The first week of November was not boring for financial markets as we got an important read on both the labor market and the current leanings of policymakers. On Wednesday Fed Chairman Jay Powell clarified and reinforced his determination to achieve absolute victory in the war on inflation, but not before a bit of confusion. The FOMC customarily released its post-meeting statement which was initially interpreted as slightly dovish, but the Chairman quickly squashed any notions that the committee was going wobbly in its mission. The official FOMC statement emphasized that in order to maintain a path back to their eventual goal of 2% inflation, the committee would take into account the cumulative tightening to date as well as time lags for policy to take effect. That was seen as a nod to those on the committee who worry the Fed could go too far too fast. Powell, however, quickly followed in his presser with the comment that it would be “very premature to talk about pausing… We still have a long way to go”. Quite the buzz-kill for both bonds and equities. Importantly, however, Powell also said “the time to slow the pace of rate hikes may come as soon as the next meeting “, an indication that we may see a smaller hike of 50 basis points in December.

Market reaction was at first positive bringing the yield on the 10yr Treasury below 4%. But Powell’s comments caused a quick reversal to 4.19%, near a new cycle high. The bigger reaction was in the two-year note which reached 4.73%, its highest level since 2007. The yield curve inversion between two and 10 year yields remains -54 basis points, and many suspect that this inversion will deepen further as we progress in the cycle.

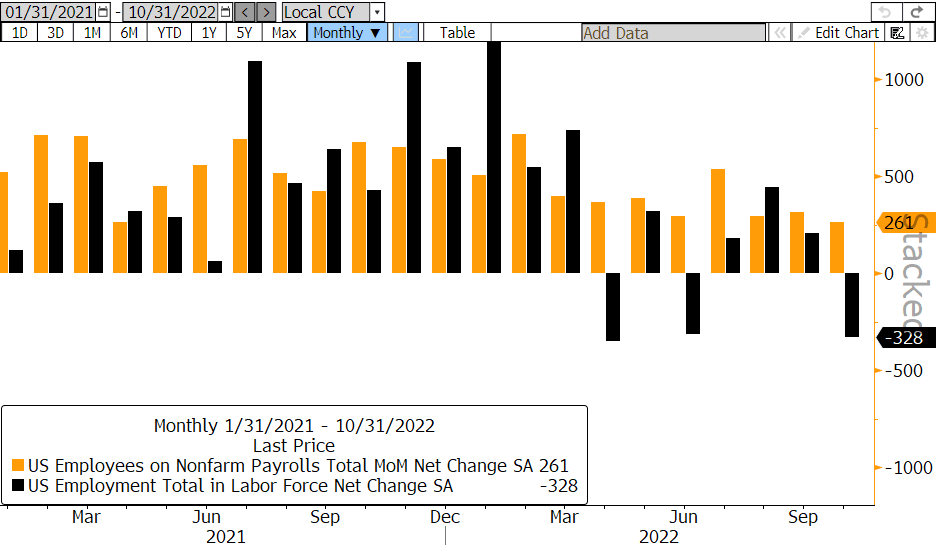

Meanwhile, the jobs market data presented its own conundrum. Earlier in the week we discovered the job openings had jumped unexpectedly, suggesting that there remains slack in the labor force. Then this morning the BLS reported that we added 261K jobs in October, notably higher than the 193K estimate. Data for the last two months were revised higher as well. Though job creation was better than expected, it remained the smallest job gain since the end of 2020 and shows the labor market continues to cool as rate hikes gradually work through the economy. The unemployment rate ticked up to 3.7%. Remember that the jobs report contains two components, the payrolls report and the household survey. And in the survey of households, the economy showed a loss of more than 300K jobs. The household survey may be a canary in the coal mine that leads the payrolls data in showing weakness. All of this indicates that the labor market is showing the effects of the Fed’s demand destruction, but only slowly.

US Non-Farm Payrolls and Employment Change

The Baker Group is one of the nation’s largest independently owned securities firms specializing in investment portfolio management for community financial institutions.

Since 1979, we’ve helped our clients improve decision-making, manage interest rate risk, and maximize investment portfolio performance. Our proven approach of total resource integration utilizes software and products developed by Baker’s Software Solutions* combined with the firm’s investment experience and advice.

Author

Jeffrey F. Caughron

Senior Partner

The Baker Group LP

800.937.2257

*The Baker Group LP is the sole authorized distributor for the products and services developed and provided by The Baker Group Software Solutions, Inc.

INTENDED FOR USE BY INSTITUTIONAL INVESTORS ONLY. Any data provided herein is for informational purposes only and is intended solely for the private use of the reader. Although information contained herein is believed to be from reliable sources, The Baker Group LP does not guarantee its completeness or accuracy. Opinions constitute our judgment and are subject to change without notice. The instruments and strategies discussed here may fluctuate in price or value and may not be suitable for all investors; any doubt should be discussed with a Baker representative. Past performance is not indicative of future results. Changes in rates may have an adverse effect on the value of investments. This material is not intended as an offer or solicitation for the purchase or sale of any financial instruments.