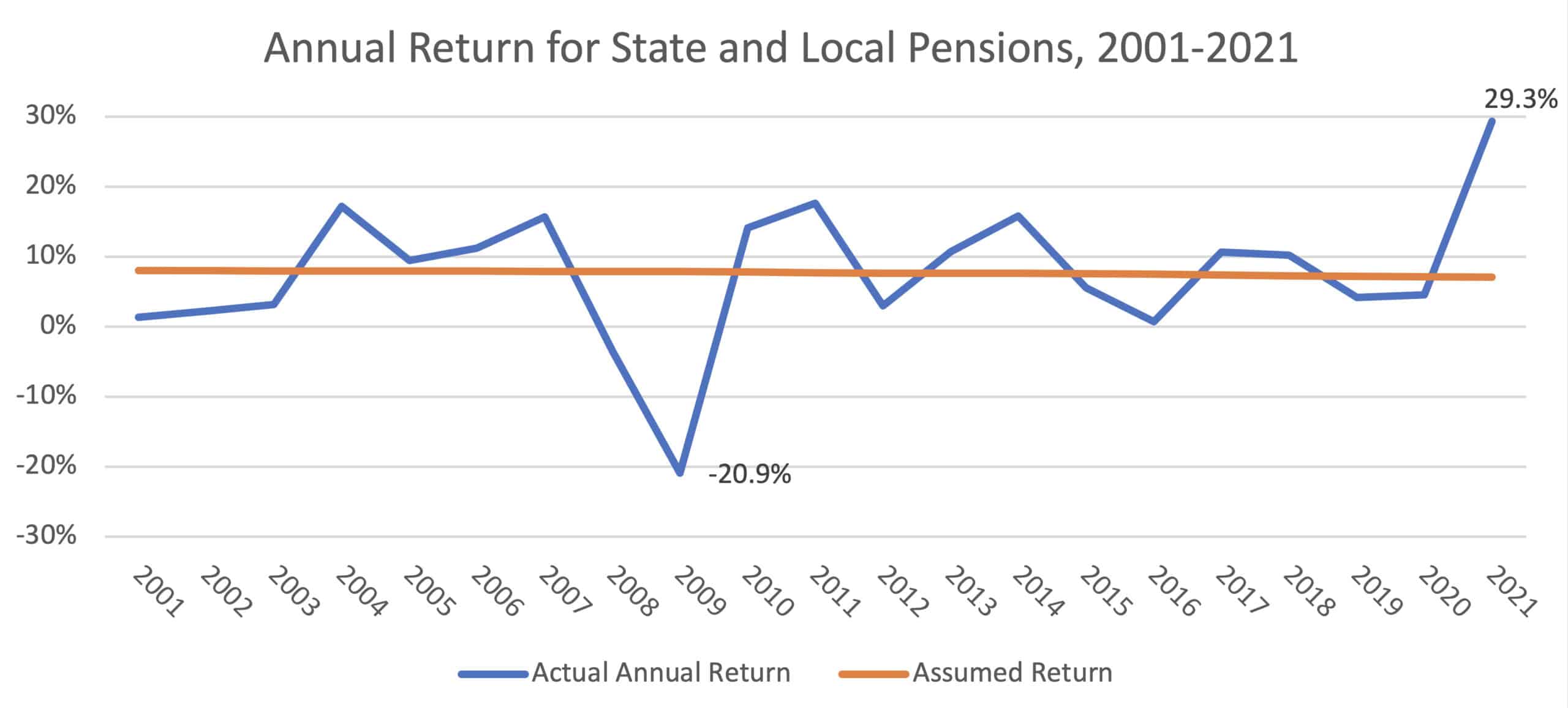

Municipal bond investors finally have some good news regarding public pension plans after worrying about growing unfunded pension liabilities for many years. The Pew Charitable Trusts reports that aggregate state retirement systems are over 80% funded for the first time since 2008, following record investment returns for the fiscal year ending in 2021.

