Labor Day has now come and gone, and the “unofficial” end of summer is now officially in the rearview mirror. The short trading week proved to be mild as yields across the Treasury curve remained relatively flat. This week was light for economic news and didn’t offer much evidence for traders to change the current belief that the Fed could be nearing the end of their tightening cycle.

Factory Orders fell for the first time since February and were down by -2.1% for the month of July with much of that decline being attributed to transportation. Mortgage Applications for the week declined -2.9% after last week’s positive bounce ended a streak of declining applications that go back to the early part of July. It will be interesting to watch that trend as the seasonality of the fall and winter months typically slow home buying activity.

Applications for unemployment benefits fell to the lowest level since February as Initial Jobless Claims dropped to 216,000 last week. Given the backdrop of last week’s employment numbers, this data suggests that there is still some tightness in the labor market even as conditions show signs of cooling. The Fed is expected to remain steady at the next meeting on September 20th but will want to see continued signs of a softer labor market to guide future policy decisions.

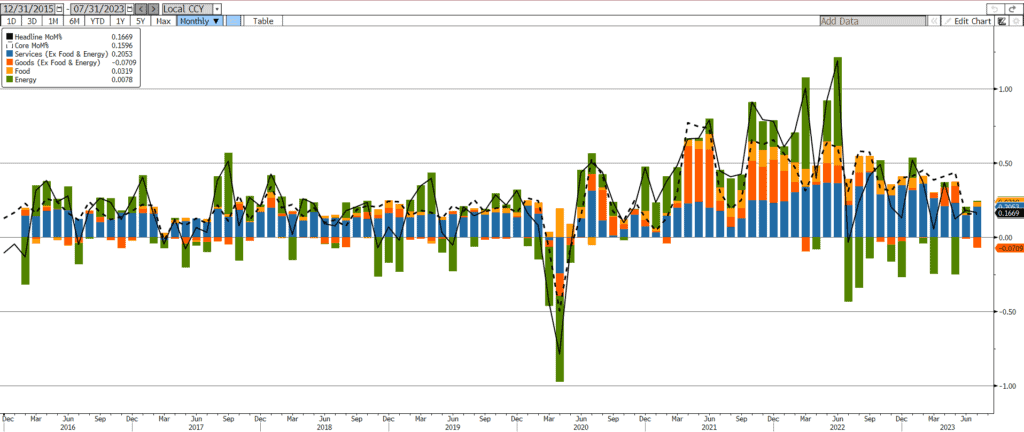

Next week’s economic calendar should provide significantly more information for markets to digest before the Fed’s next meeting. Some of the more closely watched updates will be the CPI and PPI reports released by the US Bureau of Labor Statistics. Fed watchers will be looking for continued moderation in inflation numbers. Additionally, markets will get an opportunity to evaluate Retail Sales numbers for the month of August along with the University of Michigan’s Consumer Sentiment report.

The Baker Group is one of the nation’s largest independently owned securities firms specializing in investment portfolio management for community financial institutions.

Since 1979, we’ve helped our clients improve decision-making, manage interest rate risk, and maximize investment portfolio performance. Our proven approach of total resource integration utilizes software and products developed by Baker’s Software Solutions* combined with the firm’s investment experience and advice.

Author

Dillon Wiedemann

Senior Vice President of FSG

Financial Analyst

The Baker Group LP

800.937.2257

*The Baker Group LP is the sole authorized distributor for the products and services developed and provided by The Baker Group Software Solutions, Inc.

INTENDED FOR USE BY INSTITUTIONAL INVESTORS ONLY. Any data provided herein is for informational purposes only and is intended solely for the private use of the reader. Although information contained herein is believed to be from reliable sources, The Baker Group LP does not guarantee its completeness or accuracy. Opinions constitute our judgment and are subject to change without notice. The instruments and strategies discussed here may fluctuate in price or value and may not be suitable for all investors; any doubt should be discussed with a Baker representative. Past performance is not indicative of future results. Changes in rates may have an adverse effect on the value of investments. This material is not intended as an offer or solicitation for the purchase or sale of any financial instruments.