Happy Friday, everyone! It is March 1st already and the rule of thumb is that the jobs report comes out the “First Friday of the Month”. So where is the jobs report for the month of February? Well, rules of thumb are not always perfect rules. The Bureau of Labor Statistics (BLS) actual rule is that the report release “is scheduled for the third Friday after the conclusion of the survey reference week.” Therefore, we will have to wait until next Friday to get the jobs report from the BLS, where expectations are for 190,000 more jobs and the unemployment rate to hold steady at 3.7%.

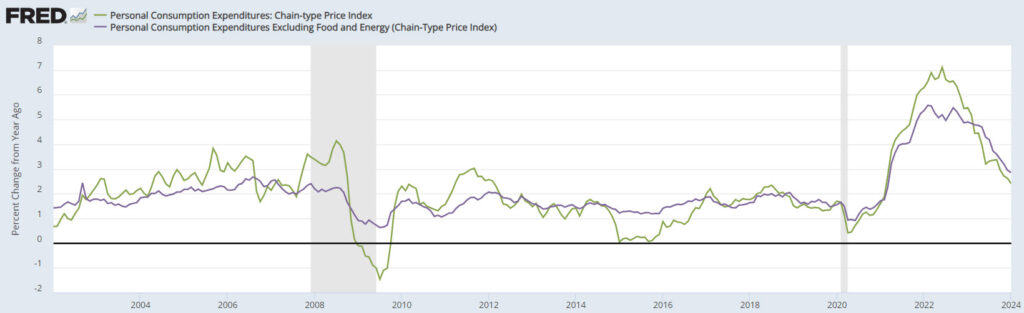

Yesterday, all eyes were on the release of the Fed’s preferred measure of inflation, the Personal Consumption Expenditure (PCE) Deflator, rose just 0.3% in January (est = 0.3%) and 2.4% (est = 2.4%) from a year ago, the lowest annual reading since February 2021 and down from 7.1% in June 2022. PCE inflation is nearly at the Fed’s target of 2% and this report will be welcome news for the Fed as it decides when to begin lowering interest rates from the highest level in 23 years. Excluding food and energy, Core PCE rose 0.4% (est = 0.4%) and 2.8% from a year ago (est = 2.8%). The Fed believes core inflation is a better indicator of the trend for underlying inflation as headline inflation tends to be more volatile and moves towards core inflation over time. Core inflation has not moved down as much as headline inflation mainly due to more “sticky” services which remain stubbornly high. Personal Income was also reported this morning and it showed a much stronger gain of 1.0% (est = 0.4%) as payrolls surged in January. But the higher income did not boost spending with Personal Spending rising just 0.2% (est = 0.2%) and once you adjust for inflation, Real Personal Spending fell 0.1% (-0.1%). Real consumer spending makes up 60-70% of GDP so this report could lead to a downgrade of Q1 growth estimates.

Earlier in the week, the Conference Board, a business research group, said that its consumer confidence index fell to 106.7 from a revised 110.9 in January. Expectations were for the index to remain unchanged month over month. The index measures both Americans’ assessment of current economic conditions and their outlook for the next six months. As mentioned prior, consumer spending accounts for about 60-70% of U.S. economic activity, so economists pay close attention to consumer behavior as they take measure of the broader economy. The index measuring Americans short-term expectations for income, business and the job market fell to 79.8 from 81.5 in January. A reading under 80 has often signaled an upcoming recession.

Stocks are flat early on this Friday morning trading session and bonds are flat as well. The markets will look to next Friday’s job report to get further insight into the strength of the labor market. Until then, have a great weekend!

PCE and Core PCE (Year over Year Percentage Change) – 2002 to Current

The Baker Group is one of the nation’s largest independently owned securities firms specializing in investment portfolio management for community financial institutions.

Since 1979, we’ve helped our clients improve decision-making, manage interest rate risk, and maximize investment portfolio performance. Our proven approach of total resource integration utilizes software and products developed by Baker’s Software Solutions* combined with the firm’s investment experience and advice.

Author

Dale Sheller

Managing Director

Director of Financial Strategies Group

The Baker Group LP

800.937.2257

*The Baker Group LP is the sole authorized distributor for the products and services developed and provided by The Baker Group Software Solutions, Inc.

INTENDED FOR USE BY INSTITUTIONAL INVESTORS ONLY. Any data provided herein is for informational purposes only and is intended solely for the private use of the reader. Although information contained herein is believed to be from reliable sources, The Baker Group LP does not guarantee its completeness or accuracy. Opinions constitute our judgment and are subject to change without notice. The instruments and strategies discussed here may fluctuate in price or value and may not be suitable for all investors; any doubt should be discussed with a Baker representative. Past performance is not indicative of future results. Changes in rates may have an adverse effect on the value of investments. This material is not intended as an offer or solicitation for the purchase or sale of any financial instruments.