All eyes were on the FOMC meeting this week that took place March 19-20. Following the two-day policy meeting, the central bank’s rate-setting Federal Open Market Committee (FOMC) left its benchmark overnight borrowing rate in a range between 5.25%-5.50%, as expected. There were no major changes to the policy statement nor were there changes to the FOMC’s quarterly projections for rate cuts this year, which pleased markets. The overall sentiment seemed to be relief; relief that the Committee had not dialed back December’s rate cut forecasts for 2024 even though they did eliminate a cut from their 2025 forecast.

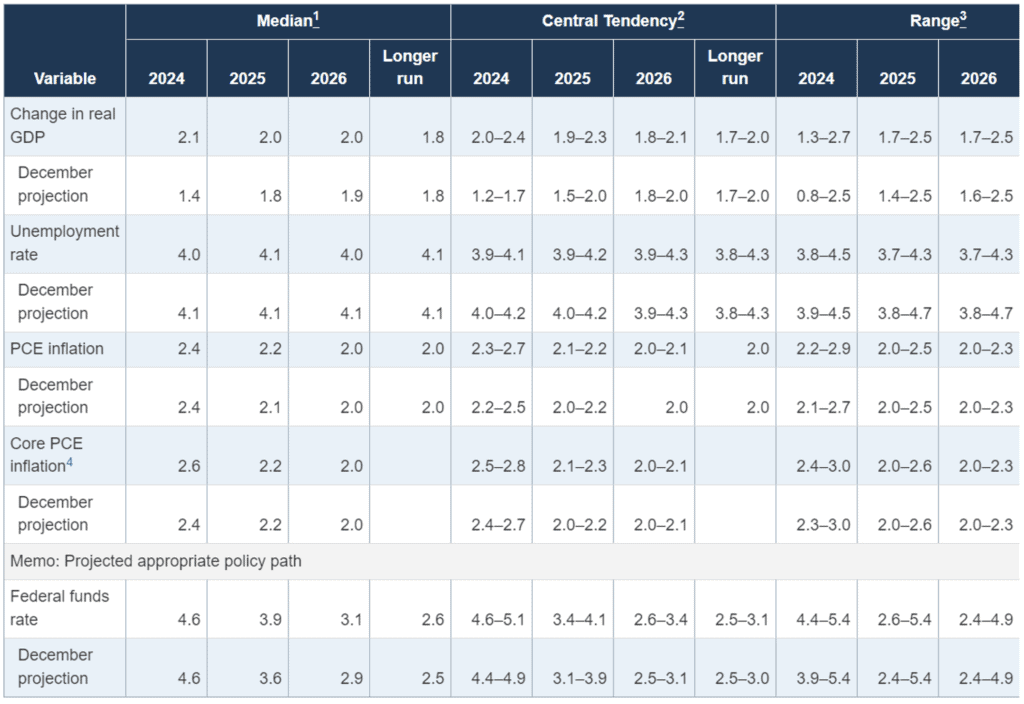

The “dot plot,” which reflects expected policy rates for the next three years and in the long run from the 19 officials who comprise the FOMC, was unchanged for year-end 2024 at 4.6%, implying the Committee expects to cut rates 75bps by the end of this year. However, the median dot for next year rose to 3.9%, up from 3.6% in the December dot plot, which indicates three potential cuts in 2025, one less cut than the December forecast. The 2026 forecast showed three cuts as well. For the long run “neutral rate,” policymakers nudged up their forecast to 2.6% from 2.5% in December.

In addition to the dot plot, the Summary of Economic Projections (SEP) also provides the Fed’s estimates for Gross Domestic Product (GDP), inflation (PCE), and unemployment. In the March SEP, the FOMC raised its 2024 GDP forecast to 2.1% from 1.4% previously and held its long-run growth estimate at 1.8%. On the inflation front, the FOMC maintained its 2024 forecast for headline PCE inflation at 2.4% but lifted its Core PCE inflation expectation to 2.6% from 2.4%. The unemployment rate forecast for 2024 was lowered to 4.0% from 4.1%.

Markets rallied following the release. All three major U.S. stock indexes finished at their highest closing levels ever for the first time in more than two years and Treasury yields headed mostly lower. With no more economic releases for the week, Treasury yields look to end the week down ~1-13 bps across the curve. The 2-year UST is currently down 13bps from last week to 4.59%, the 5-year UST is also down 13bps to 4.195%, and the 10-year UST is down 9bps on the week to 4.21%. Fed Funds futures markets currently have the first rate cut fully priced in by the July meeting and are showing the greatest probability that the cut comes in June. Futures are also currently reflecting slightly more than the Fed’s three rate cuts for 2024.

Elsewhere this week, we got a variety of housing data which showed housing starts popped 10.7% in February to an annual rate of 1.521 million, 5.9% higher than a year ago. Building permits were also up 1.9% in February to 1.518 million vs. 1.496 million expected. Existing home sales came in well above expectations rising 9.5% to 4.38 million in February from 4 million in January, the largest increase in a year after ticking up 3.1% in January. Expectations were for existing home sales to fall 1.3% month-over-month.

Next week, markets will switch attention to the release of the Fed's favored inflation gauge, Personal Consumption Expenditures (PCE) on Friday. We will also get Q4 2023 GDP revision, and more housing data.

The Baker Group is one of the nation’s largest independently owned securities firms specializing in investment portfolio management for community financial institutions.

Since 1979, we’ve helped our clients improve decision-making, manage interest rate risk, and maximize investment portfolio performance. Our proven approach of total resource integration utilizes software and products developed by Baker’s Software Solutions* combined with the firm’s investment experience and advice.

Author

Andrea F. Pringle

Financial Strategist/MBS Analyst

The Baker Group LP

800.937.2257

*The Baker Group LP is the sole authorized distributor for the products and services developed and provided by The Baker Group Software Solutions, Inc.

INTENDED FOR USE BY INSTITUTIONAL INVESTORS ONLY. Any data provided herein is for informational purposes only and is intended solely for the private use of the reader. Although information contained herein is believed to be from reliable sources, The Baker Group LP does not guarantee its completeness or accuracy. Opinions constitute our judgment and are subject to change without notice. The instruments and strategies discussed here may fluctuate in price or value and may not be suitable for all investors; any doubt should be discussed with a Baker representative. Past performance is not indicative of future results. Changes in rates may have an adverse effect on the value of investments. This material is not intended as an offer or solicitation for the purchase or sale of any financial instruments.