The Federal Reserve has numerous tools at its disposal that can be used to conduct monetary policy. Rate moves, reserve requirements, open market operations, asset purchases or sales (QE or QT), etc. One tool that’s been increasingly used with mixed results in recent years is “communications policy” or forward guidance on monetary policy. Right now, communications policy is being heavily deployed by FOMC members, and the message is unambiguous. The Fed has told us loudly and clearly that they are unwavering in their commitment to crushing inflation, and they will do whatever it takes for as long as is necessary to make that happen. Fed Chair Powell has led the charge, but a parade of policymakers has given speeches and interviews that reiterate the message. Cleveland Fed President Mester was on the tape yesterday talking about the risk of “declaring victory over the inflation beast too soon” followed by Vice Chair Brainerd who echoed that sentiment. But James Bullard‘s interview this morning was to the point in emphasizing his concern that the market is underestimating the commitment and resolve of the Fed. Per Bullard: “I have felt Wall Street is underpricing the idea that inflation may just be relatively high and it may take quite a while to bring it back to 2%. This would mean interest rates have to be higher for longer. That’s a scenario that is not garnering enough attention in today’s market pricing.”

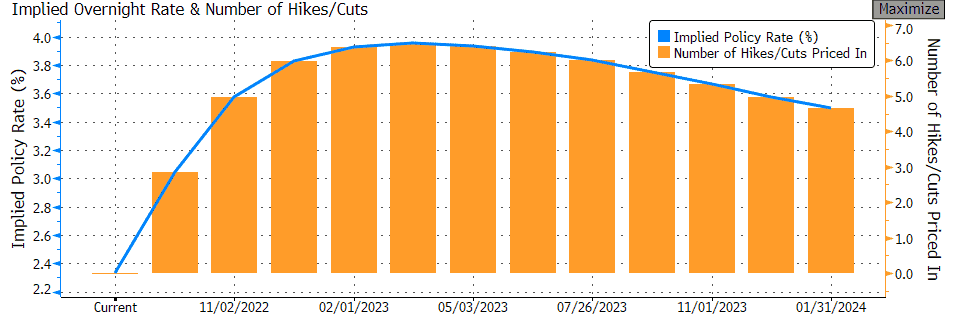

It’s absolutely true that forward pricing in bonds and futures markets are projecting and expecting the Fed to stop-and-reverse in the middle of next year, removing at least some portion of the current tightening. For perspective, futures are projecting that the funds rate will reach a level close to 4% in the first half of 2023, only to bend lower in the latter half of the year to finish around 3.5%, implying a half-percent adjustment somewhere along the line presumably due to economic weakness. This seems to be bothering FOMC officials who insist that the market should not expect any easing until inflation data starts to trend lower. Ah, there’s the rub. Assuming we’ve seen peak inflation (and there’s no guarantee of that), how far and how fast must it fall in order for the Fed to say mission accomplished? It seems a fair question, but one that no Fed official wants to discuss. For now, they want no discussion of ease… just focus on the inflation fight.

Bond yields flirted with the upper end of the range this week, reaching 3.37% at mid-week and remaining above 3.25% as we approach the weekend… not far from the March high of 3.50%. The short-end, taking cues from the Fed, has jumped to the highest levels in a decade and a half as the 2yr now sits at 3.51%. The curve inversion (2s vs 10s) has lessened, but remains at 22bps.

The data stream this week was incredibly light, but we make up for it next week. Look for data on all-important consumer and wholesale price inflation, plus retail sales and consumer sentiment.

Implied Overnight Fed Funds Rate (Fed Funds Futures)

The Baker Group is one of the nation’s largest independently owned securities firms specializing in investment portfolio management for community financial institutions.

Since 1979, we’ve helped our clients improve decision-making, manage interest rate risk, and maximize investment portfolio performance. Our proven approach of total resource integration utilizes software and products developed by Baker’s Software Solutions* combined with the firm’s investment experience and advice.

Author

Jeffrey F. Caughron

Senior Partner

The Baker Group LP

800.937.2257

*The Baker Group LP is the sole authorized distributor for the products and services developed and provided by The Baker Group Software Solutions, Inc.

INTENDED FOR USE BY INSTITUTIONAL INVESTORS ONLY. Any data provided herein is for informational purposes only and is intended solely for the private use of the reader. Although information contained herein is believed to be from reliable sources, The Baker Group LP does not guarantee its completeness or accuracy. Opinions constitute our judgment and are subject to change without notice. The instruments and strategies discussed here may fluctuate in price or value and may not be suitable for all investors; any doubt should be discussed with a Baker representative. Past performance is not indicative of future results. Changes in rates may have an adverse effect on the value of investments. This material is not intended as an offer or solicitation for the purchase or sale of any financial instruments.