Happy Jobs Friday, everyone! As I sit here and wait for the stock market to open, I’m interested to see if a man who goes by the name “Roaring Kitty” will become a billionaire in a month or will Gamestock’s stock value plummet and erase his unrealized gains. Meanwhile, I’m going to refocus my energy on this week’s economic data releases rather than watch Roaring Kitty mint money gambling in the stock market.

This week was primarily headlined by various economic releases related to the labor market. This morning, The Bureau of Labor Statistics (BLS) released their monthly jobs reports for the month of May. The BLS reported the US Economy added 272,000 non-farm payrolls in May, well above expectations of 180,000. The last two months of job gains were revised down by 15,000. The job gains were broad-based with the largest gains in health care (+68,000), government (+52,000), leisure and hospitality (+42,000) and professional services (+32,000). Average hourly earnings also beat expectations, rising 0.4% in May (est = 0.3%) and 4.1% from a year ago (est = 3.9%). The non-farm payroll gains are unwelcome news for the Fed as it looks to slow the economy and bring down inflation to their target.

The separate household survey of individuals told a very different story this morning with job losses coming in at 408,000 for the month of May. The headline unemployment rate which is derived from the household survey ticked up a tenth of a percent to 4.0%. The highest level since January 2022 and up 0.6% from the low in April 2024. A 0.6% increase in the unemployment rate may not seem like much on the surface, but history has shown us that it isn’t necessarily the level but rather the change of the unemployment rate that matters. Every recession except one since World War II has begun with an increase in unemployment of 0.6% or smaller.

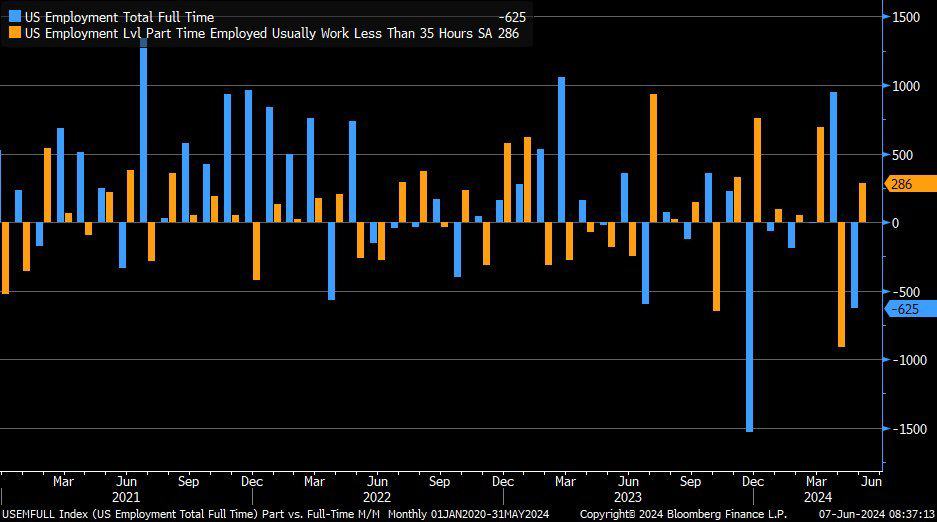

The labor force participation rate declined from 62.7 to 62.5. Additionally, the household survey also showed that full-time workers declined by 625,000, while those holding part-time positions increased by 286,000. A significant reduction in full-time workers and an increase in part-time workers in not something you typical see in a strong labor market.

Despite the weakness buried within the details of the May jobs report, the headline beat on non-farm payrolls and the increase in wage gains was enough to convince traders the Fed will keep rates “higher for longer”. The fed funds futures market is now pricing in a 50% chance of a rate cut in September and the first full cut in December. As of 9:15am CT, bond yields are rising sharply with the 2yr yield up 13bp to 4.85% and the 10yr yield up 13bp to 4.42%.

Earlier this week on Tuesday, the Job Openings and Labor Turnover Survey (JOLTS) report showed that job openings fell in April to their lowest level since 2021 as the labor market shows further signs of cooling off from the hiring boom that followed the US economy reopening after the pandemic. There were 8.06 million jobs open at the end of April, a decrease from the 8.35 million job openings in March. The JOLTS report also showed 5.6 million hires were made during the month, little change from the previous month.

Yesterday, the weekly jobless claims edged higher to a seasonally adjusted 229,000 for the week ended June 1st. Expectations were for 220,000 claims in the latest week. The continuing jobless claims increased by 2,000 to a seasonally adjusted 1.792 million during the week ending May 25th.

Next week, all eyes are on the Fed and the Consumer Price Index (CPI) inflation release. On Wednesday, the CPI index will be released for the month of May and the month over month change is expected at 0.1% and the year over year at 3.4%. Core CPI (excluding food and energy) is expected to come in at a 0.3% month over month change and a 3.5% year over year increase. Also on Wednesday, The Fed will conclude their two-day meeting next Wednesday and will most likely decide to keep rates unchanged. The fed funds futures markets are calculating a 1% chance of the Fed cutting rates next week. The US will have to wait to join the rate cut party started up north as Canada became the first G7 nation to cut interest rates this week. Yesterday, the European Central Bank went ahead with its first rate cut since 2019 on Thursday, keeping its word despite an increasingly uncertain inflation outlook.

Stay tuned until next week! Have a great weekend!

Monthly Change in Full Time and Part Time Workers (2021 to Present)

The Baker Group is one of the nation’s largest independently owned securities firms specializing in investment portfolio management for community financial institutions.

Since 1979, we’ve helped our clients improve decision-making, manage interest rate risk, and maximize investment portfolio performance. Our proven approach of total resource integration utilizes software and products developed by Baker’s Software Solutions* combined with the firm’s investment experience and advice.

Author

Dale Sheller

Managing Director

Director of Financial Strategies Group

The Baker Group LP

800.937.2257

*The Baker Group LP is the sole authorized distributor for the products and services developed and provided by The Baker Group Software Solutions, Inc.

INTENDED FOR USE BY INSTITUTIONAL INVESTORS ONLY. Any data provided herein is for informational purposes only and is intended solely for the private use of the reader. Although information contained herein is believed to be from reliable sources, The Baker Group LP does not guarantee its completeness or accuracy. Opinions constitute our judgment and are subject to change without notice. The instruments and strategies discussed here may fluctuate in price or value and may not be suitable for all investors; any doubt should be discussed with a Baker representative. Past performance is not indicative of future results. Changes in rates may have an adverse effect on the value of investments. This material is not intended as an offer or solicitation for the purchase or sale of any financial instruments.