Most financial markets got clobbered again this week as Fed Chairman Powell reiterated the Fed’s intention to raise interest rates as much as is necessary to break the back of inflation. The Dow, for example, lost another 1,000 points, failing to hold momentum from a mid-week rally. The bond market, however, was a notable exception. Treasuries rallied on safe-haven flows and growing concerns about recession risk, and the yield curve (as measured by the 2yr to 10yr yield spread) flattened to a range of 20-25bps, down from 45bps recently. Kansas City Fed President Esther George characterized the stock market selloff as a “rough week” but indicated that this is exactly what the Fed expects to happen as they see “the transmission of our policy through markets understanding that further tightening should be expected”. Well said, Madam President. The markets are indeed getting the message that the Fed isn’t fooling around.

The first quarter of this year was a textbook example of stagflation as GDP growth was negative while we hit a new decades-long high in inflation. For the year, the Dow is down more than 5,000 points (-15% from the January highs), and the S&P is down 18%. The carnage isn’t limited to speculative technology stocks as consumer staples like Walmart and Target are reporting their worst quarterly results in over a quarter of a century. Analysts suggests that the odds of recession in the next year have risen to at least 30%.

Markets are increasingly fearful that the Fed won’t be able to tame inflation without significantly damaging economic growth and the labor market. Indeed, the Fed is only able to fight half of the inflation enemy… the half that is driven by robust demand. Raising rates will cool that to be sure. But the supply-side problems are different. Higher interest rates don’t unclog trade routes or put dock-workers back to work. Raising the cost of borrowing won’t accelerate the automation or innovation needed to solve labor market mismatch problems. Demand destruction alone will slow inflation, but not without substantial cost. That seems to be the message from the bond market, and the message isn’t lost on Jay Powell who acknowledged that, “You’d still have a strong labor market if unemployment were to move up a few ticks, but there are a number of plausible paths to have, as I said, a softish landing.” That’s Fedspeak if I’ve ever heard it. When they say things like that, fasten your seat belts.

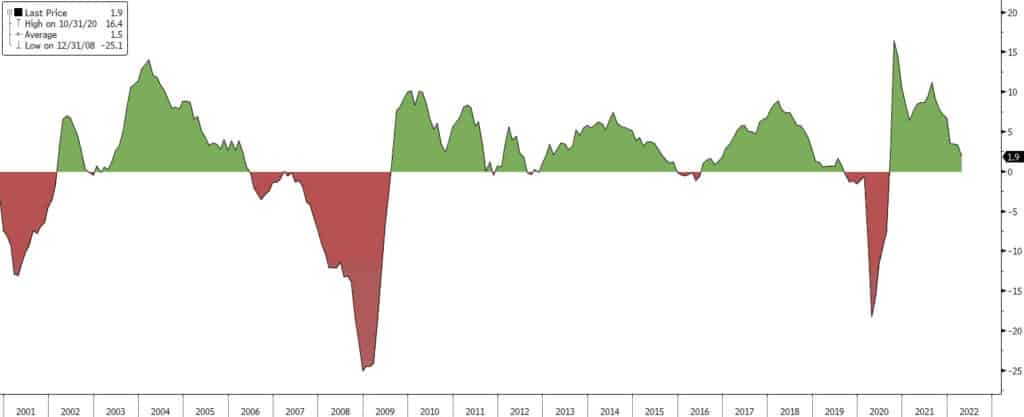

The economic calendar this week included two regional indices, NY and Philadelphia, both of which fell short of expectations and prior readings. Retail sales surprised somewhat to the upside, but Building Permits and Existing Home Sales were weaker than expected and Leading Economic Indicators showed the lowest reading in well over a year. Next week we’ll get New Home Sales and Capital Expenditures data, and we’ll see what the latest GDP readings look like.

US Leading Economic Indicators (6mo MA)

2000-Today

The Baker Group is one of the nation’s largest independently owned securities firms specializing in investment portfolio management for community financial institutions.

Since 1979, we’ve helped our clients improve decision-making, manage interest rate risk, and maximize investment portfolio performance. Our proven approach of total resource integration utilizes software and products developed by Baker’s Software Solutions* combined with the firm’s investment experience and advice.

Author

Jeffrey F. Caughron

Senior Partner

The Baker Group LP

800.937.2257

*The Baker Group LP is the sole authorized distributor for the products and services developed and provided by The Baker Group Software Solutions, Inc.

INTENDED FOR USE BY INSTITUTIONAL INVESTORS ONLY. Any data provided herein is for informational purposes only and is intended solely for the private use of the reader. Although information contained herein is believed to be from reliable sources, The Baker Group LP does not guarantee its completeness or accuracy. Opinions constitute our judgment and are subject to change without notice. The instruments and strategies discussed here may fluctuate in price or value and may not be suitable for all investors; any doubt should be discussed with a Baker representative. Past performance is not indicative of future results. Changes in rates may have an adverse effect on the value of investments. This material is not intended as an offer or solicitation for the purchase or sale of any financial instruments.