This week proved to be a calm week in the bond market as yields across the curve remained relatively flat. The 10yr sits at 3.56% and within 5 basis points of the start of the week. The Fed has remained steadfast in their plan to raise short-term rates, but bond investors have actually seen yields on the 10yr fall -68bps from the highs in Oct. ’22. It may still be too soon to call a peak in yields, but for investors who feel they have missed an opportunity, it’s important to note that you’d have to go all the way back to April of 2011 to see bond yields at current levels.

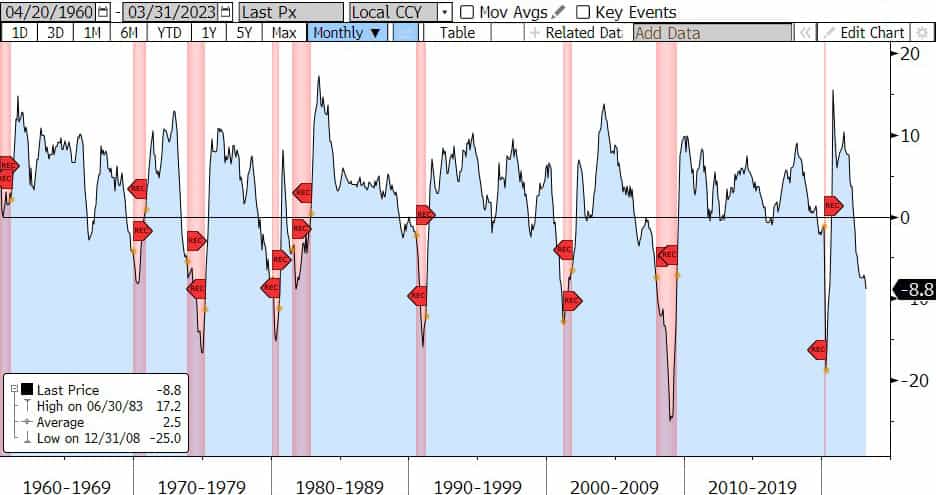

As for economic updates, we kicked off the week with a look at Housing Starts and Building Permits, both of which came in softer than February’s numbers at -0.8% MoM and -8.8% MoM respectively. Starts and Permits are strong leading indicators for future housing growth and continue to remain subdued by higher mortgage rates. Speaking of Leading Indicators, we also got a look at the LEI which fell -1.2% from last month and the 6mo annualized number is now down -8.8%. We have all heard that “correlation does not equal causation”, but this another data point that has never been this negative outside of a recession and suggests the “soft-landing” could be a little firmer than we would like.

This week’s economic release did have a bright spot as the Empire Manufacturing index surprised to the upside and expanded for the first time in 5 months, but noted that factory headcount declined for the third month in a row. Additionally, Continuing Jobless Claims have been slowly trending up since the lows in September to 1.865mm.

Looking ahead to next week, is the first look at Q1 GDP along with the University of Michigan’s Consumer Sentiment Report. And, just in time for the Fed’s May 3rd meeting, we will also get a look at their preferred measure of inflation, the PCE Index. We will see where the inflation data leads us as the Fed remains hyper-focused on returning to long-term price stability, but the current CME FedWatch tool is showing a strong 88% probability of a 0.25% rate hike to the 500-525 range. The Fed Funds Futures market is currently betting that this will be the last rate hike we see from the Fed before they pause, but as ever, this will be data dependent and the picture only gets clearer with time.

The Baker Group is one of the nation’s largest independently owned securities firms specializing in investment portfolio management for community financial institutions.

Since 1979, we’ve helped our clients improve decision-making, manage interest rate risk, and maximize investment portfolio performance. Our proven approach of total resource integration utilizes software and products developed by Baker’s Software Solutions* combined with the firm’s investment experience and advice.

Author

Dillon Wiedemann

Senior Vice President of FSG

Financial Analyst

The Baker Group LP

800.937.2257

*The Baker Group LP is the sole authorized distributor for the products and services developed and provided by The Baker Group Software Solutions, Inc.

INTENDED FOR USE BY INSTITUTIONAL INVESTORS ONLY. Any data provided herein is for informational purposes only and is intended solely for the private use of the reader. Although information contained herein is believed to be from reliable sources, The Baker Group LP does not guarantee its completeness or accuracy. Opinions constitute our judgment and are subject to change without notice. The instruments and strategies discussed here may fluctuate in price or value and may not be suitable for all investors; any doubt should be discussed with a Baker representative. Past performance is not indicative of future results. Changes in rates may have an adverse effect on the value of investments. This material is not intended as an offer or solicitation for the purchase or sale of any financial instruments.