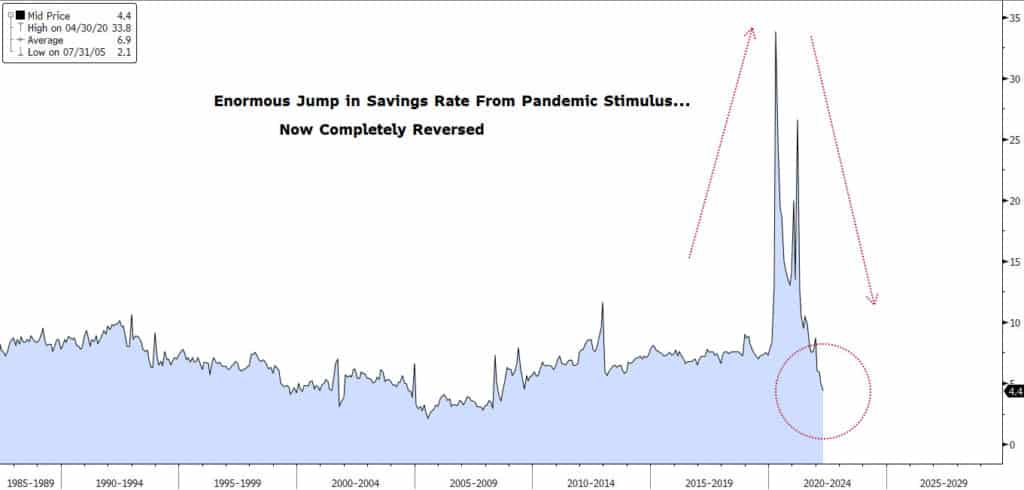

As we approach the mid-point of the year, all eyes have been focused on the Fed and their “expeditious” determination to stamp out inflation. An enormous liquidity bubble created by the excessive buildup of reserves in the prior two years has conspired with the Treasury’s equally excessive fiscal support from stimulus checks, enhanced unemployment benefits and PPP loans to set the stage for an inflation wildfire which is now raging and requires a powerful response. The wealth-effect of all that stimulus spurred strong consumer demand as well as heavy speculative investment in nonsensical things like pretend computer dog-image money. To top it all off, the Russian invasion of Ukraine and continued drag from clogged supply chains made a bad situation much worse. The result was the highest level of consumer price inflation in over forty years. Now, to get inflation back under control… the piper must be paid.

On Wednesday, the Fed decisively channeled the lessons of Paul Volker, raising the Fed Funds rate

by 75bps this week to 1.75%, and telegraphing a steady march to 2.50% by summer’s end and more

than 3% by year-end. The 75bps hike was the largest since 1994, and the Fed’s revised “Dot Plot” now

projects an eventual 3.80% rate in 2023. Bond yields across the maturity spectrum jumped substantially to price-in the Fed’s guidance, and now offer the highest returns in nearly 15 years.

Let’s not forget that monetary policy tightening slows inflation by indiscriminately crushing demand so that it no longer needs supply. The cost of credit becomes more expensive. Households spend less and companies invest less. Asset prices fall and markets become less liquid, so companies and households become poorer and less inclined to spend creating a “negative wealth effect”. Unemployment can be expected to rise in the process. Monetary tightening is not a scalpel; it is a sledgehammer, and as Shakespeare said, “violent delights have violent ends.” A recession, it seems, is imminent at some point.

Lost in the news about Wednesday’s FOMC meeting was a rather alarming emergency European Central Bank meeting as policymakers around the globe scramble to react appropriately given their unique circumstances vis a vis the US. The Bank of England raised rates for the fifth consecutive meeting and said larger moves may still be needed across the pond, and the Bank of Japan is walking a tightrope with currency valuation a critical consideration for them.

Knowing all of this, financial markets can be expected to focus intently on economic data trends in coming months as well as the reaction of inflation measures. One number that came this week was monthly Retail Sales for May which slowed to a crawl unexpectedly as the so-called “control group” showed zero growth while expectations were for a .3% increase. Housing Starts and Building Permits fell 14.4% and 7% respectively, both far worse than expected. Industrial Production and Capacity Utilization underperformed as well. The producer price index also came this week, showing 10.8% wholesale inflation, the highest level since the 1970s. Looks like the Fed’s got a lot more work to do. Stay tuned.

US Personal Savings Rate: 1980 – Today

The Baker Group is one of the nation’s largest independently owned securities firms specializing in investment portfolio management for community financial institutions.

Since 1979, we’ve helped our clients improve decision-making, manage interest rate risk, and maximize investment portfolio performance. Our proven approach of total resource integration utilizes software and products developed by Baker’s Software Solutions* combined with the firm’s investment experience and advice.

Author

Jeffrey F. Caughron

Senior Partner

The Baker Group LP

JCaughron@GoBaker.com

800.937.2257

*The Baker Group LP is the sole authorized distributor for the products and services developed and provided by The Baker Group Software Solutions, Inc.

INTENDED FOR USE BY INSTITUTIONAL INVESTORS ONLY. Any data provided herein is for informational purposes only and is intended solely for the private use of the reader. Although information contained herein is believed to be from reliable sources, The Baker Group LP does not guarantee its completeness or accuracy. Opinions constitute our judgment and are subject to change without notice. The instruments and strategies discussed here may fluctuate in price or value and may not be suitable for all investors; any doubt should be discussed with a Baker representative. Past performance is not indicative of future results. Changes in rates may have an adverse effect on the value of investments. This material is not intended as an offer or solicitation for the purchase or sale of any financial instruments.