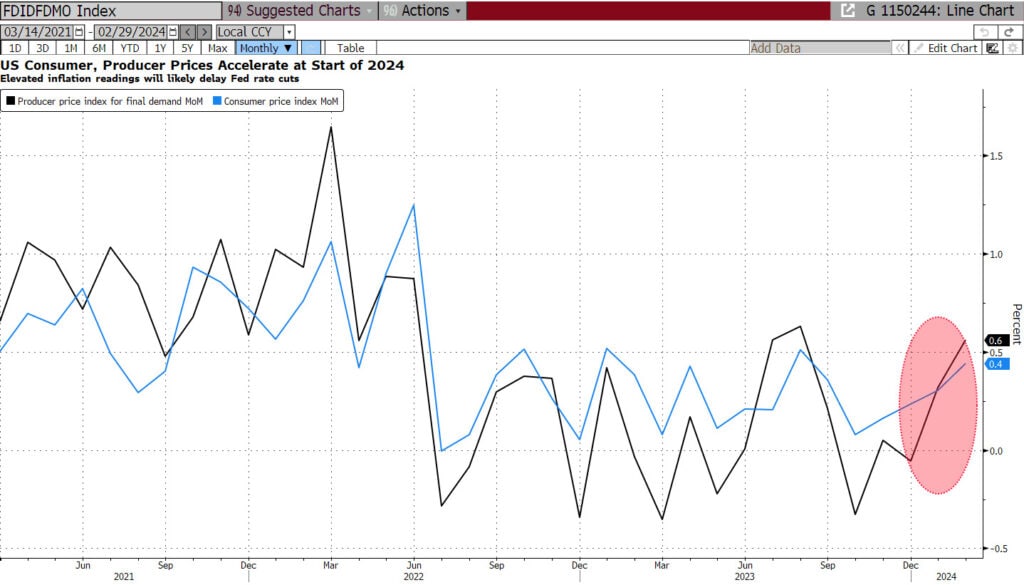

Markets appear to be stabilizing this morning after a week of volatility. Yesterday’s hotter than expected Producer Price Index (PPI) print was read as weakening the case for imminent rate cuts from the Fed and sent bond yields soaring. The 10-year UST yield popped nearly 10bps yesterday morning following the report and gained even more ground this morning. At the time of this writing, the 10-year UST is yielding 4.3162%, the highest in about a month.

PPI Final Demand came in up 0.6% for the month of February vs. 0.3% expected and up 1.6% from the prior year vs. 1.2% expected. The increase in producer prices, which tend to lead consumer prices, is expected to cause the Fed some heartburn as it contemplates the trajectory of inflation. Also adding to the volatility on Thursday were stronger than expected weekly jobless claims and weaker than expected retail sales. Initial jobless claims for the week ending March 9th showed fewer people sought out jobless benefits than expected (209k vs. 218k est.) and the prior week’s figure was also revised down to 210k from 217k. Labor market strength continues to worry some policy watchers who fear strong wages will make inflation more difficult to tame.

Thursday’s weaker than expected retail sales print also raised concerns that the strength of the all-important consumer is waning. Personal consumption accounts for nearly 70% of U.S. GDP and falling consumer spending threatens weaker economic growth. February’s retail sales rose 0.6% from the prior month (vs. 0.8% est.). The Retail Sales Control Group, which feeds directly into GDP, came in flat for the month of February. Expectations were for that measure to rebound 0.4% from its fall to -0.3% in January.

Tuesday’s reading of the Consumer Price Index (CPI) also sent bond yields up with the 10-year UST popping as much as 8bps intraday before settling up 6bps on the day. Headline CPI actually came in as expected, up 0.4% month-over-month in February (and 3.2% YoY), but the Core CPI measure is what riled markets. Core CPI, which excludes volatile food and energy items to better track the underlying trend of inflation, rose a little more than expected, up 0.4% vs. 0.3% est. Still, it was the lowest annual reading for Core CPI in three years.

Next week, all eyes will be on the Fed’s policy meeting where they will most certainly debate the strength of this week’s inflation data. Interest rates are expected to remain unchanged for the fifth straight meeting. Much of the focus will be on the central bank’s new “dot plot” which they produce just four times a year. The chart shows where each member of the FOMC estimates the federal funds rate to be at the end of each of the next three years and over the long run. Investors take the median of the dots as guidance for the trajectory of the federal funds rate. The last production of the dot plot showed a median of 75bps of cuts expected this year. Markets will be closely watching the updated chart for any changes at the March 19-20 meeting. Futures markets themselves have “unpriced” several cuts since the Fed’s last dot plot was released in December. If the FOMC’s forecast also shows fewer cuts, it could make for a bumpy week!

The Baker Group is one of the nation’s largest independently owned securities firms specializing in investment portfolio management for community financial institutions.

Since 1979, we’ve helped our clients improve decision-making, manage interest rate risk, and maximize investment portfolio performance. Our proven approach of total resource integration utilizes software and products developed by Baker’s Software Solutions* combined with the firm’s investment experience and advice.

Author

Andrea F. Pringle

Financial Strategist/MBS Analyst

The Baker Group LP

APringle@GoBaker.com

800.937.2257

*The Baker Group LP is the sole authorized distributor for the products and services developed and provided by The Baker Group Software Solutions, Inc.

INTENDED FOR USE BY INSTITUTIONAL INVESTORS ONLY. Any data provided herein is for informational purposes only and is intended solely for the private use of the reader. Although information contained herein is believed to be from reliable sources, The Baker Group LP does not guarantee its completeness or accuracy. Opinions constitute our judgment and are subject to change without notice. The instruments and strategies discussed here may fluctuate in price or value and may not be suitable for all investors; any doubt should be discussed with a Baker representative. Past performance is not indicative of future results. Changes in rates may have an adverse effect on the value of investments. This material is not intended as an offer or solicitation for the purchase or sale of any financial instruments.