Bond markets seemed to be in a bit of a holding pattern to start the week awaiting Thursday’s release of the Consumer Price Index (CPI). The 10-year Treasury yield hovered around the 4% psychological level through Wednesday with limited economic news. When the inflation numbers finally hit the wires Thursday morning, it caused a confused, 2-way reaction that ultimately settled with yields down on the day as investors tried to reconcile hot headline numbers with the fact that the core measure dropped below 4% for the first time since May 2021.

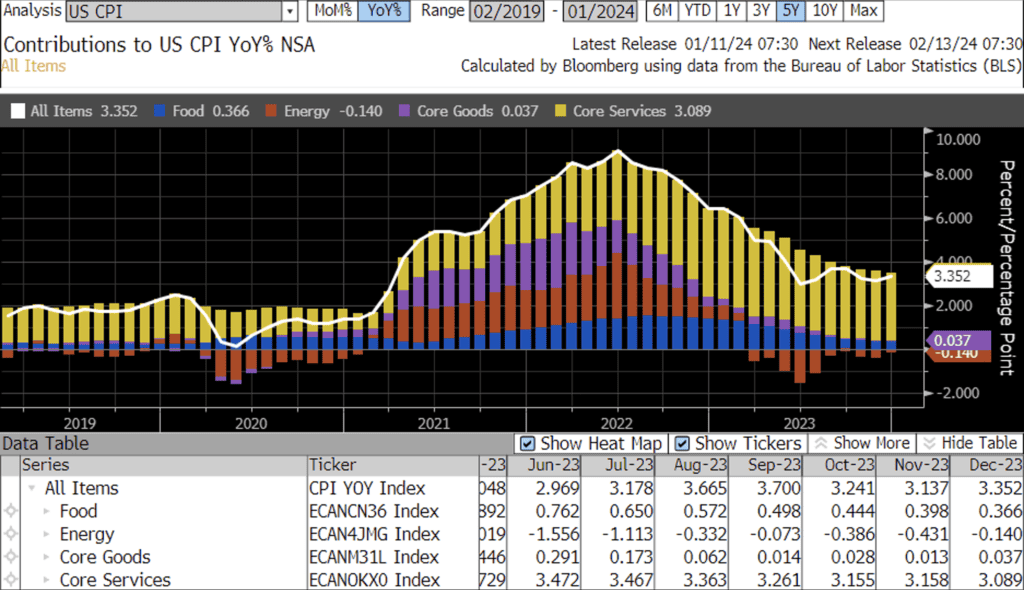

Headline CPI rose higher than expected in December, up 0.3% month-over-month (vs. 0.2% consensus) and 3.4% year-over-year (vs. 3.2% consensus). Excluding food and energy, Core CPI rose 0.3% MoM (0.3% consensus) and 3.9% YoY (3.8% consensus), but it also marked the first time that Core CPI printed below 4% in nearly 2.5 years. The closely watched shelter component accelerated in December, rising 0.5% and making up more than half of the monthly gain in CPI.

Bond yields initially rose following the report but reversed course, perhaps as investors reckoned that a hotter than expected CPI print driven by higher shelter prices will be less of an issue for the Fed’s favorite inflation measure, Personal Consumption Expenditures (PCE), which comes out in two weeks. PCE weights housing costs much lower than CPI where housing costs are the largest single category by far and can have a disproportionately large impact on the overall measure of inflation. The report was not enough to deter Fed Funds futures traders who remained confident that the first rate cut from the Fed will be in March.

Friday’s read of the less closely watched but still important inflation measure of producer prices also spurred rate cut bets. Producer prices, which tend to lead consumer prices, unexpectedly declined 0.1% MoM in December (vs. a 0.1% increase expected). YoY PPI increased just 1.0% (vs. 1.3% expected). Following the report, the 2-year Treasury yield fell to the lowest level since May and the 10-year Treasury yield is down ~5bps at the time of this writing. Futures markets increased their bets on a March rate cut following the report. The probability of a first quarter cut now stands at 77.7% according to the CME Fed Watch Tool and futures markets are betting on a 25bp rate cut in every subsequent meeting through the end of the year.

Next week will be another important one for markets. It is a short week with the Martin Luther King Jr. holiday on Monday, but a lot of data will be released in the days that follow. A a slew of housing data is due throughout the week as well as the reading of retails sales for the final month of the year on Wednesday. Hope everyone is able to enjoy the long weekend and stay warm.

The Baker Group is one of the nation’s largest independently owned securities firms specializing in investment portfolio management for community financial institutions.

Since 1979, we’ve helped our clients improve decision-making, manage interest rate risk, and maximize investment portfolio performance. Our proven approach of total resource integration utilizes software and products developed by Baker’s Software Solutions* combined with the firm’s investment experience and advice.

Author

Andrea F. Pringle

Financial Strategist/MBS Analyst

The Baker Group LP

800.937.2257

*The Baker Group LP is the sole authorized distributor for the products and services developed and provided by The Baker Group Software Solutions, Inc.

INTENDED FOR USE BY INSTITUTIONAL INVESTORS ONLY. Any data provided herein is for informational purposes only and is intended solely for the private use of the reader. Although information contained herein is believed to be from reliable sources, The Baker Group LP does not guarantee its completeness or accuracy. Opinions constitute our judgment and are subject to change without notice. The instruments and strategies discussed here may fluctuate in price or value and may not be suitable for all investors; any doubt should be discussed with a Baker representative. Past performance is not indicative of future results. Changes in rates may have an adverse effect on the value of investments. This material is not intended as an offer or solicitation for the purchase or sale of any financial instruments.