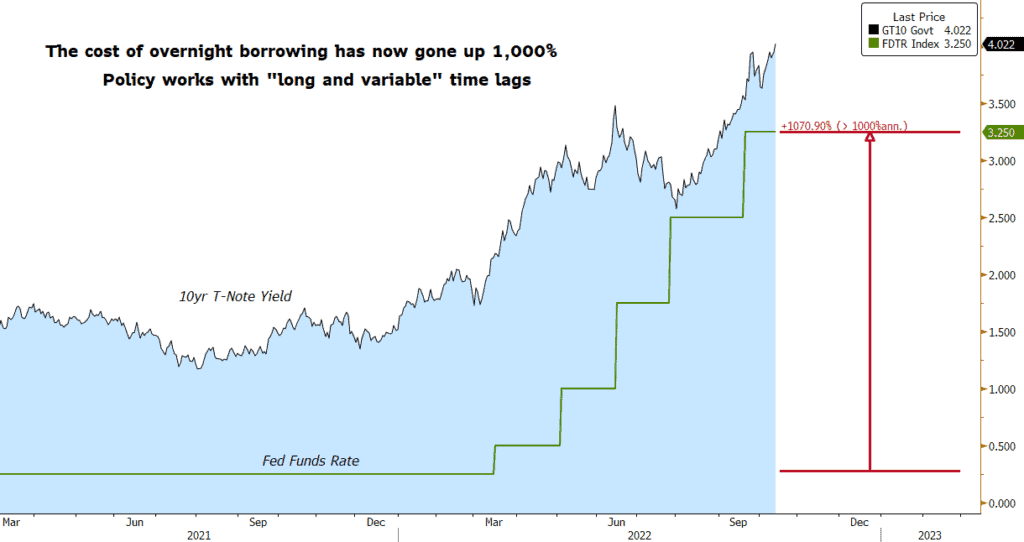

US Inflation continued to misbehave in September, prompting another week of policymakers calling for rates to go higher and stay there until price pressures fade. Core consumer prices last month clocked a 40-year high of 6.6%, validating concerns expressed in the minutes of the last FOMC meeting about the persistence and breadth of inflation that risks becoming deeply entrenched into economic decisions. For their part, the Fed is clear about their determination to squash that impulse. As noted in the minutes: “the cost of taking too little action to bring down inflation outweighed the cost of taking too much action”. At this point, a fourth consecutive 75bps increase in fed funds is baked in the cake for November, which would bring the rate to 4% as we approach year-end. That, in nominal terms, would cap the single most aggressive year of monetary policy tightening since 1981. In terms of the percentage change in the cost of overnight borrowing, though, this tightening campaign is much more severe.

To be sure, there is a strong argument to be made that the Fed is now entering a dangerous phase where “long and variable” time lags can trick policymakers into overtightening. After all, the Fed only began raising rates in March, and the most aggressive hikes have yet to be fully felt throughout the economy. As the higher cost of borrowing filters through into households and businesses, the impact could be a profound and screeching halt to economic activity. Recession, layoffs, and a pullback in consumer spending may be what it takes to dampen price pressures. The timing and magnitude of that process is a known unknown. This concern is not lost on policymakers, some of whom see the early signs of “systemic risk” popping up around the globe (e.g., UK Gilt market). Kansas City Fed President George, for example, has noted the risks of moving too abruptly and disrupting financial markets in a way that can be self-defeating. The Fed is walking a tightrope indeed. For now, though, they are bound and determined to stay the course and get inflation off of high boil.

Bond yields were generally higher across the curve and the curve remains deeply inverted. The 2yr T-Note yield at 4.50% is a full 50bps higher than that of the 4% 10yr. As the Fed proceeds, we may see a curve inversion that is much deeper still. In the meantime, yields and yield spreads are well priced for what’s coming down the pipe… and offer a nice boost to earnings for those with cash to put to work.

In addition to consumer price data, we also learned this week that Retail Sales were flat in September, perhaps an early sign that higher borrowing costs are starting to bite. The “control group”, a subcomponent of retail sales which feeds into GDP calculations, remained nominally positive, but when adjusted for inflation it was flat as well. The University of Michigan consumer sentiment survey produced surprisingly positive results in terms of the current outlook, but inflation concerns remain front and center.

US Rates: Fed Funds, 2yr T-Note, 10yr T-Note

The Baker Group is one of the nation’s largest independently owned securities firms specializing in investment portfolio management for community financial institutions.

Since 1979, we’ve helped our clients improve decision-making, manage interest rate risk, and maximize investment portfolio performance. Our proven approach of total resource integration utilizes software and products developed by Baker’s Software Solutions* combined with the firm’s investment experience and advice.

Author

Jeffrey F. Caughron

Senior Partner

The Baker Group LP

800.937.2257

*The Baker Group LP is the sole authorized distributor for the products and services developed and provided by The Baker Group Software Solutions, Inc.

INTENDED FOR USE BY INSTITUTIONAL INVESTORS ONLY. Any data provided herein is for informational purposes only and is intended solely for the private use of the reader. Although information contained herein is believed to be from reliable sources, The Baker Group LP does not guarantee its completeness or accuracy. Opinions constitute our judgment and are subject to change without notice. The instruments and strategies discussed here may fluctuate in price or value and may not be suitable for all investors; any doubt should be discussed with a Baker representative. Past performance is not indicative of future results. Changes in rates may have an adverse effect on the value of investments. This material is not intended as an offer or solicitation for the purchase or sale of any financial instruments.