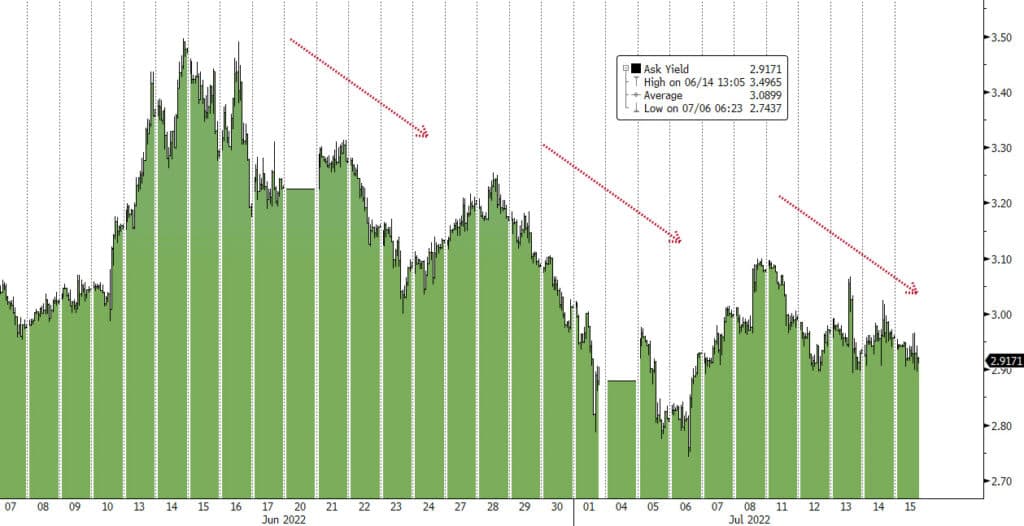

It was a hot midsummer week, actually and metaphorically. Temperatures were about as high as expected, but inflation rates were even higher. Consumer prices over the last year through June rose a sizzling 9.1%, exceeding consensus estimates and reaching the highest level in four decades. That news caused markets to re-think and re-price for an even more aggressive Fed and a sharper upward path for rates. The expectation is now that the Fed Funds rate will reach 3.5% by year-end. Bond yields have already incorporated that math into current pricing as the 2yr T-Note yield hovers around 3.10%. Interestingly and importantly, the longer end of the yield curve has bent quite a bit lower. The 10yr yield is currently 2.92% (down from 3.5% a month ago), so we have a 2s/10s inversion of nearly 20bps… the last time we were that inverted was prior to the great recession. Historically, curve inversions precede either financial crisis or recessions most of the time. Food for thought indeed.

Fed officials are no doubt doing their best to land the plane softly, but the headwinds and inflation turbulence is severe. The Fed clocked negative growth in the first quarter, and most estimates and “nowcast” models are calling for negative or paltry growth in Q2 at best. Coupled with the inflation trend, this is the very definition of stagflation. For the sake of their credibility the Fed should learn the lessons of Paul Volker, stick to their guns and stamp out inflation regardless of what that does to growth and employment. St. Louis President James Bullard seems determined to do that saying that we may need to get the funds rate as high as 4% by the turn of the year. Not all of his colleagues agree and time will tell, but markets appear to respond favorably to a more aggressive approach, even knowing that the impact on growth will be negative.

To be sure, there are some nuggets of good news in the inflation data. Core inflation (stripping out volatile items to trim the mean) has actually fallen for six consecutive months. Inflation expectations from consumer surveys as well as financial markets are projecting lower, not higher, inflation going forward. A key survey of consumer sentiment has shown consistently falling 5–10-year inflation expectations every month this year. That corresponds with the fall in breakeven rates calculated from Treasury Inflation Protected Securities. This should give the Fed some comfort that things are slowly trending in the right direction.

Other data released this week included retail sales and industrial production, both of which exceeded estimates, as well as the University of Michigan sentiment surveys which produced better than expected readings too.

It's a strange time indeed. The Fed has found themselves way behind the curve and is trying heroically to get back in front of things. That’s a difficult task for a central bank when the economy is already turning south but inflation is far from dead. Hopefully things will cool off eventually, but for now it promises to be a long, hot summer.

US 10yr T-Note Yield (Daily Chart): Last 30 Days

The Baker Group is one of the nation’s largest independently owned securities firms specializing in investment portfolio management for community financial institutions.

Since 1979, we’ve helped our clients improve decision-making, manage interest rate risk, and maximize investment portfolio performance. Our proven approach of total resource integration utilizes software and products developed by Baker’s Software Solutions* combined with the firm’s investment experience and advice.

Author

Jeffrey F. Caughron

Senior Partner

The Baker Group LP

JCaughron@GoBaker.com

800.937.2257

*The Baker Group LP is the sole authorized distributor for the products and services developed and provided by The Baker Group Software Solutions, Inc.

INTENDED FOR USE BY INSTITUTIONAL INVESTORS ONLY. Any data provided herein is for informational purposes only and is intended solely for the private use of the reader. Although information contained herein is believed to be from reliable sources, The Baker Group LP does not guarantee its completeness or accuracy. Opinions constitute our judgment and are subject to change without notice. The instruments and strategies discussed here may fluctuate in price or value and may not be suitable for all investors; any doubt should be discussed with a Baker representative. Past performance is not indicative of future results. Changes in rates may have an adverse effect on the value of investments. This material is not intended as an offer or solicitation for the purchase or sale of any financial instruments.