Treasury yields are down again this week on softening economic data and well-received Treasury sales. In fact, the 10-year fell during the month of November the most since 2008, when the financial crisis prompted the Fed to drop rates to near zero and launch its first quantitative easing program. We open the final month of the year with the 2-year UST rate down 25bps since last Friday to ~4.70%. The 10-year is down 13bps to 4.34% and the 30-year is down 9bps to 4.51% at the time of this writing. Fed funds futures markets have also moved up their calls for the next rate cut and are now fully pricing in a rate cut by the May meeting with a near 50% chance they cut in March.

On Monday, Treasuries snapped back into action after the holiday weekend with a strong bond auction where $109 billion of 2-year and 5-year notes were digested without much market disruption. The benchmark 10-year yield fell 10bps to 4.37% on Monday as the well-received auction calmed jitters about another heavy load of debt sales from the U.S. government.

Enticing yields lower on Tuesday were comments from the particularly hawkish Fed Governor, Christopher Waller, who said, "I am increasingly confident that policy is currently well positioned to slow the economy and get inflation back to 2%." He also said there was “no reason” to mandate that interest rates remain “really high” if inflation maintains a consistent decline. The more dovish Fed President, Austan Goolsbee, also highlighted the risks of keeping rates too high for too long in his comments, saying, “Anybody who cooks a turkey knows that you got to pull it out of the oven before it's to the point where you want it to be, because it's going to have residual heat."

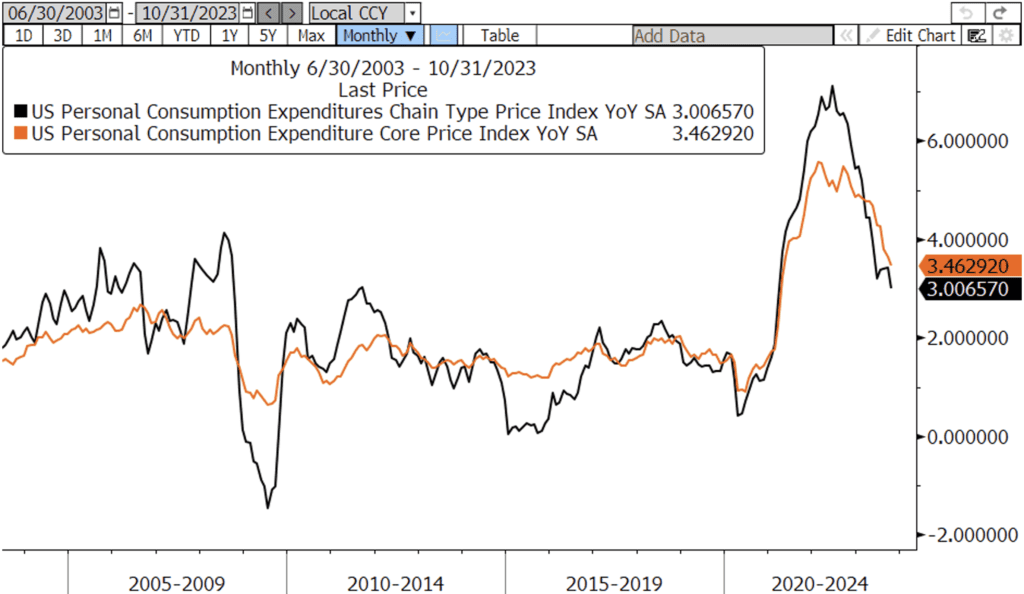

Thursday’s release of the Personal Consumption Expenditures (PCE) price index, the Fed's targeted measure of inflation, showed inflation cooler than expected in October. Prices rose 3.0% vs. 3.1% consensus, the lowest level since March 2021 and down considerably from the peak of 7.1% in June 2022. The numbers reinforce most analysts’ view that inflation will continue its downward trajectory in the months ahead as the economy cools. Also on Thursday, the Department of Labor’s report of continuing jobless claims showed claims rose more than expected to 1.927 million vs. 1.865 million consensus for the week ended November 18th. This figure has been climbing since September, suggesting unemployed Americans are finding it more difficult to find a new job.

The week’s spattering of housing data showed mixed results. New home sales came in shy of expectations at 679k vs. 721k consensus. The FHFA House Price Index for September came in stronger than forecast, up 0.6% month-over-month vs. 0.5% consensus; while the Case-Shiller home price index for September also posted an increase, albeit smaller than expected (+0.67% MoM versus +0.8% consensus). Pending home sales, which declined less than expected, still fell to the lowest level on record going back to 2001 in October. Contract signings to purchase previously owned homes declined 1.5% vs. a drop of 2.0% expected.

Next week, markets will have to rely on data for direction as today marks the final day before the Fed’s blackout period in which central bank officials are prohibited from public speaking ahead of their December 14 rate announcement. And there is plenty of market-moving data on the docket as next week is the all-important employment week culminating with the unemployment and non-farm payrolls figures on Friday.

The Baker Group is one of the nation’s largest independently owned securities firms specializing in investment portfolio management for community financial institutions.

Since 1979, we’ve helped our clients improve decision-making, manage interest rate risk, and maximize investment portfolio performance. Our proven approach of total resource integration utilizes software and products developed by Baker’s Software Solutions* combined with the firm’s investment experience and advice.

Author

Andrea F. Pringle

Financial Strategist/MBS Analyst

The Baker Group LP

800.937.2257

*The Baker Group LP is the sole authorized distributor for the products and services developed and provided by The Baker Group Software Solutions, Inc.

INTENDED FOR USE BY INSTITUTIONAL INVESTORS ONLY. Any data provided herein is for informational purposes only and is intended solely for the private use of the reader. Although information contained herein is believed to be from reliable sources, The Baker Group LP does not guarantee its completeness or accuracy. Opinions constitute our judgment and are subject to change without notice. The instruments and strategies discussed here may fluctuate in price or value and may not be suitable for all investors; any doubt should be discussed with a Baker representative. Past performance is not indicative of future results. Changes in rates may have an adverse effect on the value of investments. This material is not intended as an offer or solicitation for the purchase or sale of any financial instruments.