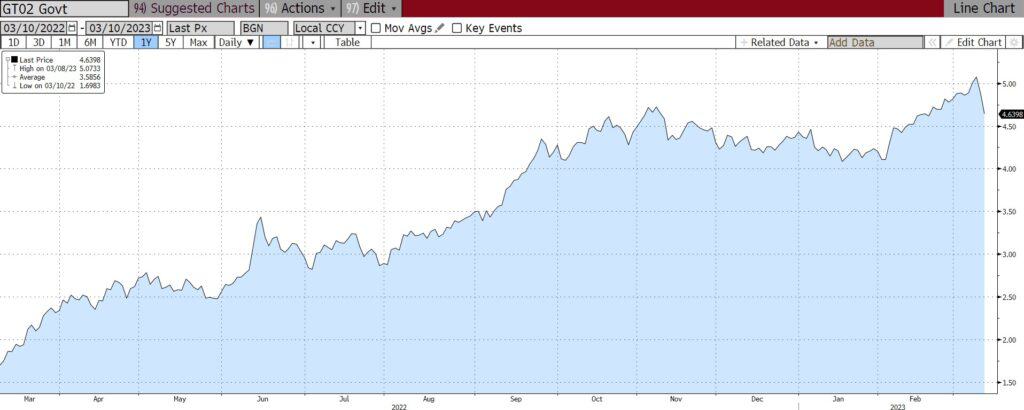

The Treasury Market is seeing a very strong rally this morning with prices up and yields down. The 2-year Treasury is sitting at 4.62% and the 10-year Treasury at 3.68%. The 2-Year Treasury reached a recent high of 5.07% on Wednesday and is now down 42 basis points from that point. The bond markets may be shaking off the strong nonfarm payrolls report, however, the markets seem to still be digesting the news of the stock price crash of Silicon Valley Bank. Stocks are relatively flat on this Friday morning’s trading session with the Dow Jones Industrial Average Index up 45 points and the S&P 500 Index down 27 points.

Alongside next week’s anticipated release of CPI data, we will also get changes in the Producer Price Index, retail sales data, housing starts and building permits as well as consumer sentiment information. Have a great weekend!

2-Year Treasury Yield (3/10/2022 to Present)

The Baker Group is one of the nation’s largest independently owned securities firms specializing in investment portfolio management for community financial institutions.

Since 1979, we’ve helped our clients improve decision-making, manage interest rate risk, and maximize investment portfolio performance. Our proven approach of total resource integration utilizes software and products developed by Baker’s Software Solutions* combined with the firm’s investment experience and advice.

Author

Dale Sheller

Managing Director

Director of Financial Strategies Group

The Baker Group LP

800.937.2257

*The Baker Group LP is the sole authorized distributor for the products and services developed and provided by The Baker Group Software Solutions, Inc.

INTENDED FOR USE BY INSTITUTIONAL INVESTORS ONLY. Any data provided herein is for informational purposes only and is intended solely for the private use of the reader. Although information contained herein is believed to be from reliable sources, The Baker Group LP does not guarantee its completeness or accuracy. Opinions constitute our judgment and are subject to change without notice. The instruments and strategies discussed here may fluctuate in price or value and may not be suitable for all investors; any doubt should be discussed with a Baker representative. Past performance is not indicative of future results. Changes in rates may have an adverse effect on the value of investments. This material is not intended as an offer or solicitation for the purchase or sale of any financial instruments.