Relative calm returned to the bond market this week after several weeks of extreme volatility triggered by Trump’s introduction of the highest tariffs in more than a century on virtually every country in the world. The ever-escalating trade war and Trump’s threats to fire Federal Reserve Chairman Powell had some market participants worrying the dollar could lose its reserve currency status and US Treasuries might be at risk of losing their safe-haven status as the world’s largest risk-free asset. Adding to those fears were rumors that large holders of US bonds like China and Japan were selling long Treasuries in an effort to “punish” the US by driving up long-term interest rates. The result was a 50bp surge in the 10yr yield at the beginning of April that spooked markets worldwide. But this week the administration seemed to get the message and made a concerted effort to calm the bond market. Trump and Treasury Secretary Bessent announced the US had trade proposals from 18 countries and was actively working on deals with China, Japan and India among others. They even announced they could lower tariffs on China as a sign of their willingness to negotiate. That alone led to rallies in both the stock and bond markets as it was the first sign of de-escalation since tariffs were introduced on China. Adding to the good news, Trump explicitly stated he has no plans to fire Chairman Powell and bonds rallied further. For the week, bond yields fell 2-7bp and the 10yr has now recovered about half of its early April selloff.

The economic data was a mixed bag this week. New Home Sales surged 7.4% on lower prices while Existing Home Sales fell 5.9%, the most since 2022. Durable Goods Orders surged 9.2%, but were flat after excluding the volatile transportation sector. We got much worse than expected regional economic indices from the Chicago, Philadelphia and Richmond Federal Reserves. Finally, Leading Economic Indicators fell by a larger than expected 0.7% as consumer sentiment, stock prices, and new order all pointed to weaker growth ahead.

Next is absolutely packed with economic data that has a chance to bring volatility back to the markets. Here’s an abbreviated list of the biggest releases to pay attention to and the current estimate: JOLTS Job Openings (7.49mm), ADP (+125k), Q1 GDP (+0.3%), PCE (2.2%) and Core PCE (2.6%), ISM Manufacturing (48.0), Non-Farm Payrolls (+125k) and Unemployment (4.2%).

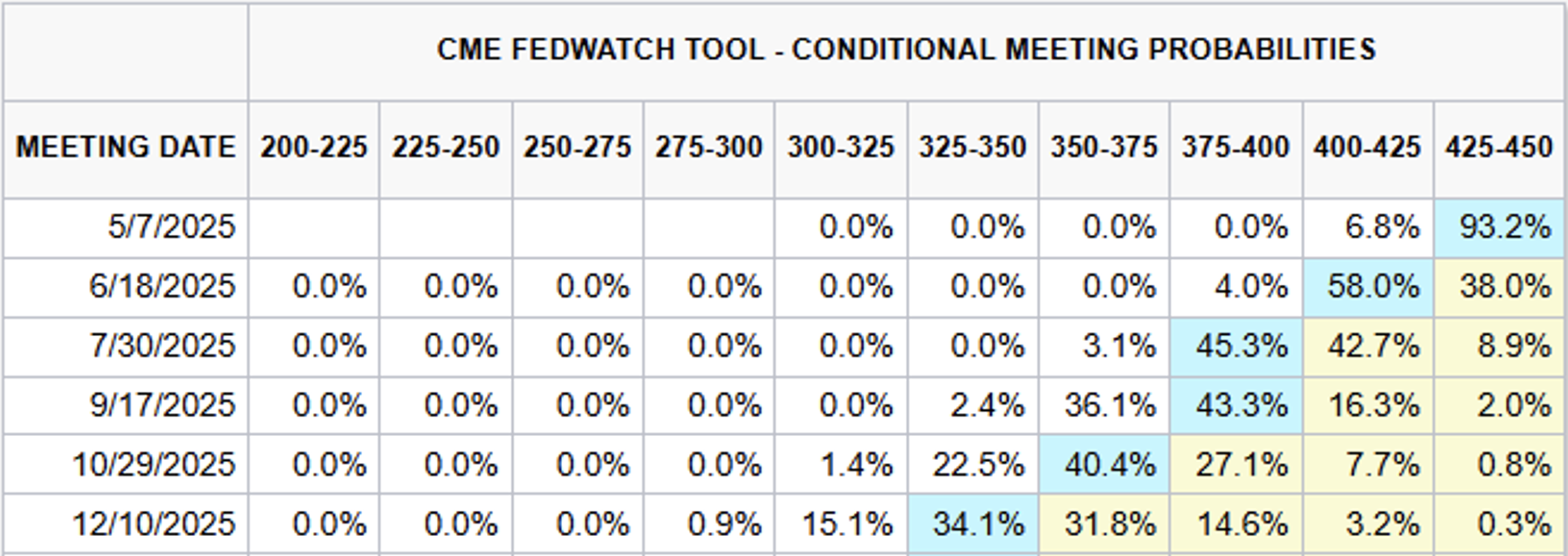

Fed Funds Futures Rate Cut Probabilities

The Baker Group is one of the nation’s largest independently owned securities firms specializing in investment portfolio management for community financial institutions.

Since 1979, we’ve helped our clients improve decision-making, manage interest rate risk, and maximize investment portfolio performance. Our proven approach of total resource integration utilizes software and products developed by Baker’s Software Solutions* combined with the firm’s investment experience and advice.

Author

Ryan W. Hayhurst

President

The Baker Group LP

800.937.2257

*The Baker Group LP is the sole authorized distributor for the products and services developed and provided by The Baker Group Software Solutions, Inc.

INTENDED FOR USE BY INSTITUTIONAL INVESTORS ONLY. Any data provided herein is for informational purposes only and is intended solely for the private use of the reader. Although information contained herein is believed to be from reliable sources, The Baker Group LP does not guarantee its completeness or accuracy. Opinions constitute our judgment and are subject to change without notice. The instruments and strategies discussed here may fluctuate in price or value and may not be suitable for all investors; any doubt should be discussed with a Baker representative. Past performance is not indicative of future results. Changes in rates may have an adverse effect on the value of investments. This material is not intended as an offer or solicitation for the purchase or sale of any financial instruments.