In an effort to earn higher returns in an era of low interest rates, pension fund managers have broadly been shifting asset allocations to a higher concentration of risky assets such as private equity and hedge funds. The National Association of State Retirement Administrators (NASRA) reports that alternative investments comprised 21% of the investment portfolios of public pension funds surveyed in 2021 compared to only about 5% in 2005. According to NASRA, investment returns have historically accounted for 61% of public pension fund revenue from 1991-2020, making it a large contributor to the overall performance of a pension plan. This strategy of taking on more risk to potentially earn a higher return proved very profitable during 2021 as risky assets outperformed assumed rates of return and most public pension plans earned returns greater than 25% with some plans even hitting their highest single year return in their history.

Source: Public Plans Database; Census of Governments

This is great news for municipal employers that participate in those pension plans, especially following investment underperformance in 2020 and a period of increasing annual required contributions. Most public pension plans now have better funded positions and lower net pension liabilities, which should lead to lower growth in annual required contributions from municipalities and will help to relieve some budget pressure for those municipalities. The Pew Charitable Trusts estimates that contribution levels increased by 8% per year on average over the past 10 years, but the most underwater plans had contributions increase by 16% on average over that same time period. For some municipalities, coming up with funds for those rising contribution levels has become very difficult, and pension contributions have become a significant budget item. However, many state and local governments may be well-positioned today to make excess contributions and pay down some pension liabilities, since 2021 was also generally a year of large budget surpluses and revenue growth. For example, Connecticut has paid $1.7 billion from surplus cash into its state employee and teachers’ pension funds in the last 2 years, and they may add an extra $6.3 billion over the next 5 years according to Bloomberg.

While most public pension plans have recently improved financially, investors should remain wary of municipalities that have exposure to troubled pension plans for a few reasons. First, a single year of outstanding investment performance unfortunately may not be enough to pull underfunded plans out of worrisome territory, and the previous discussed increased allocation in highly risky assets makes plan assets sensitive and investment returns volatile. Moody’s has calculated that, in some instances, it would only take about a 5% loss next year to reverse the positive effects of a 25% return in 2021. Further, Moody’s anticipates a greater than one-in-six chance that a pension plan with a 7% assumed annual return will suffer a loss of 5% or more in a given year.

Second, unfunded pension liabilities are still very high and represent a large amount of debt. Moody’s estimates that net pension liabilities are still above $4 trillion, larger than the municipal bond market, even after the high investment returns realized in 2021 when adjusting for a conservative investment return assumption. Many states have enacted reforms to their pension plans to help keep liabilities down in the future, but the impact of those reforms will be felt further down the road because they are often effective only for new hires.

Lastly, keep in mind that the statistics presented are aggregated to show broad trends. Individual states’ plans may differ and may not be as well-positioned as the average plan, and some municipalities even have their own local plans, which could have drastically different funded positions and investment outcomes.

Despite the fact that it is comforting to know that net pension liabilities have generally fallen and that municipalities may benefit from lower pension contributions, prudent municipal bond investors should continue to carefully monitor individual municipalities’ specific exposure to pension liabilities.

The Baker Group is one of the nation’s largest independently owned securities firms specializing in investment portfolio management for community financial institutions.

Since 1979, we’ve helped our clients improve decision-making, manage interest rate risk, and maximize investment portfolio performance. Our proven approach of total resource integration utilizes software and products developed by Baker’s Software Solutions* combined with the firm’s investment experience and advice.

Author

Dana Sparkman, CFA

Executive Vice President/Municipal Analyst

The Baker Group LP

800.937.2257

*The Baker Group LP is the sole authorized distributor for the products and services developed and provided by The Baker Group Software Solutions, Inc.

INTENDED FOR USE BY INSTITUTIONAL INVESTORS ONLY. Any data provided herein is for informational purposes only and is intended solely for the private use of the reader. Although information contained herein is believed to be from reliable sources, The Baker Group LP does not guarantee its completeness or accuracy. Opinions constitute our judgment and are subject to change without notice. The instruments and strategies discussed here may fluctuate in price or value and may not be suitable for all investors; any doubt should be discussed with a Baker representative. Past performance is not indicative of future results. Changes in rates may have an adverse effect on the value of investments. This material is not intended as an offer or solicitation for the purchase or sale of any financial instruments.