This shortened post-holiday week began with signs of a hawkish Fed, underscored by minutes from the June FOMC meeting and comments from two policymakers who reinforced the importance of staying focused on the fight to bring down inflation. St. Louis Fed President James Bullard said “it would make a lot of sense to go with 75 (basis points) at this juncture” in order to get the fed funds rate above 3% by the end of this year. Fed governor Christopher Waller agreed, saying in a separate interview that “Inflation is just too high and doesn’t seem to be coming down… we need to move to a much more restrictive setting in terms of interest rates… and we need to do that as quickly as possible.” Waller said he was definitely in support of doing another 75bps in July.

In recent days and weeks, markets have reacted to the rising probability of recession as the Fed continues its tightening campaign. But a common theme heard from policymakers as well as traders and money managers is that the Fed’s credibility rests heavily on their success in bringing down inflation. Concerns about pushing the economy into recession are missing the point that inflation itself is a tax on economic activity. The higher the inflation-tax, the more damaging to households and the economy overall. Per Bullard, “If we don’t get it under control, inflation on its own could put us in a really bad economic outcome down the road.” Well said. And as much as anything, it’s the inflationary psychology that really does long-term damage. If inflationary expectations become embedded into decision-making by households and businesses, the problem becomes self-perpetuating. Ultimately, it’s all about the Fed’s cred.

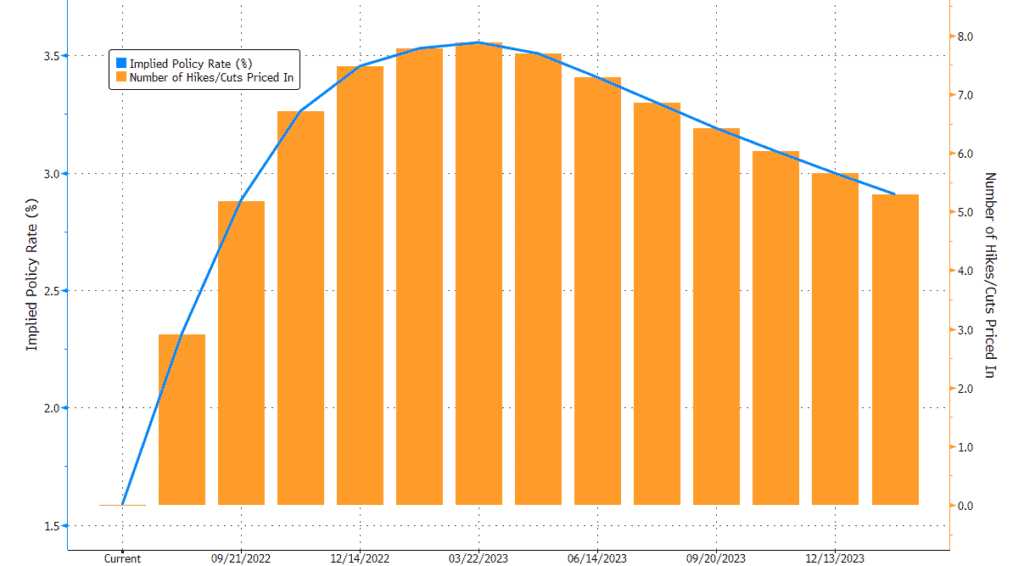

At this point, markets seem to be taking policymakers at their word. Bond yields have priced-in continued rate hikes to an ultimate terminal rate of 3.50% or so, and the Treasury yield curve has re-inverted with the 2yr yield about 5bps higher than that of the 10yr (3.12% vs 3.07% respectively). Still, the Fed cannot go wobbly and give any indication that they’re willing to abandon tight money policies and revert back to the days of QE and the “Fed Put”. They’ve got to stay on task.

The other critical piece of market news came with this morning’s jobs report. A strong 372K increase in payrolls may be enough to seal the deal on another 75bps hike at the July FOMC meeting. The unemployment rate remained at 3.6% and total unemployment sits at just under 6 million… both measures roughly where they were pre-pandemic. The labor force participation rate clocked a still-sluggish 62.2%, and the employment to population ratio remained at 59.9%. Both of these measures remain below their February 2020 levels. It’s always worth remembering employment is a lagging indicator… beware of what may be coming down the pipe as the Fed hikes rates.

Next week we’ll look forward to release of the Consumer Price Index (CPI) for June. Expect another hot number, and let’s all hope for diligence from the Fed.

US Fed Funds Futures: Rate Probabilities

The Baker Group is one of the nation’s largest independently owned securities firms specializing in investment portfolio management for community financial institutions.

Since 1979, we’ve helped our clients improve decision-making, manage interest rate risk, and maximize investment portfolio performance. Our proven approach of total resource integration utilizes software and products developed by Baker’s Software Solutions* combined with the firm’s investment experience and advice.

Author

Jeffrey F. Caughron

Senior Partner

The Baker Group LP

800.937.2257

*The Baker Group LP is the sole authorized distributor for the products and services developed and provided by The Baker Group Software Solutions, Inc.

INTENDED FOR USE BY INSTITUTIONAL INVESTORS ONLY. Any data provided herein is for informational purposes only and is intended solely for the private use of the reader. Although information contained herein is believed to be from reliable sources, The Baker Group LP does not guarantee its completeness or accuracy. Opinions constitute our judgment and are subject to change without notice. The instruments and strategies discussed here may fluctuate in price or value and may not be suitable for all investors; any doubt should be discussed with a Baker representative. Past performance is not indicative of future results. Changes in rates may have an adverse effect on the value of investments. This material is not intended as an offer or solicitation for the purchase or sale of any financial instruments.