In a week that has been fairly light on data, market participants have been eagerly awaiting news from the Jackson Hole Economic Policy Symposium and particularly the speech from Fed Chair Jerome Powell this morning. Markets are looking for any clues from his comments that address the two key questions on everyone’s minds – how high will interest rates go, and how long will they stay there?

It has been a jittery week for markets in the lead up to Jackson Hole. Bond yields continued to push higher on Monday and credit-rating firm S&P Global cut the credit ratings and revised its outlook for multiple mid-tier U.S. banks late in the day. The agency cited concerns that funding risks and shakier profitability will test the credit strength of the sector. The news rekindled concerns about the impact on U.S. banks from a particularly tough August for bond prices and borrowing rates.

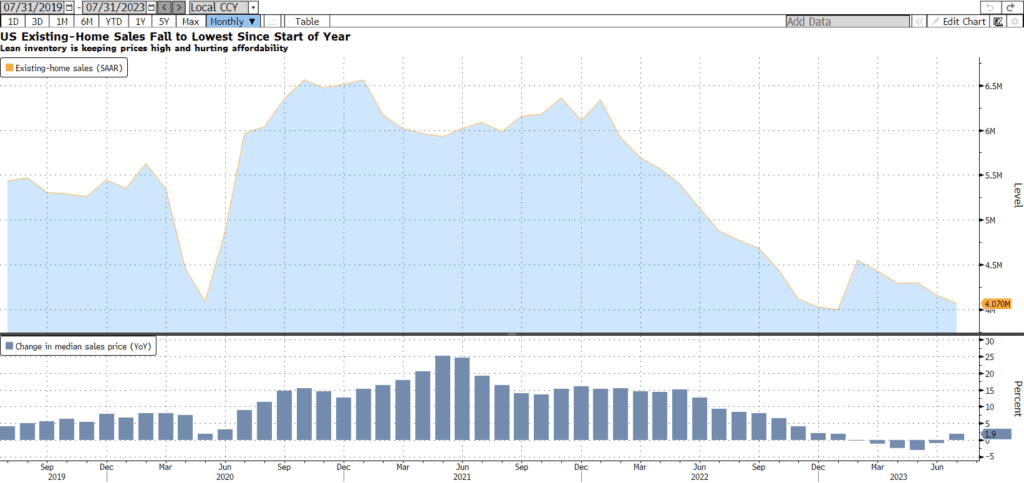

Tuesday and Wednesday brought some relief with a bounce in bond prices and the 10-year Treasury yield pulled back from 16-year highs. On Tuesday, we also saw Existing Home Sales slide further on lean inventory. Sales of previously owned homes decreased 2.2% from a month earlier to an annualized pace of 4.07mm, well shy of the 4.15mm consensus estimate. It is no secret that existing homeowners are discouraged from listing their properties with mortgage rates more than doubling over the past few years and inventory has fallen as a result. With no end in sight to that dynamic, asking prices remain high and demand will likely continue to struggle.

The combination of low inventory and higher borrowing costs is steering many buyers toward new construction, and we saw New Home Sales come in stronger than expected on Wednesday. Purchases of new homes increased 4.4% to an annualized pace of 714k, the highest level in more than a year and above expectations of 703k. However, the recent pickup in mortgage rates toward 7.5% is weighing on homebuilder sentiment and translating into weaker demand across all purchase types. Home purchase applications are now down to the lowest level since 1995.

Finally, in this morning’s address from Jackson Hole, Powell continued to tout the central bank’s commitment to defeating the inflation problem. He said, “Although inflation has moved down from its peak – a welcome development – it remains too high. We are prepared to raise rates further if appropriate, and intend to hold policy at a restrictive level until we are confident that inflation is moving sustainably down toward our objective.” He also suggested the Fed could hold rates steady at its next meeting in September as investors expect. “Given how far we have come, at upcoming meetings we are in a position to proceed carefully as we assess the incoming data and the evolving outlook and risks.”

Treasury yields initially dipped as Powell spoke, but the policy-sensitive 2-year Treasury was little changed around 5.04%. The 10-year Treasury yield dropped to 4.2%. Futures markets are still pricing in a final 2023 rake hike at the Fed’s Oct. 31 – Nov. 1 meeting with about 60% confidence and are expecting several rate cuts in 2024. While we may not have seen the final peak in short-term rates, the Fed appears committed to bringing down economic growth and consumption as needed to quell inflation. Whether that success ends in a recession or soft landing, both scenarios come with lower interest rates in the future and prudent ALM planning remains key.

The Baker Group is one of the nation’s largest independently owned securities firms specializing in investment portfolio management for community financial institutions.

Since 1979, we’ve helped our clients improve decision-making, manage interest rate risk, and maximize investment portfolio performance. Our proven approach of total resource integration utilizes software and products developed by Baker’s Software Solutions* combined with the firm’s investment experience and advice.

Author

Andrea F. Pringle

Financial Strategist/MBS Analyst

The Baker Group LP

800.937.2257

*The Baker Group LP is the sole authorized distributor for the products and services developed and provided by The Baker Group Software Solutions, Inc.

INTENDED FOR USE BY INSTITUTIONAL INVESTORS ONLY. Any data provided herein is for informational purposes only and is intended solely for the private use of the reader. Although information contained herein is believed to be from reliable sources, The Baker Group LP does not guarantee its completeness or accuracy. Opinions constitute our judgment and are subject to change without notice. The instruments and strategies discussed here may fluctuate in price or value and may not be suitable for all investors; any doubt should be discussed with a Baker representative. Past performance is not indicative of future results. Changes in rates may have an adverse effect on the value of investments. This material is not intended as an offer or solicitation for the purchase or sale of any financial instruments.